These two crucial events affect Bitcoin’s investor base

2021 is a crucial year for Bitcoin, and by extension, for the larger cryptocurrency market. While Bitcoin has come a long way in terms of adoption, the bull run of 2020-21 has seen two very crucial events affect Bitcoin’s investor base.

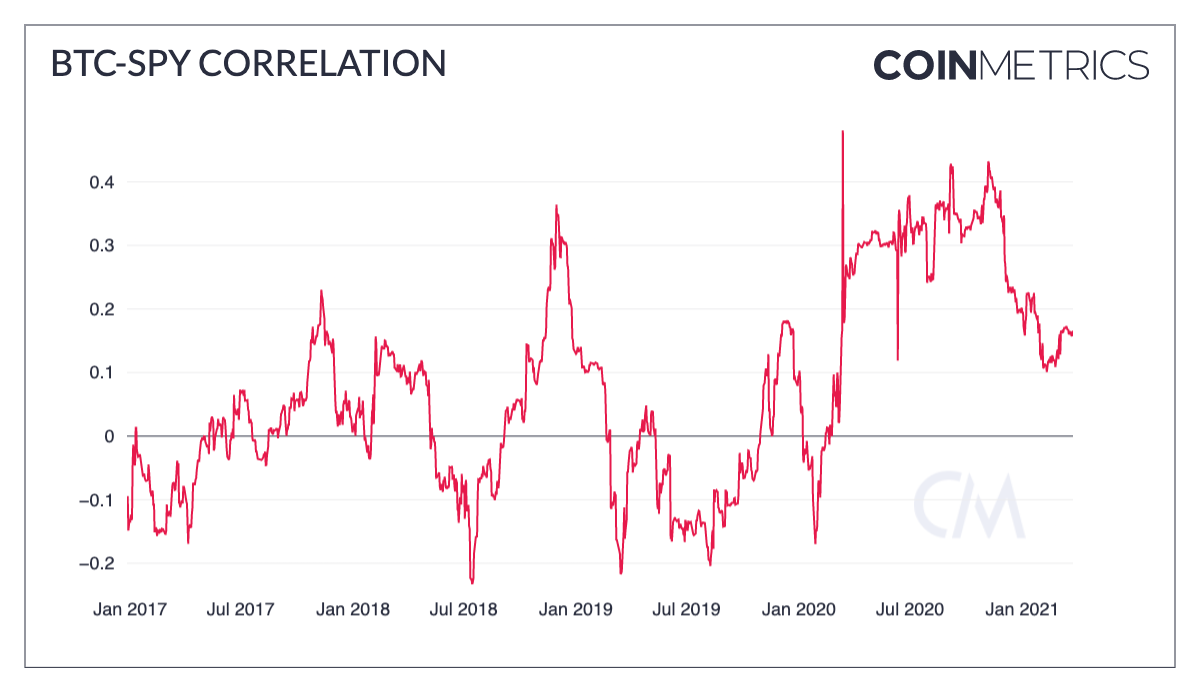

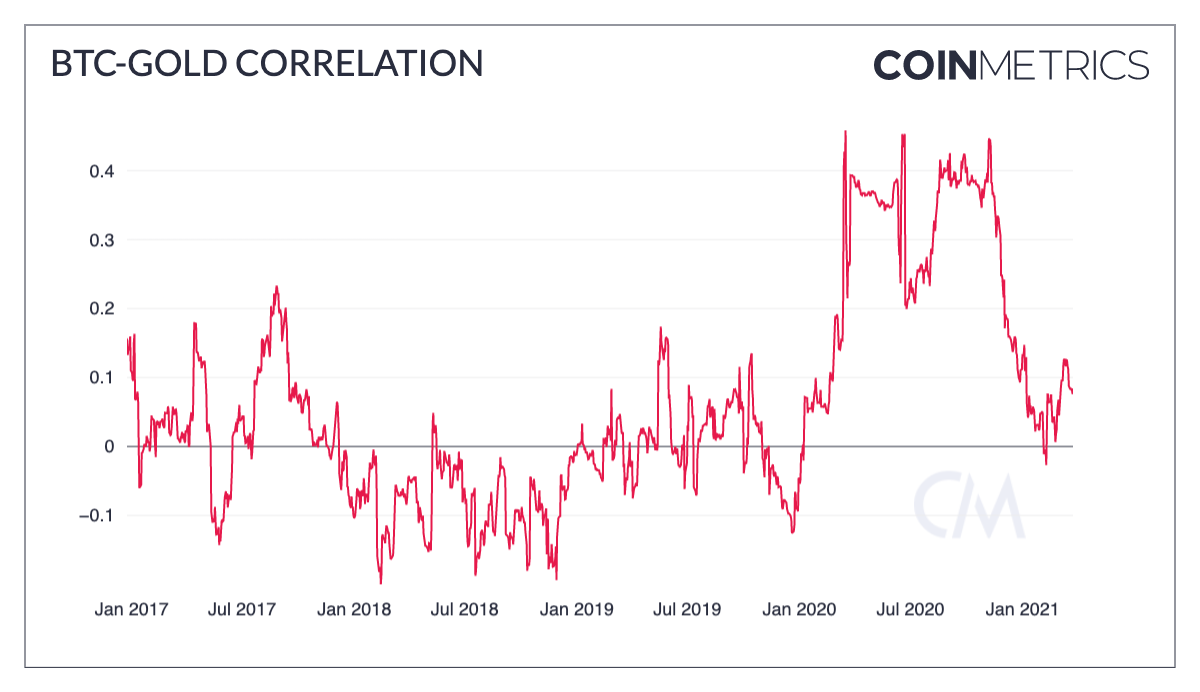

The first was a hike in institutional investments, with the surge in interest coming from traditional and institutional circles. Following the same, Bitcoin’s price was quick to respond too. The year also saw another interesting development which included the traditional market, and BTC’s relationship with the S&P 500, with gold seeming to have undergone its very own evolution over the past few months.

With the first quarter of 2021 coming to a close, Bitcoin’s price and its performances as a store of value asset are extremely positive and continue to fuel a spike in institutional and retail investors. This, despite the high valuation Bitcoin currently enjoys, with the crypto trading close to $60k at the time of writing.

In fact, according to market data, this is the best Q1 in the last 8 years from a price valuation standpoint, and the same has allowed the coin to register 100% gains, according to data provided by Arcane Research. Over the same timeframe, two developments spurred the price of BTC – The first was Tesla’s investment in BTC, and the second involved BNY Mellon announcing integrated services for BTC and other crypto-assets.

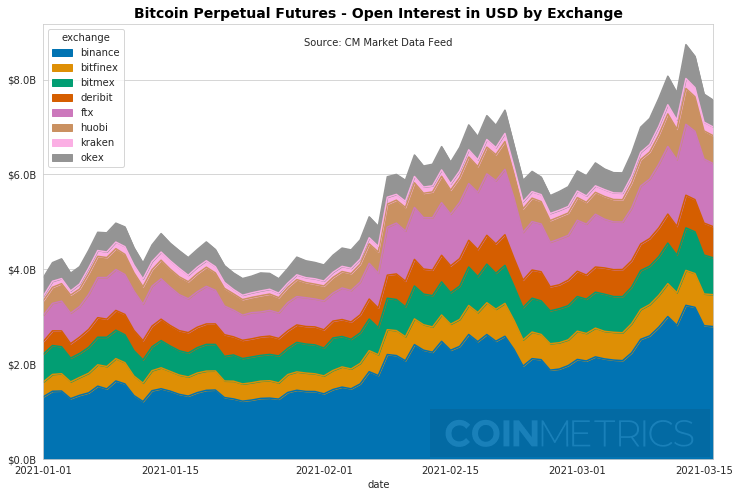

Interestingly, over the same timeframe, Bitcoin has also seen its Futures Open Interest levels hit all-time highs. This. according to data provided by CoinMetrics, has been a double-edged sword that in turn enabled long-term growth for the asset. The report pointed out,

“With new money pouring into the market BTC futures open interest levels hit all-time highs preceding both major selloffs. Although painful in the short-term, these sell-offs helped close out some over-leveraged positions, clearing the path for further growth.”

In addition to this, the cryptocurrency has been able to maintain a positive price trend over the past three months. In fact, Bitcoin’s close competitors in the traditional finance market seemed to have tweaked their relationship with the king coin.

While 2020 was not the norm thanks to the unprecedented macroeconomic conditions, Bitcoin maintained a high correlation with asset classes like the S&P. However, 2021 saw the trend reverse itself and BTC now enjoys a lot more independence thanks to the low correlation with the S&P – taking correlation levels back to what is considered the normal range.

This change in the relationship was also evident if one were to take a look at the BTC-Gold correlation. As a store of value and a long-term asset, BTC’s closest competitors continue to be monetary metals like gold, and CoinMetrics’s data seemed to suggest that the change in BTC’s correlation with gold has had ‘an even steeper decline, although it rebounded a bit in March.’

This has led to BTC eating into gold’s market share, with the “Bitcoin is digital gold” narrative gaining momentum.

In the coming months and remaining three-quarters of 2021, one could see Bitcoin’s correlation fall even further when it comes to traditional assets. This is likely to push institutional investor confidence primarily because of the autonomy the BTC market has enjoyed in comparison to other assets. Further, price prediction models’ projected values may soon materialize as the coin finds adequate momentum to break past its established ATH of around $61.7k.