These 3 factors will determine if Ethereum’s recovery will be sustainable

Ethereum’s recovery is well underway, with the price holding near the $2000 level. Despite a price drop of nearly 45% in the past week, over 85% ETH HODLers are profitable at the current price level. The number of large transactions dropped over the past week, there were $193.39 Billion worth of large transactions on the Ethereum network. The on-chain sentiment continues to remain bearish, but the inflow of investment in Ethereum makes it likely that the recovery starts.

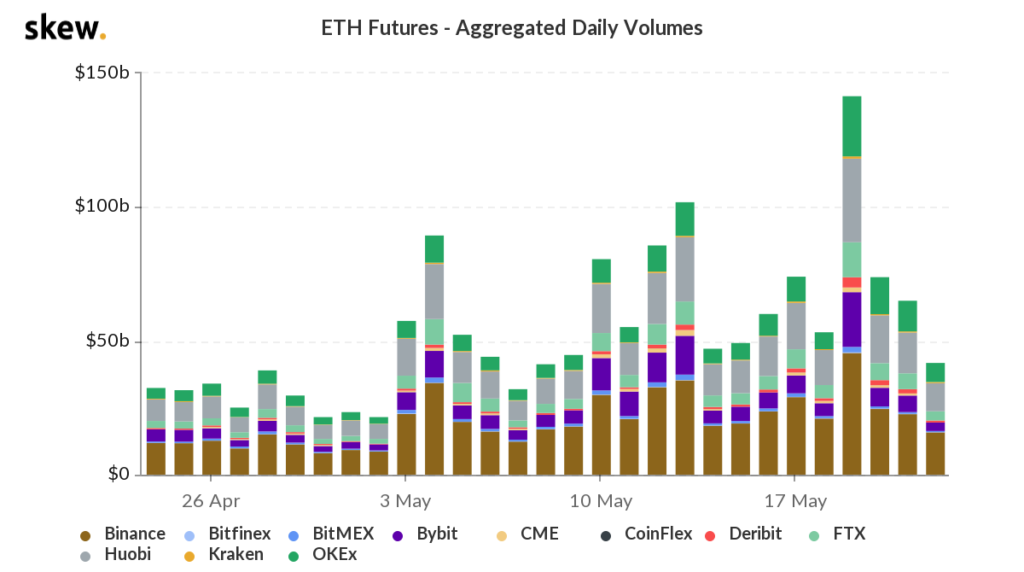

ETH Futures Aggregate Daily Volume || Source: Skew

Factor 1

Since Ethereum was overleveraged and the longs led Ethereum’s price to plummet. However, based on the above chart, the aggregate daily volume of ETH futures is below $70 Billion since May 19, 2021. Since the volume is consistently lower than the peak hit on May 19, it is likely that the recovery is underway, just as on-chain metrics point.

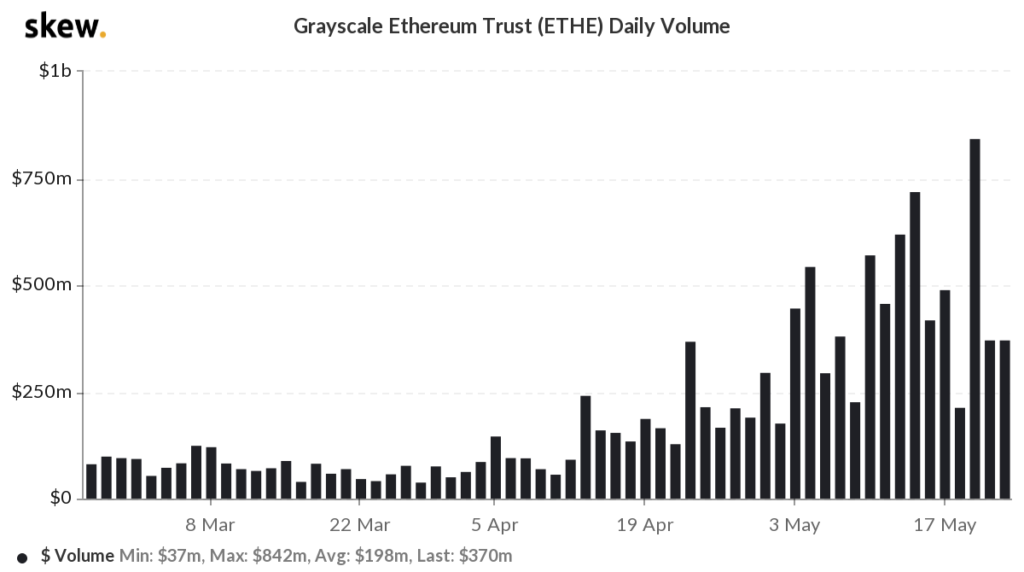

Grayscale Ethereum Trust ETHE || Source: Skew

Factor 2

The daily volume of the Grayscale Ethereum Trust has dropped, just as the aggregate futures daily volume. The last time Grayscale Ethereum Trust volume hit this level, Ethereum’s price rallied to the $3000 level, it is likely that if the volume remains below this level, the rally that starts will be a sustainable one.

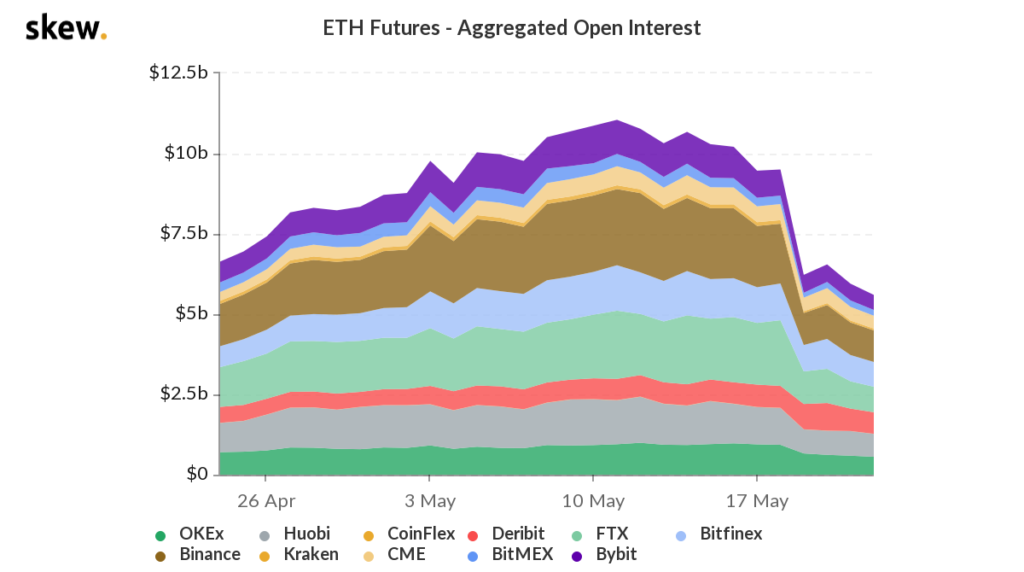

Source: Skew

Factor 3

Among other metrics, Ethereum’s open interest has dropped significantly, based on the above chart. After hitting a peak in the last week of April, open interest has dropped. As the social volume increases consistently, and ETH futures metrics signal a recovery from the price drop.

With a circulating supply of 115 Million ETH, and 31% drop in the overall market capitalization, ETH’s recovery is likely. 88% HODLers are profitable at the current price level, the current price action makes it likely that more traders profit from buying/ accumulating when the price was below $2500 level.

In the long-term ETH’s ROI has been high, consistently increasing. The accumulation through the dips is signaled by the increase in the concentration of large HODLers. Though the increase is not clear yet, that is a key metric to look out for. The increase in the concentration of large HODLers may also signal an increase in the inflow of investment in Ethereum.