This Bitcoin metric hasn’t seen these levels since the very early BTC days

The bitcoin market has been witnessing heavy drawdowns since the beginning of June. As the month comes to an end, the largest digital asset has dropped by 30% and was still reflecting high bearishness. This falling value of the digital asset has directly impacted the earnings of miners, who were already facing another concern on the regulatory front.

Miners struggle to continue

The mining difficulty has been reduced twice already by 16% and 5% on 30th May and 14th June, respectively. The Bitcoin network was scheduled for another adjustment on 29th June which is estimated to drop by 23%. This will make it more challenging for the miners to mine Bitcoin blocks, subsequently resulting in increasing block time.

The mining difficulty is designed to adjust itself every 2016 blocks. Now that the miners are being faced to shut down operations, the next difficulty is going to be adjusted lower.

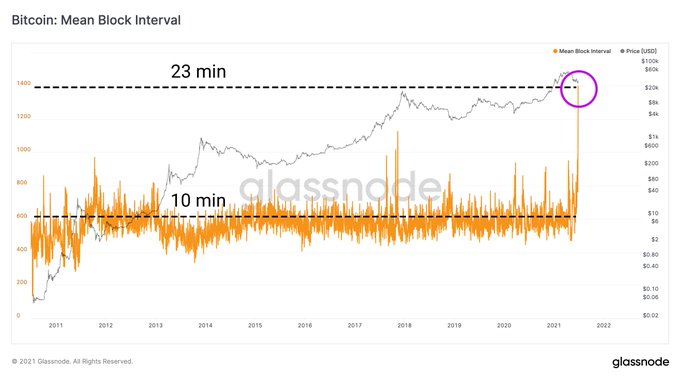

According to data provided by Glassnode, on 27th June, the Bitcoin network was noting an average time of 1400 seconds or 23.3 minutes to mine one block.

Source: Glassnode

This was the largest daily mean block interval since the early days of mining. This meant only 58 blocks were being mined on Sunday, which represented a drop of 60% from the baseline of 144 blocks/day.

The instability observed in the mining operations with falling hash rate has now resulted in the miners’ revenue crumbling. Their revenue fell from $70 million in May to $12.8 million, reported on 27th June. This was an 80% drop. Miners were last seen earning this sum in November 2020 when the BTC price was around $13,000.

Source: Glassnode

Bitcoin is in troubled waters thanks to the crackdown on crypto taking place in China. However, Bitcoin miners have suffered through a low profits period even last year before Bitcoin halving. As the miners move to Kazakhstan and the United States, mining will get more distributed and will push the digital asset back on track.