Is it still worth placing a bet on SushiSwap [SUSHI]?

Born out of the food farming mania that was part and parcel of the DeFi summer in 2020, SushiSwap was initially seen as merely a “generic, tokenized fork” of Uniswap. Within months, however, the former was giving the latter a run for its money, with SushiSwap’s growing volumes contributing to its market share hiking with every passing week.

Consider this – In December, Sushiswap was processing an average of 25% of Uniswap’s weekly volume. By late January, however, the protocol was averaging 48%. At the time, Bankless analyst Lucas Campbell had noted,

“It’s nearly impossible to deny the trend: it’s up and to the right.”

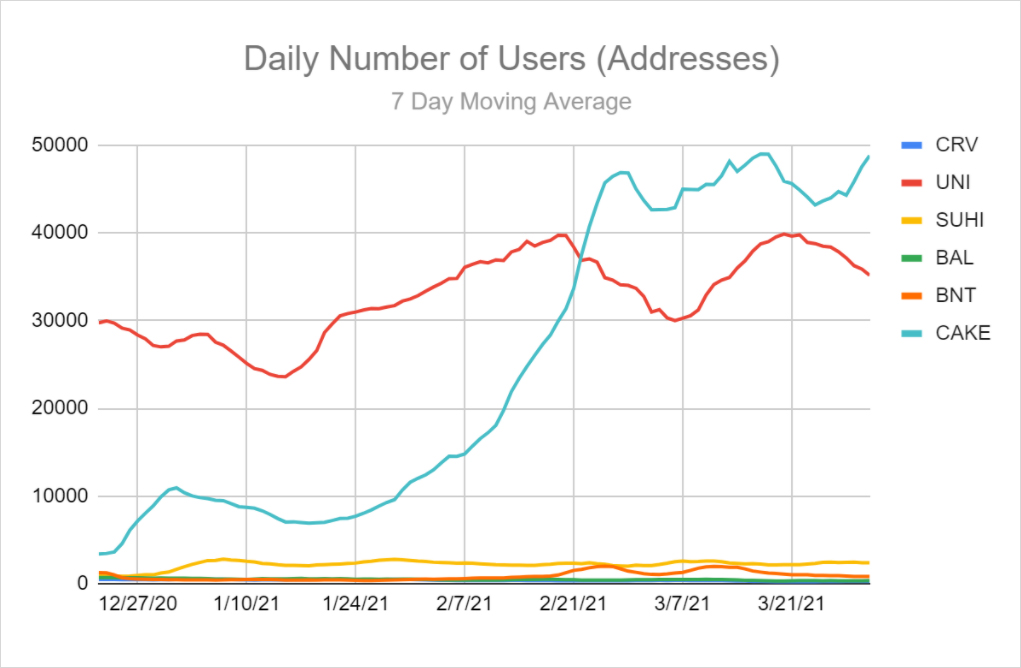

With volumes and market cap and market share climbing through the roof, there was good reason to believe so too. However, fast-forward to April 2021, and it would seem that a lot of momentum that was previously associated with SushiSwap has dissipated. While Uniswap remains healthy, other protocols such as PancakeSwap have emerged in the tightly-contested space.

This can be best highlighted by the fall in SushiSwap’s Total Value Locked. As a recent report pointed out, for Automated Market Makers (AMMs) such as Uniswap, SushiSwap, and PancakeSwap, “TVL is a direct representation of liquidity.” According to the same, while PancakeSwap has seen its TVL surge exponentially at the cost of Uniswap recently, SushiSwap’s TVL has remained within a set range.

What’s more, over the past few months, SushiSwap’s 24-hour volumes and the daily number of user addresses have fallen way short too, with the same to be said for the Daily Volume/User metric.

Source: Deribit Insights

Perhaps, the simplest representation of its situation was the fact that at press time, SUSHI had fallen below other DeFi coins such as Terra, Avalanche, and Aave on CoinMarketCap. Further, while the likes of UNI have risen by 69% since the 1st of March, SUSHI was trading well below its price level on that date, at press time.

What does this mean? Is there any cause for concern?

Source: SUSHI/USD on TradingView

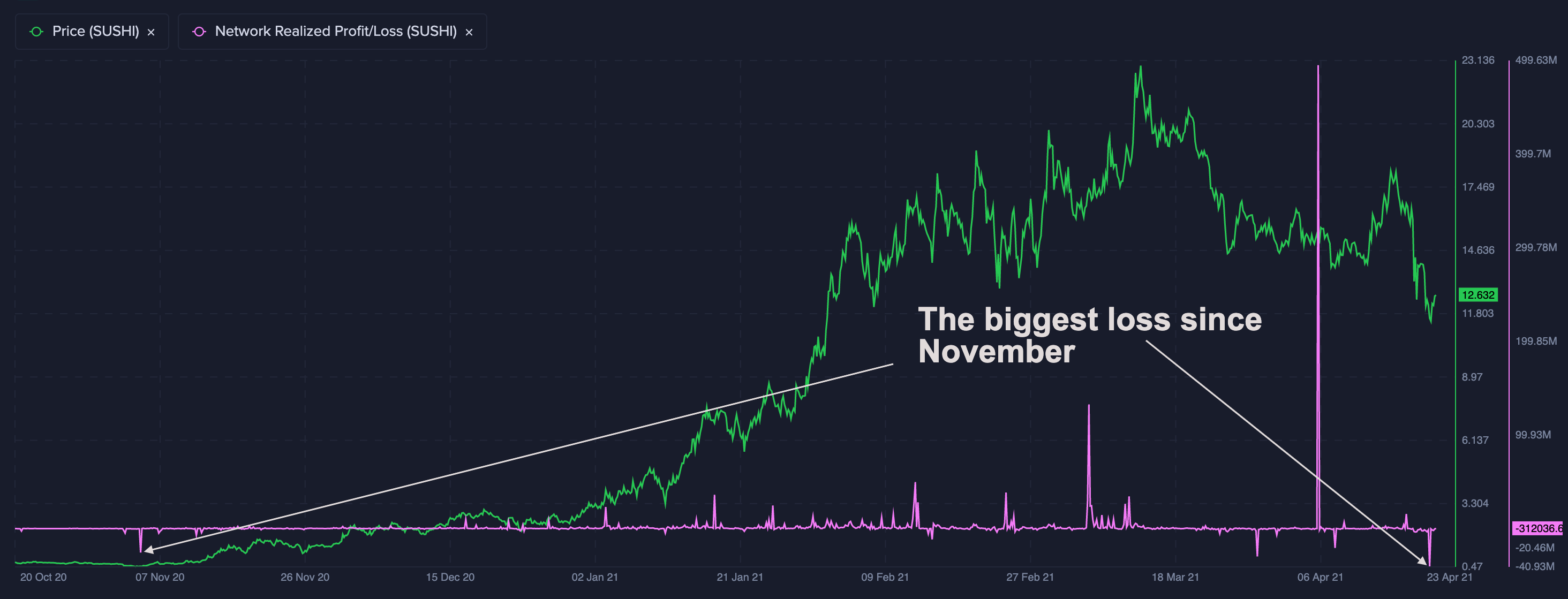

At the moment, the wider crypto-market is in the middle of a bearish phase, with alts correcting left, right, and center. Since this is expected to be temporary, one can predict that sooner or later, SUSHI will climb up the charts too. This, despite the fact that it didn’t rally when the rest of the altcoin market did so in early April. A few observations and metrics can be used to back up this assertion.

For starters, the Network Profit Loss metric is worth looking at. It “computes the average profit or loss of all coins that change addresses daily.” According to Santiment, NPL for SUSHI recently noted its biggest loss on the charts since November. This is worth highlighting, especially since the same was what flagged off the SUSHI rally towards the end of 2020 and the start of 2021.

Source: Santiment

Corresponding to the same, SUSHI’s active addresses are also holding steady, with the same observed to be at levels much higher than those seen in the month of March. Finally, the total balance of addresses holding between 100K to 1M SUSHI has risen sharply on the charts too.

What these findings indicate is that despite its lukewarm price performance on the charts, SUSHI remains a healthy altcoin. In fact, it can also be argued that while the prevailing market narrative is one favoring the bears, there’s good reason to expect an upside for SUSHI in the near term thanks to a series of organic developments in its ecosystem.

The introduction of Kashi lending and Margin Trading on SushiSwap’s BentoBox is one such reason. Kashi Lending is the first DApp built on top of the latter, with the same powered by isolated lending pairs similar to liquidity pools, but with “one side used purely as collateral for the other side, which is lent out.” Here, according to Messari’s Ryan Selkis,

“…. the riskiness of an asset as a collateral is completely contained within that pair.”

Both Kashi lending and BentoBox also have support for Binance Smart Chain and will be available on EVM-compatible networks, with one developer commenting,

“…. we imagine Sushi providing infrastructure for new projects to come market quick.”

What these new features and plans and updates reveal is that real development is happening behind the scenes for SUSHI. Backed by strong fundamentals, one can expect the altcoin to recover and rally soon. With Uniswap recently introducing a “business source license” with an eye on SushiSwap, it would seem that the competition hasn’t died down yet.