This could be the ideal strategy for MATIC

MATIC’s price is up 16% in the past 24 hours and this is akin to how MATIC’s price has rallied previously. Traders have attributed MATIC’s price rally to the increased demand and users for ETH network following the launch of L2. Based on network activity and the transaction volume of both ETH and its scaling solutions, traders anticipated the majority of MATIC users to come from the ETH network, since it is a leading ETH scaling solution.

However, based on the latest activity and insights from the Polygon network, Polygon’s users are not coming from the ETH network.

66% of the wallet which is the equivalent of 636,000 users, are unique to Polygon, based on data from nansen. As of March 31, 2021, AAVE’s ETH mainnet had 19000 users and MATIC had no user, to begin with, started with a count of zero. As of May 2021, MATIC has 28500 users; there was over 190% jump in the total users on AAVE.

While nearly the entire cryptocurrency market suffered a bloodbath, MATIC, its users and the network was booking gains consistently, through the bloodbath.

Source: Lunarcrush.com

A 17% increase in MATIC’s social volume, is reflected in the increase in price and trade volume, based on the above chart from Lunarcrush. Additionally, a majority of the news users on AAVE came from 0xPolygon, instead of ETH, and it is clear that there is more to Polygon than what is anticipated. Based on this, Polygon has emerged as largely independent from ETH, and the rally has ensued despite ETH suffering a slump during the bloodbath. ETH’s trade volume has dropped however, the on-chain sentiment remains bearish, according to intotheblock.

There are several traders longing Polygon and it may be the ideal strategy to go long on Polygon.

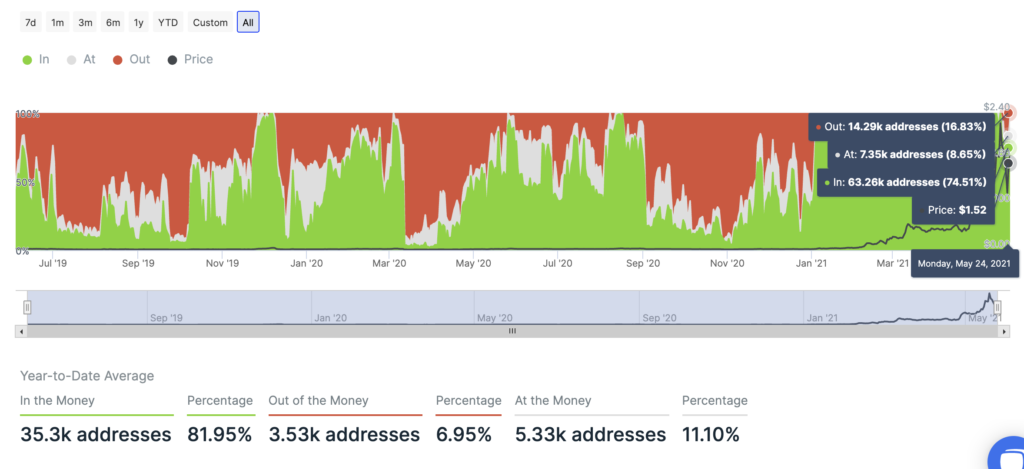

Polygon’s growth has proven to be more organic and less dependent on ETH. Network growth is up 3% despite an altcoin bloodbath. Based on the following chart from IntoTheBlock, there is high inflow of money.

Source: IntoTheBlock

74% in and 16% out shows that at the $1.52 level, Polygon’s growth is consistent. It is more organic and less dependent on ETH. Going long on MATIC is more likely profitable than other altcoins.