Tether [USDT] exchange supply dwindles as whales…

![Tether [USDT] news](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-15T095654.405.png.webp)

- Addresses with large USDT holdings are moving their assets off exchanges.

- Tether’s market cap dominated Circle, but earlier high sentiment has reduced.

Over the weekend, stablecoins became “unstable” as fifth-ranked cryptocurrency as Circle USDC in market value lost its dollar peg. Following the event, a lot of investors switched sides and held their stables in Tether [USDT]. This led to a drop in USDC’s market capitalization and increased dominance for Tether.

Realistic or not, here’s USDC’s market cap in USDT’s terms

While many may have believed that USDT could act as a safe haven, not many trusted keeping them on exchanges. In fact, whales were the leading light in this group.

Whales keep stability to themselves

According to Santiment, about $1 billion USDT left exchanges and were moved into self-custody multiple times in the last ten days. This was an uncommon occurrence because the act had only happened eight times over the last 365 days before now.

?? There have been 8 #Tether transfers valued at $1 billion or more over the past year. 4 of them have come in the past 10 days. Whales have moved $USDT out of exchanges at a rapid rate with the bank collapse and $USDC concerns being big contributors. https://t.co/lm0luYywj9 pic.twitter.com/lIaAc1BeVD

— Santiment (@santimentfeed) March 15, 2023

During the time Circle revealed its exposure, Tether’s CEO Paolo Ardoino, had assured the community that it had no links with Silicon Valley Bank (SVB). Regardless, USDC has found its way back to $1, although the price at press time was slightly below the expected value.

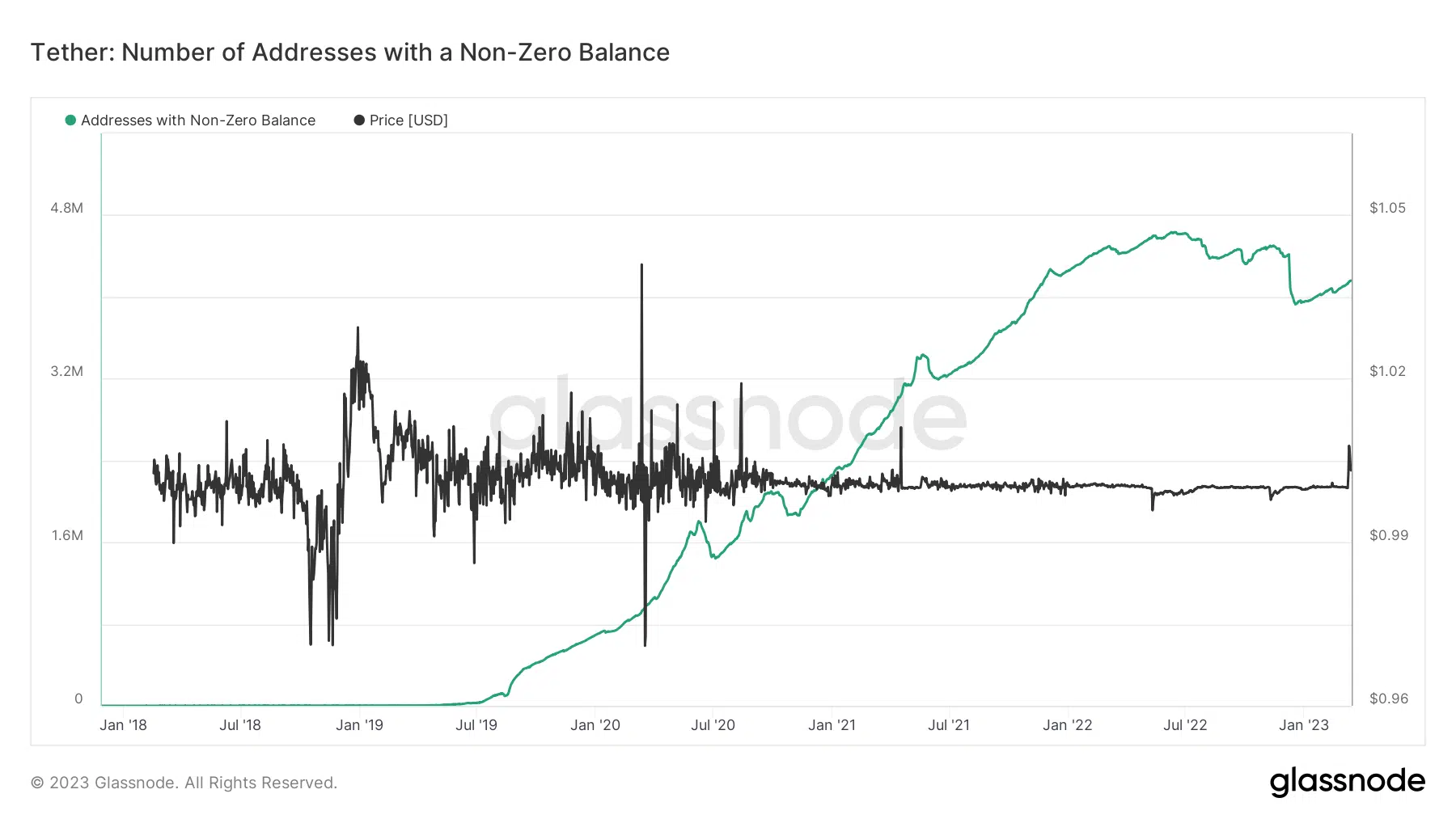

Meanwhile, USDT’s non-zero addresses decreased around 18 February. But, according to Glassnode, the number of unique addresses holding a positive amount of the stablecoin had increased to 4.15 million. This confirmed the restoration of the USDT’s superiority as USDC’s position in this aspect only had 1.59 million unique addresses.

Moreso, one part of the USDT network that caught the eye was the velocity. An explanation of this metric is that it measures how many units of a coin are circulating in a network. It is derived by calculating dividing the on-chain transaction volume by the market capitalization.

High circulation but conviction is down

At press time, USDT surpassed the highs of the last ten months, as it peaked at 0.366. This value means that there has been a rapid increase in liquid supply. Therefore, the broader market was increasingly transacting using USDT. But for those who held a large supply, keeping off exchanges was the way to go.

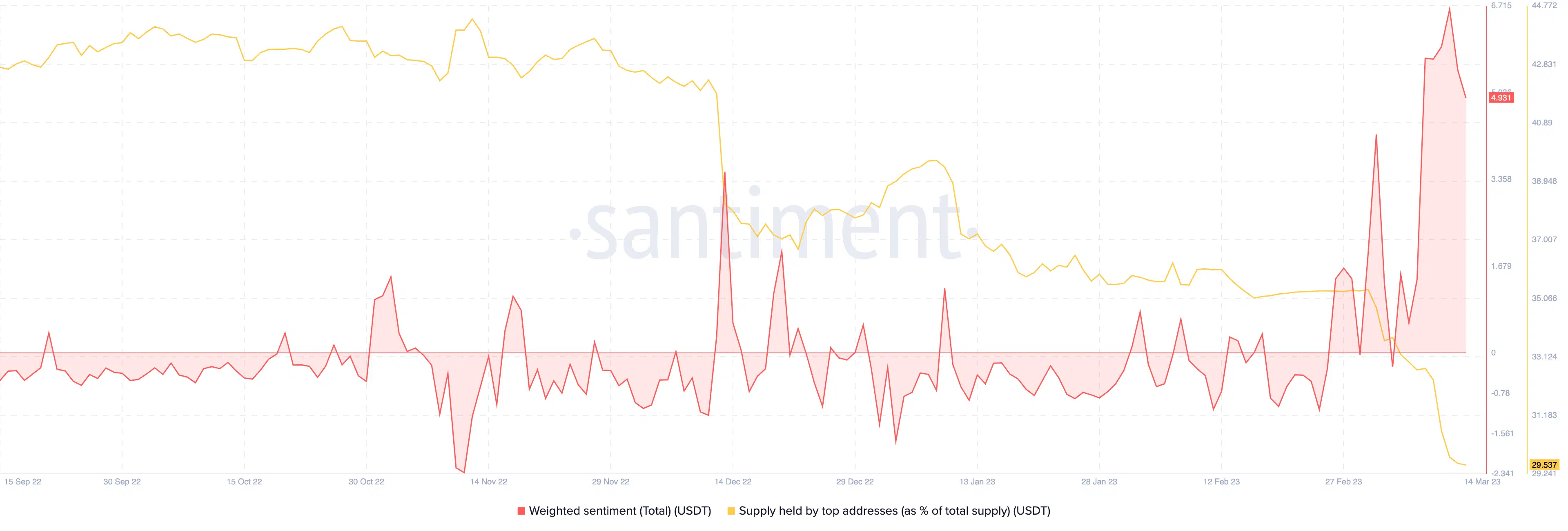

Additionally, the USDC troubles helped improve the perception towards USDT. This was because Santiment’s data showed that the latter’s stablecoin reached 6.628 on 12 March. The weighted sentiment compiles the public opinion about an asset.How much are 1,10,100 USDTs worth today?

Hence, the hike implied that social volume was high and the feeling towards USDT was largely positive. However, press time data from the on-chain analytic platform revealed that the metric had been suppressed a bit.

The supply percentage held by top addresses also trended along the downside. At press time, the chunk of these heavy-purse investors had decreased to 29.53.

![Tether [USDT] velocity](https://ambcrypto.com/wp-content/uploads/2023/03/glassnode-studio_tether-velocity.png.webp)