DeFi plunge has this effect on Uniswap, AAVE, Maker, Yearn Finance

Uniswap, AAVE, Maker, and Yearn.Finance are some of the best performing DeFi assets existing in the space at the moment. While DeFi has grown monumentally over the past few months, with Cardano releasing its smart contracts mainnet today, the excitement is unmatched. Even so, the market has seen a significant drop in DeFi’s value. And with it, these altcoins took a hit as well.

DeFi goes down

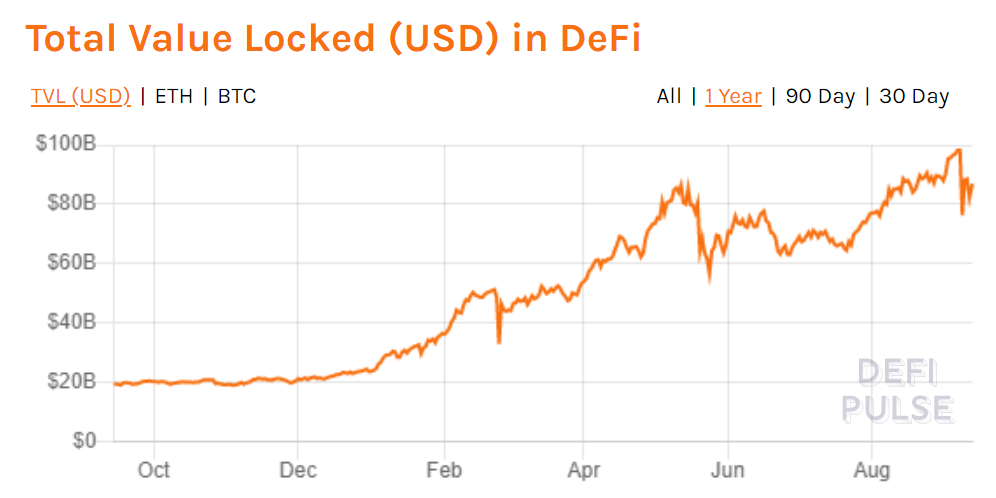

Total value locked in DeFi this week fell hard dropping by about $11 billion, from $98 billion. This is not necessarily new, as this has occurred twice this year earlier after a bull run, first in Feb then May. In February it fell by $18 billion and in May it fell by $19 billion.

However, at $87 billion, it was still way higher than ever before, so there isn’t much to worry about there.

DeFi TVL in the past | Source: DeFi Pulse – AMBCrypto

In accordance with the drop in TVL, the DeFi Pulse Index (DPI) fell by 16.62% at press time. At its worst, it plunged by 24.01%. The worry although is when it came to the top-performing DeFi assets such as Uniswap (UNI), AAVE, Maker (MKR), and Yearn.Finance (YFI).

In the last 5 days, each of these tokens dropped over 20%. Uniswap witnessed the highest fall of all, as it went all the way down to 26.86% (UNI)

Uniswaps 26% fall | Source: TradingView – AMBCrypto

So which asset is the best?

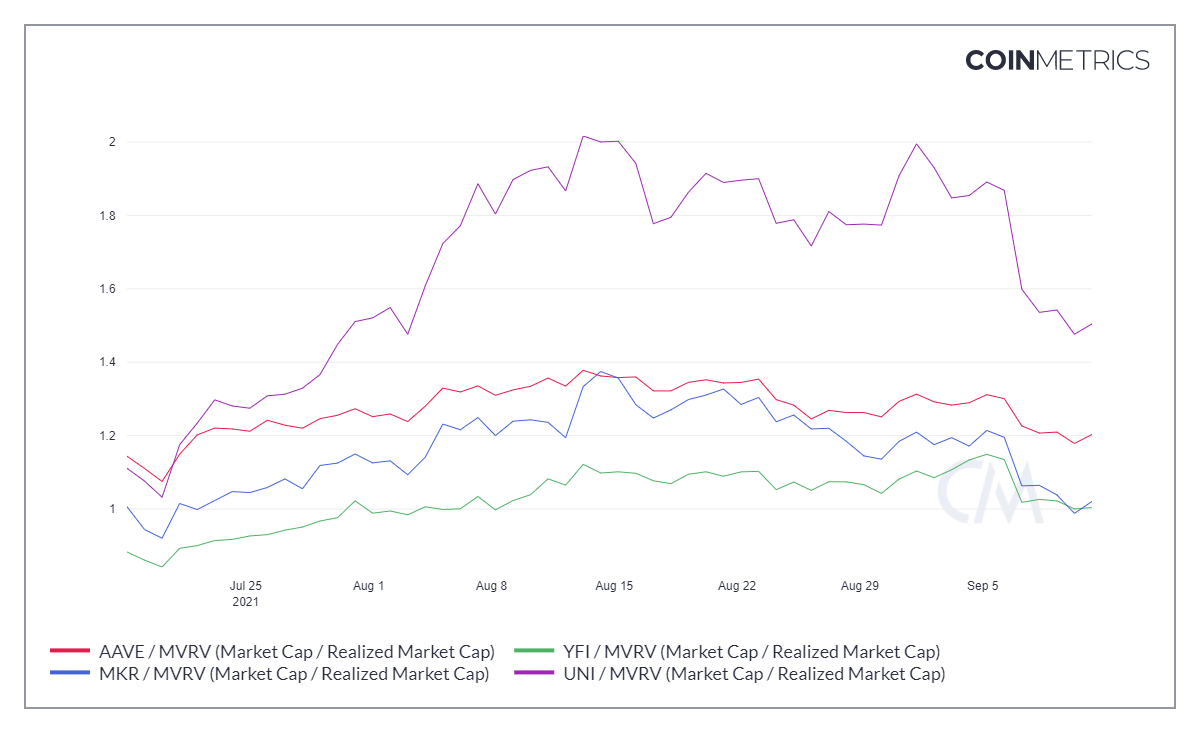

Even though UNI fell the most, it was also the strongest in terms of network performance. MVRV ratio and the network value to transactions showed stark dominance of Uniswap over the other altcoins.

MVRV of the assets | Source: Coinmetrics – AMBCrypto

As for investor participation, once again UNI lead, followed by AAVE, YFI, and MKR. Uniswap is once again the best performer, both in terms of daily active addresses and transaction numbers.

Active Address for the coins | Source: Coinmetrics – AMBCrypto

But in terms of profitability, the ranks changed. MKR is the most profitable option at the moment with YFI and UNI following it. Here AAVE came out as a bad asset since its profitability is a mere 37%.

AAVE’s profitability is at 37% | Source: Intotheblock – AMBCrypto

However, here are the latest updates. UniCode hackathon event announced for the Uniswap community. Maker Foundation moved to dissolve itself in order to give way to a completely decentralized network. Lastly, $868k earnings reported by YFI in Q2, through yield farming treasuries.

These were helping the price rise and make the 3 alts, a better choice of investment. So AAVE, may be the one here to stay away from.