The year is 2043; What is XRP’s ODL show like?

- Ripple’s ODL product reaches new heights but sees a decline in sales.

- XRP’s price and weighted sentiment metric surge, but growing short positions raise concerns.

Ripple‘s On Demand Liquidity (ODL) product has been making headlines as the firm reported sales of over $200 million in Q4 of 2022.

The firm Ripple continued its European expansion and eventually, the market saw ODL being launched in France and Sweden. Despite this recent milestone, the overall sales of the ODL product saw a decline from $310.68 million in Q3 to $226.31 million in Q4. This was a decline of over 27%.

Now, a person looking ahead into the future might as well question if Ripple’s ODL will have its success story going after 20 years.

Read XRP’s Price Prediction 2023-2024

In that context, it is to be noted here that this continuous decline in sales could impact XRP negatively in the future. However, in general, the crypto community seems optimistic about the future of Ripple’s ODL.

Ripple curries favor of the public

One of the reasons for the market’s optimism can be Ripple‘s upcoming products.

Consider this- currently, the firm is working on its upcoming Ethereum Virtual Machine (EVM) sidechain for the XRPL, the first phase of which was recently launched.

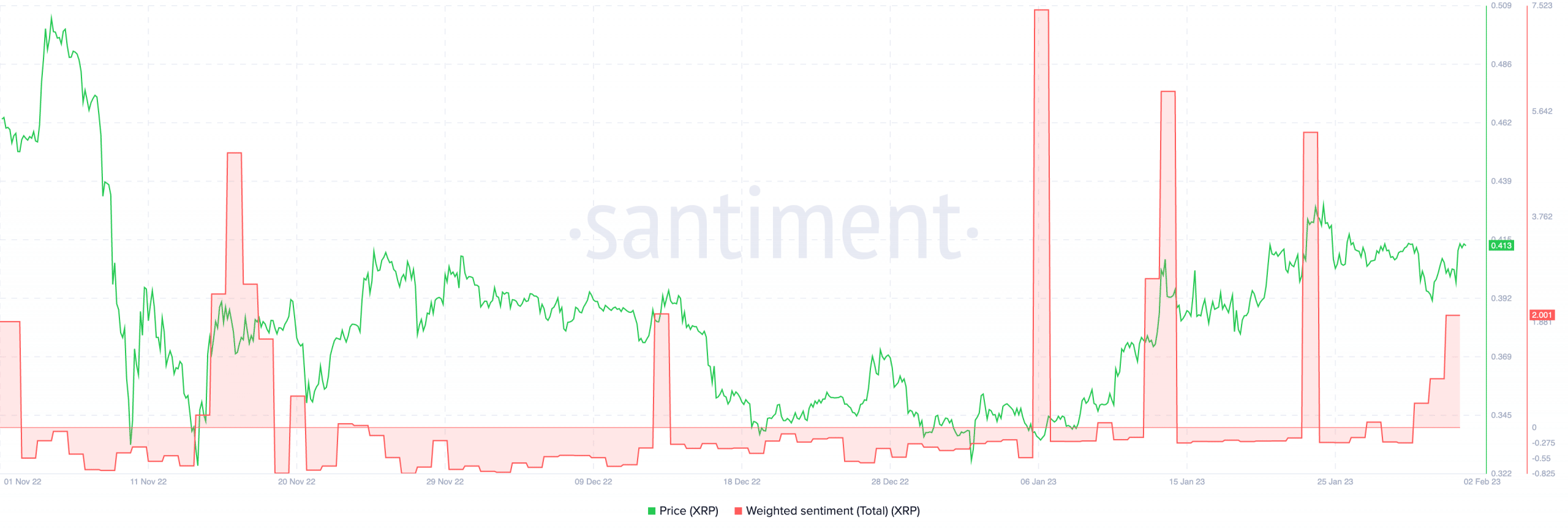

These developments led to a surge in XRP’s price and its weighted sentiment metric.

According to the metric’s readings, investors can take long bets keeping their risk appetite in focus.

Realistic or not, here’s XRPs market cap in BTC’s terms

Is it too soon to cash in?

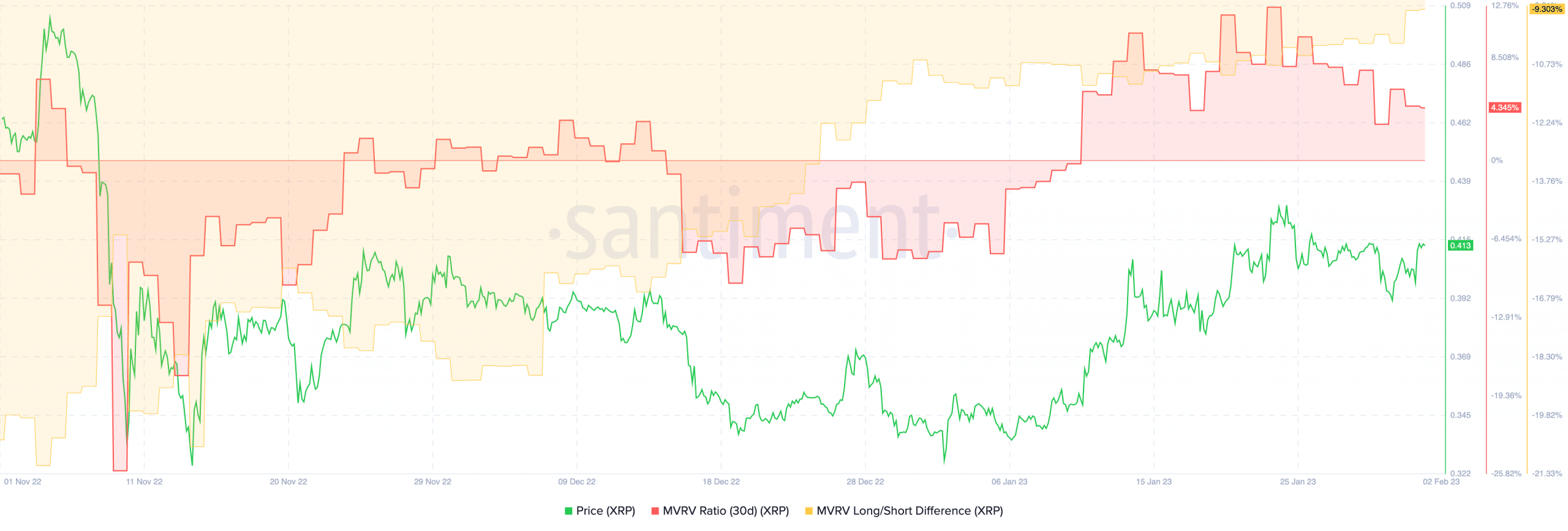

Despite the increase in prices, the overall MVRV ratio also increased, implying that if XRP holders decided to sell their holdings at the current price, they would be doing so at a profit.

Furthermore, the Long/Short indicator was negative, which suggested that many short-term holders would benefit from selling their positions.

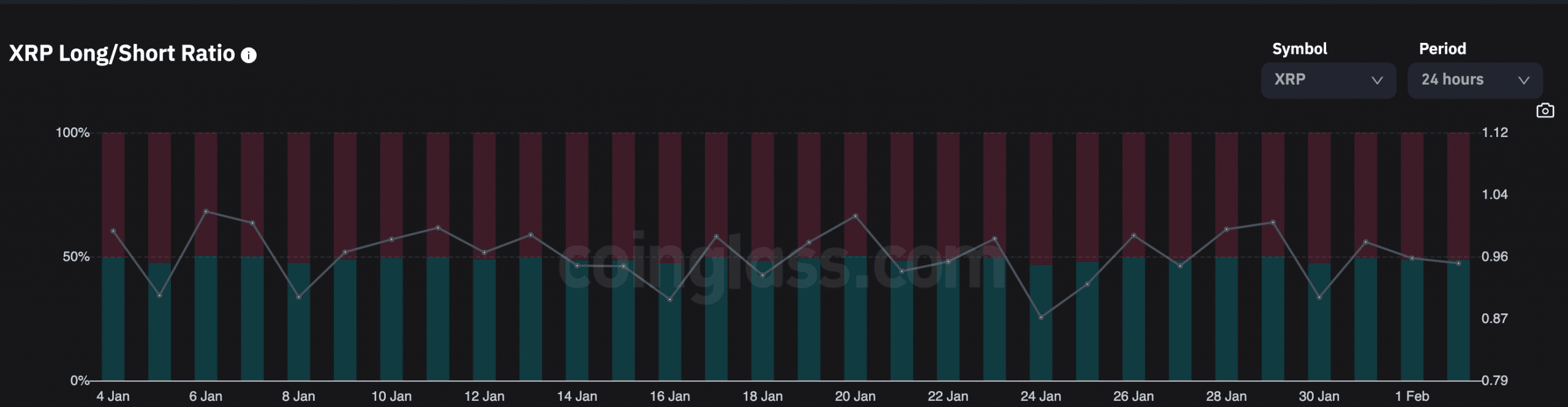

Reportedly, many traders already started betting against XRP, with the number of short positions held against the token increasing over the last few days.

According to coinglass, 51.39% of all positions taken against XRP were shorts, at the time of writing.

In conclusion, although Ripple’s ODL product witnessed growth in terms of global reach, the decline in overall sales was a matter of concern.

Other factors such as Ripple’s ongoing proceedings with the SEC, would also impact XRP price in the long term. Readers are advised to take all these components into consideration before making any decision.