Tether stablecoin USDT records $5.2B H1 2024 profit – What it means for you

- Tether’s USDT maintained robust growth in Q2, contributing to a revenue push above $5 billion.

- We uncovered key areas that have been driving Tether’s numbers.

Tether [USDT] recently disclosed its H1 2024 financials, revealing interesting developments. This included an impressive $5.2 billion in revenue, which gestures towards the company’s robust financial position.

According to the new Tether Financial report, the company achieved $1.3 billion in net operating profit in Q2 2024.

Whilst this brought its total revenue to $5.2 billion, it highlighted a bit of a slowdown in revenue compared to Q1 2024. The latter’s mammoth profits reflect the massive wave of trading activity observed during the quarter.

Fueled by bullish optimism, rooted in heavy expectations for the Bitcoin halving and ETFs.

Tether also revealed that it generated a substantial amount of Q2 revenue from traditional assets. The company noted that U.S. treasuries in its balance sheet reached a new all-time high of $97.6 billion.

In other words, it holds more U.S. treasuries than some major countries including Australia, Germany, and the UAE.

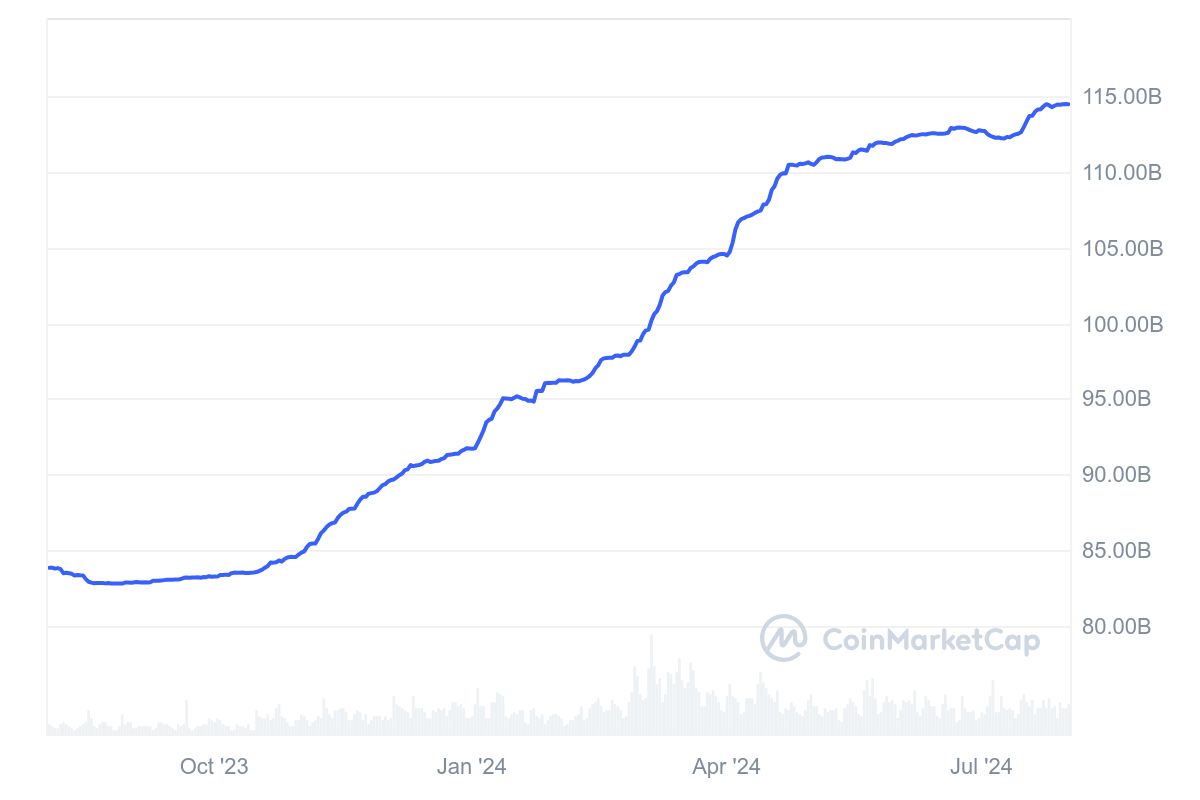

Tether’s report included a revelation that it issued 8.3 billion USDT in Q2 2024. The company’s total market cap has been growing steadily in the last 12 months, reaching $114.45 billion at press time.

Tether stablecoin maintains strong lead

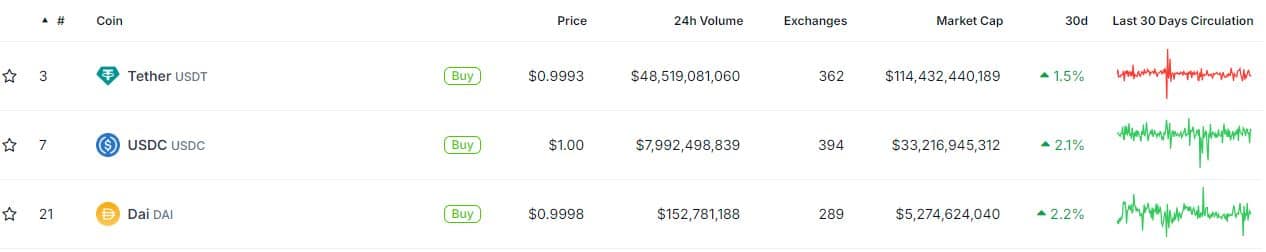

Tether continued to dominate the market in the first half of 2024, maintaining a solid lead. For context, the latest market cap figure was 3.4 times higher than that of Circle [USDC], the second-largest stablecoin.

USDT’s press time daily trading volume was six times higher than that of USDC.

The differences in volumes and market cap underscored just how far Tether is ahead of the competition. This strategic lead has allowed it to capture most of the stablecoin demand.

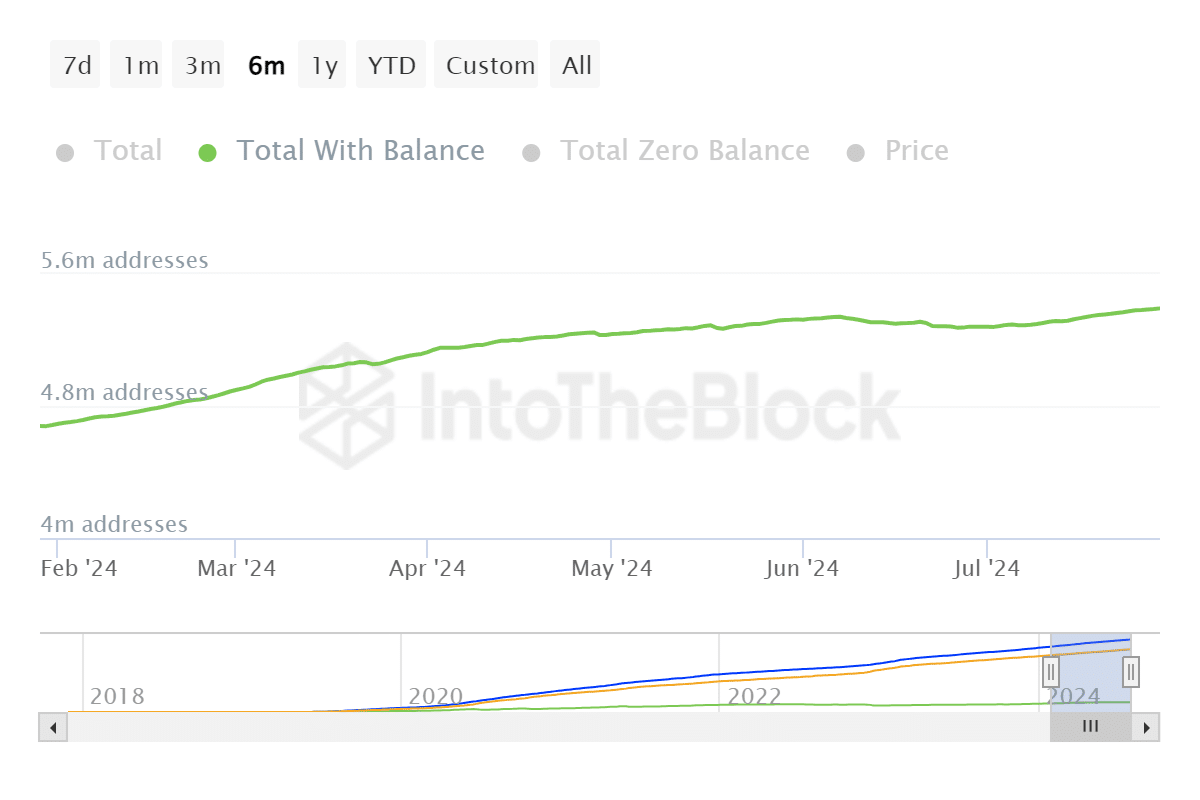

Tether’s growth was not only evident in its balance sheet or revenue but also its user growth. The stablecoin maintained robust address growth during the first half of the year.

The number of addresses on Ethereum [ETH] grew from 4.68 million at the end of January 2024, to 5.39 million at the end of July.

Address growth was even more impressive on the Tron [TRX] network. The latter added roughly 7.31 million addresses in the last 6 months alone.

These observations highlighted yet another factor contributing to Tether USDT’s demand. The crypto market has seen the return of more activity as the market switched from bearish to bullish.

Demand for the stablecoin has primarily been driven by exchanges and on-ramps. The first half of 2024 has been quite heated in terms of activity.

From the looks of things, USDT may continue to generate robust revenue in the second half of the year.