The how and why of Bitcoin, Ethereum, XRP sharing a common bullish narrative

The collective cryptocurrency market is at a critical junction. With major altcoins stagnating on the charts, Bitcoin could have reached a local top for the time being as well. However, the total market cap value was at an interesting stage.

As illustrated in the chart above, the total market cap of digital assets was right under its all-time high level of $2.42 trillion. The range was tested earlier in September, and now the value was extremely close to the ATH range again.

It can be inferred that a push above $2.42 trillion may collectively trigger a bullish leg as the market cap may head towards $3 trillion. In line with that thought, at press time, these three assets were most likely to bounce higher.

Bitcoin, Ethereum, and XRP; managing above the average?

Out of the top 10 crypto assets, only Bitcoin, Ethereum and XRP were able to manag positions above their immediate moving averages on the daily time frame. The analysis was drawn taking into consideration, the 15, 50, 100, and 200 daily moving averages, in order to evaluate the resistance or support schematics across short-term and long-term price action.

At press time, these three assets maintained position above all the MAs, indicative of the likelihood of stronger recoveries.

However, it is important to note that the trend may change over the next few days if bearish pressure continues to weigh on the markets. For example, XRP was currently testing the 50-Moving Average as support, and failure to bounce back may lead to a positional close under the moving current MA.

So how does each asset relate to the other?

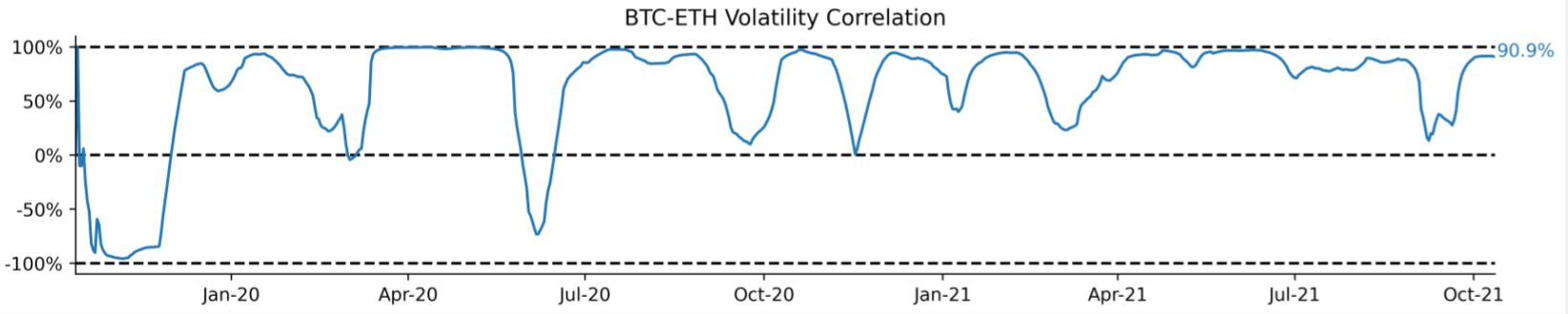

In the current market situation, it might be essential to evaluate the volatility correlation. Right now, and over the course of 2021, Bitcoin and Ethereum have shared a strong volatility correlation. This has been evident in past bullish rallies as well, but during recoveries, it has been more evident.

With respect to XRP, Bitcoin shares a correlation of 68.7% at press time, and ETH shared 71%. Hence, the correlation index remains on the higher side for these three assets.

Considering Bitcoin breaches above $60,000 in the near term, Ethereum should be able to follow suit and breach $4000. For XRP, the price range is still contemplative, since it failed to establish strong highs during the August-September rally.