Texas one step away from creating official Bitcoin Reserve

- Texas advances SB 21 to establish the nation’s first state-managed Bitcoin reserve.

- New Hampshire leads adoption while Florida withdraws Bitcoin investment bills.

As momentum around state-level Bitcoin [BTC] adoption fluctuates across the U.S., Texas is doubling down on its commitment.

While several states have cooled their enthusiasm following Donald Trump’s federal-level Bitcoin Reserve proposal, Texas is pushing forward.

Texas moves ahead with the Bitcoin Reserve bill

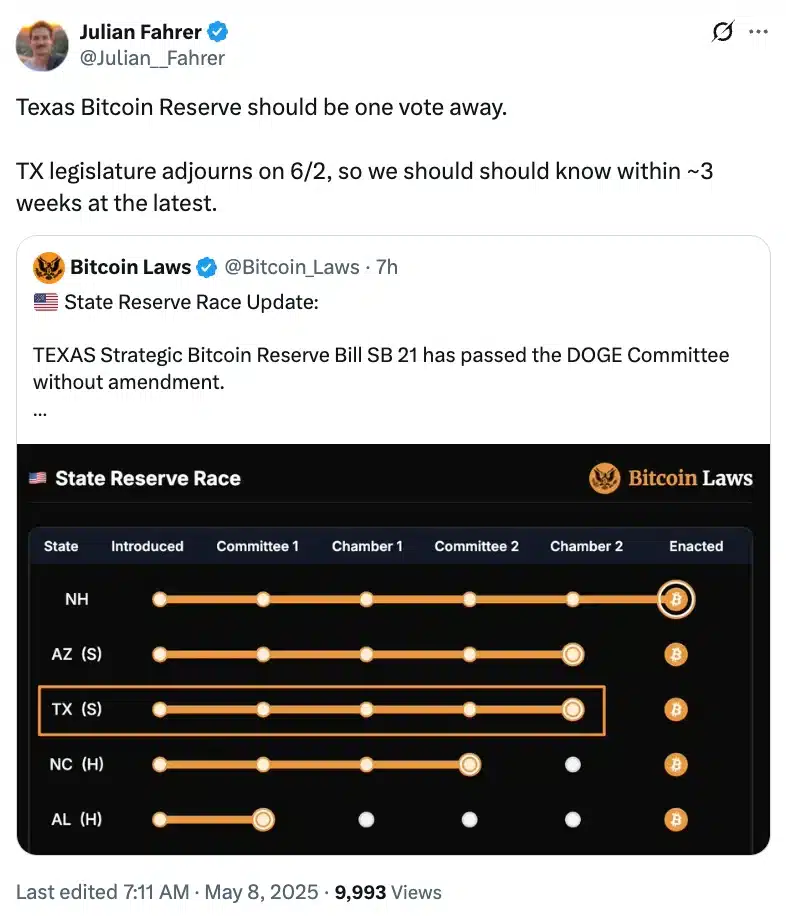

The Texas House Committee on Government Efficiency recently advanced Senate Bill 21, a proposal to create a “Texas Strategic Bitcoin Reserve.”

With the bill already clearing the Senate, only a full House vote now stands between Texas and becoming the first state to officially establish a Bitcoin reserve managed by the state comptroller.

Remarking on the same, Pierre Rochard, CEO of The Bitcoin Bond Company, noted,

“The Texas House committee has approved SB 21, next steps a Texas House vote by all members and the governor’s signature. It looks likely that Texas will have a Strategic Bitcoin Reserve, the big open question is how much BTC will be acquired.”

Initially introduced in January by Republican Senator Charles Schwertner as a BTC-exclusive measure, Senate Bill 21 later evolved to potentially accommodate other digital assets.

The revised version, refiled in February, reflects a broader approach to state-level digital asset strategy.

Adding further, Bitcoin Laws founder Julian Fahrer highlighted that the bill’s fate will likely be decided before the Texas legislature adjourns on 2nd June.

Meanwhile, BTC’s recent price surge, trading at $99,637.37 at press time, after a 2.72% 24-hour gain, adds further momentum to the bill’s relevance as the flagship cryptocurrency edges closer to the $100K milestone.

Other states and their divergent takes on Bitcoin

Beyond Texas, several U.S. states are ramping up their engagement with Bitcoin and digital asset strategies.

For instance, on the 6th of May, New Hampshire set a national precedent by officially enacting a Bitcoin reserve bill, earning praise from Governor Kelly Ayotte for leading the charge.

Meanwhile, North Carolina took a major step toward crypto integration as its House passed the “Digital Assets Investment Act” (HB92) with a 71–44 vote.

Additionally, on the 7th of May, Arizona Governor Katie Hobbs signed House Bill 2749 into law. This established the state’s first Bitcoin and Digital Asset Reserve Fund.

The fund’s purpose is to manage unclaimed digital holdings, rather than make new investments. Her decision follows an earlier veto of a more ambitious reserve proposal.

However, while some states are forging ahead with Bitcoin adoption, others have taken a step back.

Florida, once seen as a potential leader in integrating BTC into its state treasury, has quietly shelved its ambitions.

The state officially withdrew two companion bills: HB 487 and SB 550, which aimed to allocate up to 10% of specific public funds into Bitcoin, as the legislative session concluded on 3rd May.

This move reflects a more cautious stance amid the broader national debate over crypto’s role in government finance, signaling that not every jurisdiction is ready to embrace digital assets just yet.