These DeFi tokens Maker [MKR], Compound [COMP], CAKE are taking traders back to spring of 2017

Circa 2017, Bitcoin’s bull run triggered an altcoin rally; XRP, ETH, BCH, LTC, ADA, offered double-digit returns to HODLers and traders within a short-term, less than a month.

The current rally of some DeFi tokens – UNI, LUNA, AAVE, MKR, COMP is taking traders back to the spring of 2017. It has been noted that trends repeat frequently, especially in the case of altcoins that rally at least once post a Bitcoin halving. The 2017 altcoin rally was largely driven by top ICO projects, however, the current rally of DeFi tokens is driven by institutional investors, launch of new ETFs and lending.

Community-driven decentralized DeFi tokens are all the rage, the poster boy being Safemoon. In the case of projects like UNI, LINK, LUNA, AAVE, concentration by large HODLers is increasing consistently. There is increasing demand across spot exchanges since more traders are lining up for lucrative short-term ROI of these projects. So what retail traders are expecting from the current DeFi price rally is high short-term ROI relative to top altcoins.

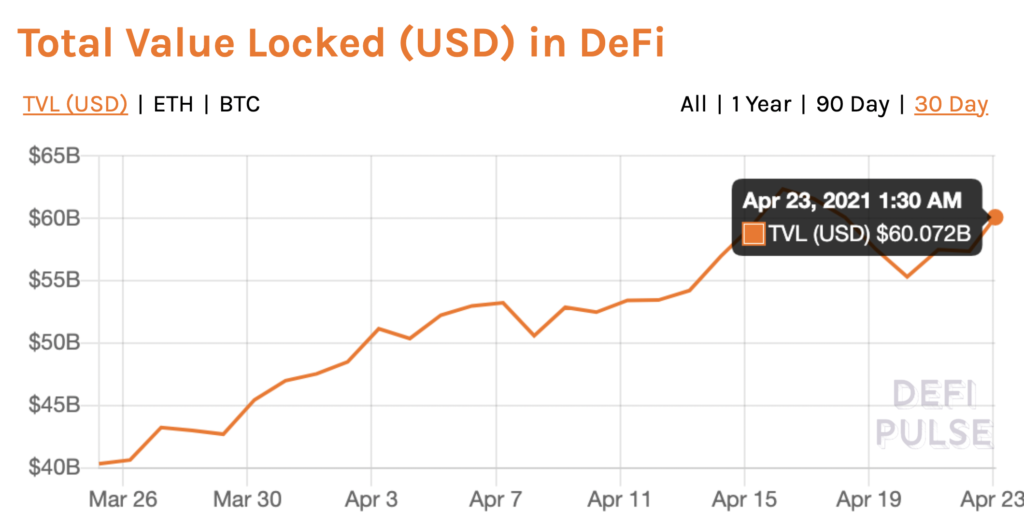

DeFi TVL || Source: DeFipulse

Maker’s price is up over 110% in the past 30 days, and the DeFi token is now trading at $4144 based on price data from coinmarketcap.com. The short-term ROI is high for MKR. The concentration by large HODLers is hitting higher, currently at 86%.

The current on-chain sentiment is bearish and large transactions on Maker network are dropping, however, this may be the early stages of consolidation, before MKR resumes its price rally. Currently, 100% of MKR HODLers are profitable and this makes it one of the top 5 DeFi projects offering high short-term returns to traders.

The increased institutional participation in DeFi is offering higher liquidity and volatility. This is evident from COMP’s rally. Compound is rallying and the price is increasing steadily, nearly 7% higher in the past 24 hours.

Trade volume has increased over a 100% in the past 24 hours and this signals a bullish sentiment. The concentration by large HODLers is hitting closer to 100% and large transactions are increasing. This could hint at increasing accumulation from large HODLers. This is one of the top metrics driving DeFi price rallies and offering high short-term returns on portfolios.

Projects like CAKE have increasing demand across spot exchanges, however, CAKE is leaving exchanges. Trade volume has dropped significantly, however like most other DeFi tokens, the project is currently going through a phase of consolidation before making a comeback and offering returns the following week.