The steady decline of stablecoins: Regulatory roadblocks and volatile markets

- Top stablecoins declined in market capitalization by over 21% compared to the same period in 2022.

- However, an increasing Stablecoin Supply Ratio (SSR) could indicate a bullish signal for Bitcoin.

While stablecoins were designed to maintain a stable value, recent months have demonstrated that they are not impervious to the volatile swings in the cryptocurrency market. Furthermore, their close association with the fluctuations in Bitcoin’s [BTC] value has become increasingly evident over time.

Steady decline of the stablecoins

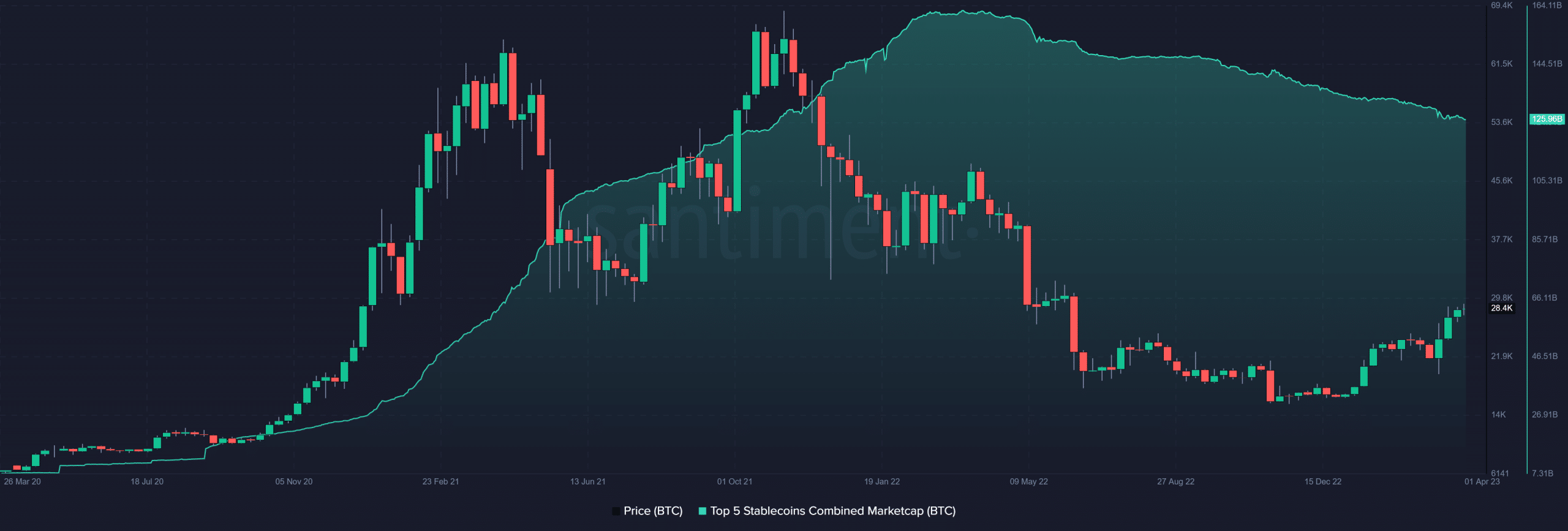

According to data from Santiment, the five largest stablecoins by market capitalization, namely Tether [USDT], USD Coin [USDC], Binance USD [BUSD], DAI, and Pax Dollar [USDP], have experienced a fall in their purchasing power over recent months. As of writing, the combined purchasing power of these stablecoins was about $125.9 billion, with a noticeable downward trend evident in the chart.

At press time, this figure was over 21% lower than what it was during the same period in 2022. However, it remained over 100% higher than its levels in 2021.

Stablecoins are typically the preferred option for cryptocurrency investors, as they provide a means to transition from volatile coins, such as Bitcoin, to a more stable asset. However, a decrease in the market capitalization of stablecoins could reduce liquidity.

It could also impede the upward momentum of other cryptocurrency assets. Conversely, an increase in the market capitalization of stablecoins may increase the likelihood of a positive trend for Bitcoin.

Santiment’s chart also revealed that the stablecoin buying power decline has slowed over the past week. The pause could be attributed to the slight volatility that Bitcoin and the wider cryptocurrency market experienced during this period.

Possible reasons for the decline

USDT faced persistent FUD over the years, particularly with regulatory concerns and the transparency of its reserves. More recently, BUSD encountered a regulatory obstacle when it was classified as a security, leading Paxos to temporarily halt the minting of BUSD until the regulatory issues are resolved.

USDC also faced some FUD after the collapse of Silicon Valley Bank and the exposure of Circle to over $3 billion, which sparked concerns about the stability of the coin.

The regulatory issues and resulting FUD surrounding stablecoins have caused them to de-peg over time, although they have reclaimed their pegs. However, the reserve of BUSD has continued to decline due to the uncertainty surrounding its regulatory status.

These events, combined with other factors, have contributed to reducing the market capitalization of stablecoins.

The BTC Stablecoin Supply Ratio

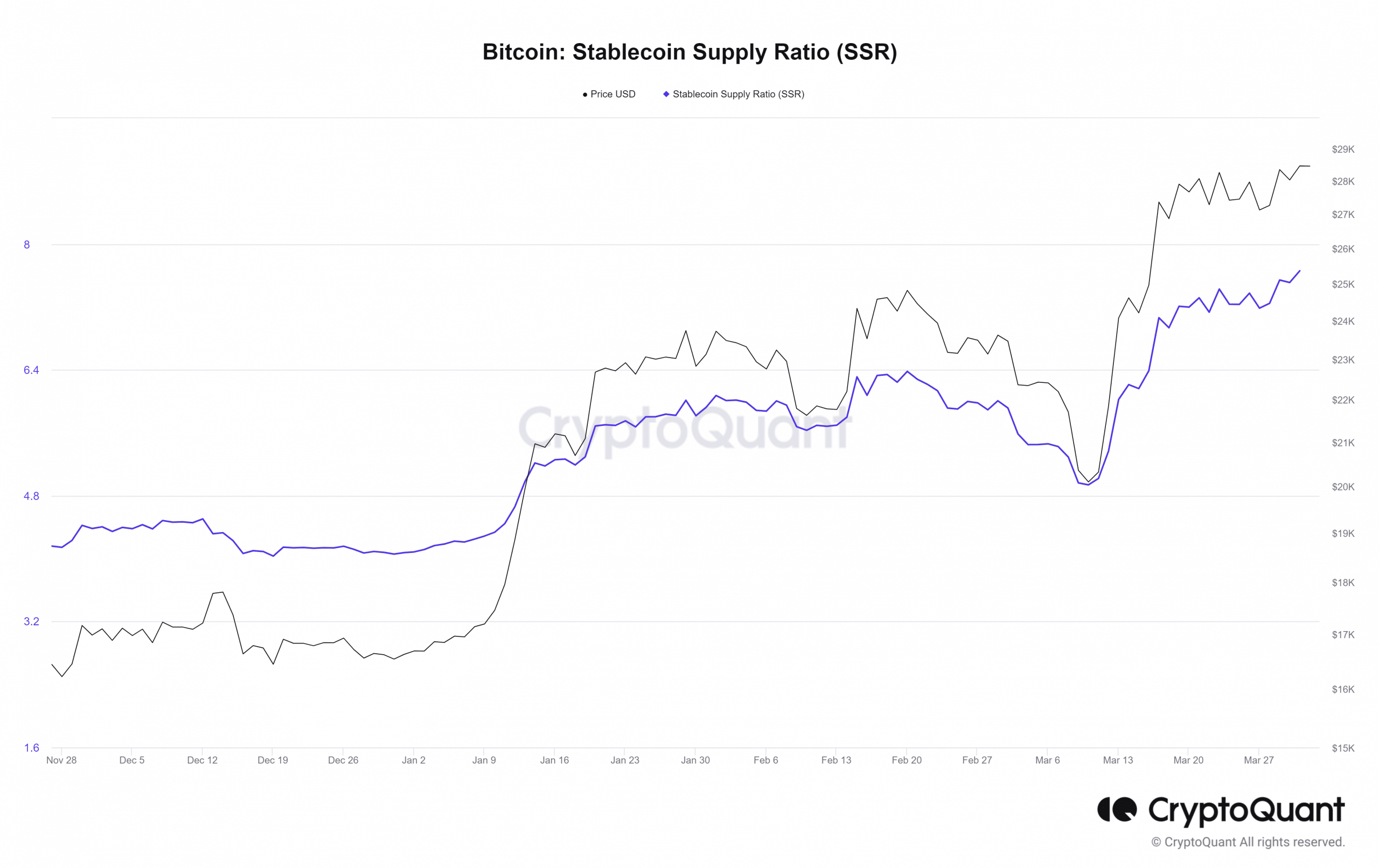

Although the market capitalization of top stablecoins declined, data from CryptoQuant indicated that the Stable Coin Supply Ratio (SSR) has been on the rise. As of the time of writing, the SSR was approximately 7.6, an improvement from around four earlier in March.

An increase in the Stablecoin Supply Ratio (SSR) could suggest a potential bullish signal for Bitcoin (BTC). It indicates a rise in capital available to flow from stablecoins into BTC. It could lead to a potential increase in demand for BTC, which could drive up its price.

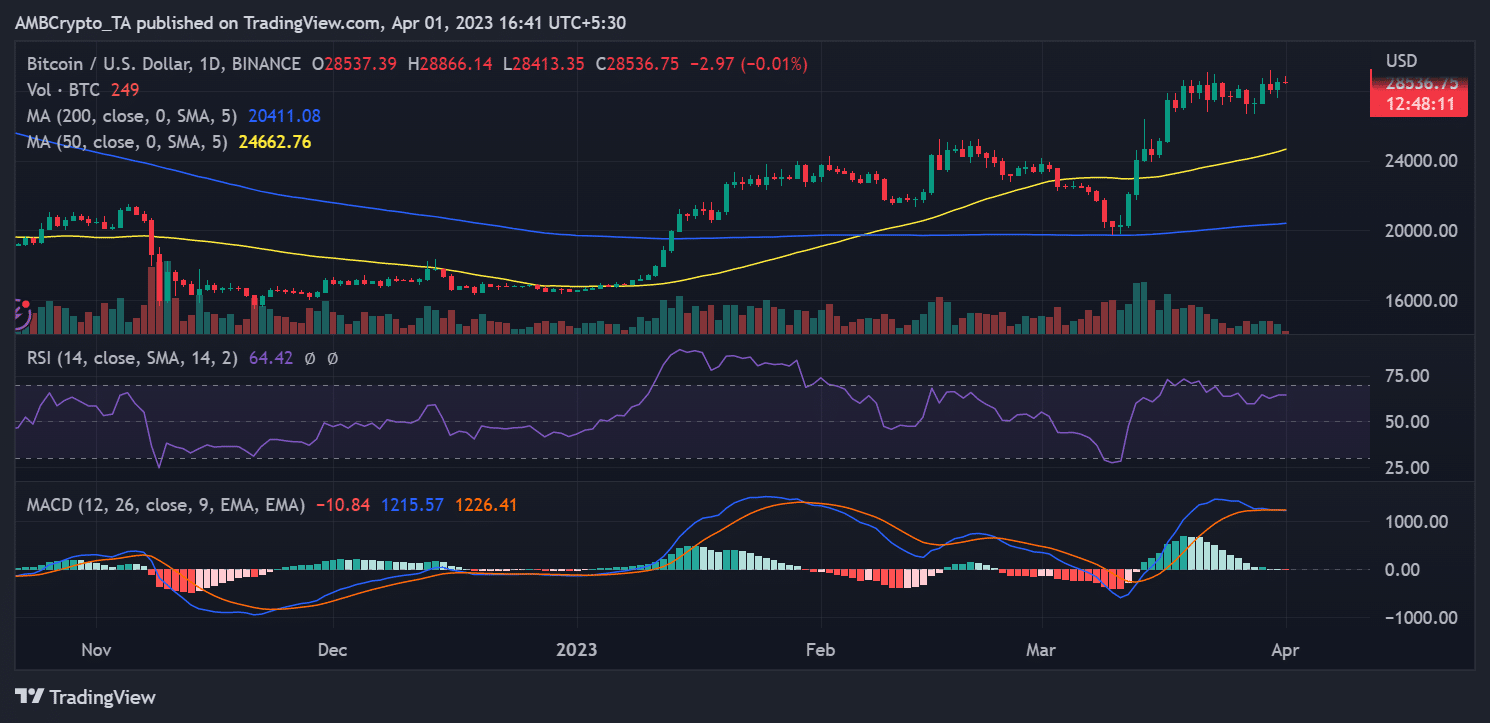

As of this writing, Bitcoin was trading at approximately $28,490, representing a loss of less than 1%. Furthermore, the long and short moving averages (yellow and blue lines) were trending below the press time price movement.