This could make or break MATIC’s journey to new ATH

The recent market sell-offs triggered by the Bitcoin flash crash painted most coins’ price charts red. However, some altcoins like Terra swam against the tide while others like MATIC registered a quick recovery. Polygon (MATIC) had been eyeing new ATHs for a while now, and with Bitcoin slowly recovering, MATIC’s price too seemed to be headed towards the $2.7 all-time high.

So, will MATIC finally make a new ATH or will the price bounce back from the $2.44 zone like it did towards May-end?

Price action looks primed for big performance

Amid the larger market sell-offs, MATIC lost close to 30% price as the alt fell to $1.5 on 4 December. However, the coin was quick to recover and soon made its way past the $2.25 level. Now with MATIC trading at $2.44, just below its ATH of $2.7 seemed like the altcoin could make a run for a new ATH.

Despite the 28.35% daily gains MATIC’s relative strength index (RSI) still hadn’t reached the overbought zone, giving the alt more scope to rise. On the previous occasion when MATIC made a run above crucial resistance levels its RSI had risen considerably giving overheated signals.

Furthermore, its RSI saw a quick rebound after testing the overbought zone in early December, the almost parabolic recovery in RSI was similar to the one seen in early May when MATIC made an ATH.

That said, MATIC’s circulating market cap finally breached the $16 billion mark at press time. Interestingly, the price rise seemed to be triggered by some positive developments taking place on the Layer 2 protocol.

Source: Messari

Accumulation and institutional support boosting price

‘Buy the dip sentiment’ worked in favor of MATIC – on 6 November, 3,000,300 MATIC (worth $5,802,630 at the time) was transferred from Binance to an unknown wallet. This showed how the accumulation trend acted in favor of the price.

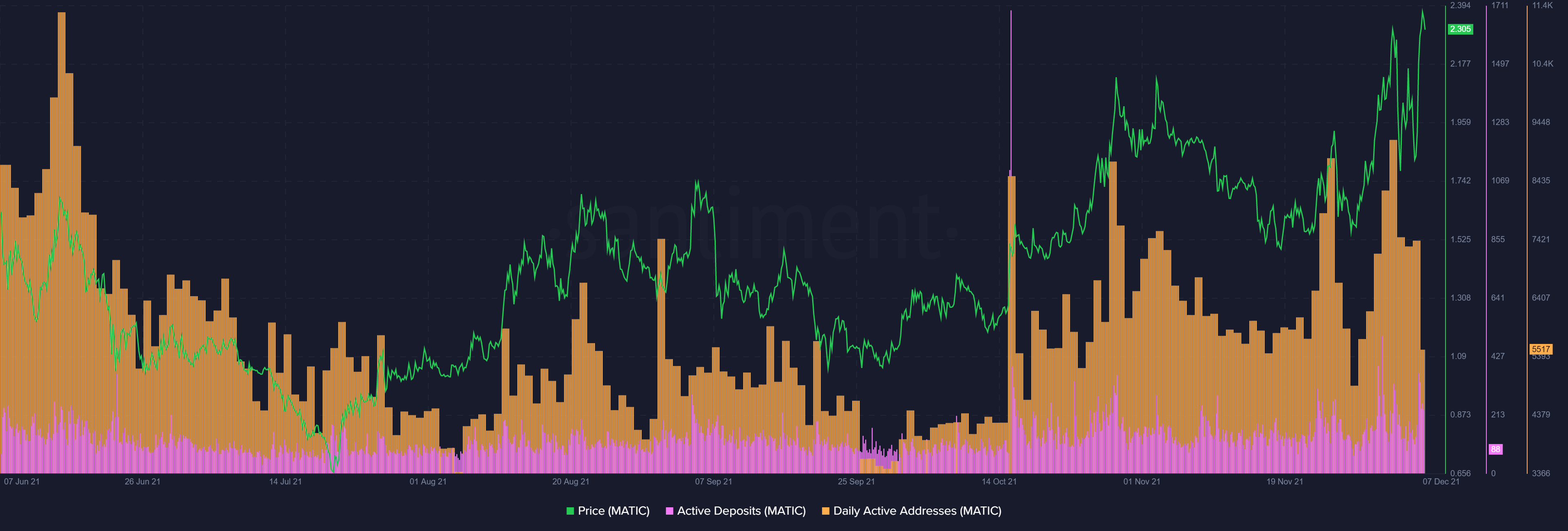

That said, daily active addresses for MATIC jumped while active deposits noted a minor drop presenting a nice rebound for the coin and highlighting high network activity.

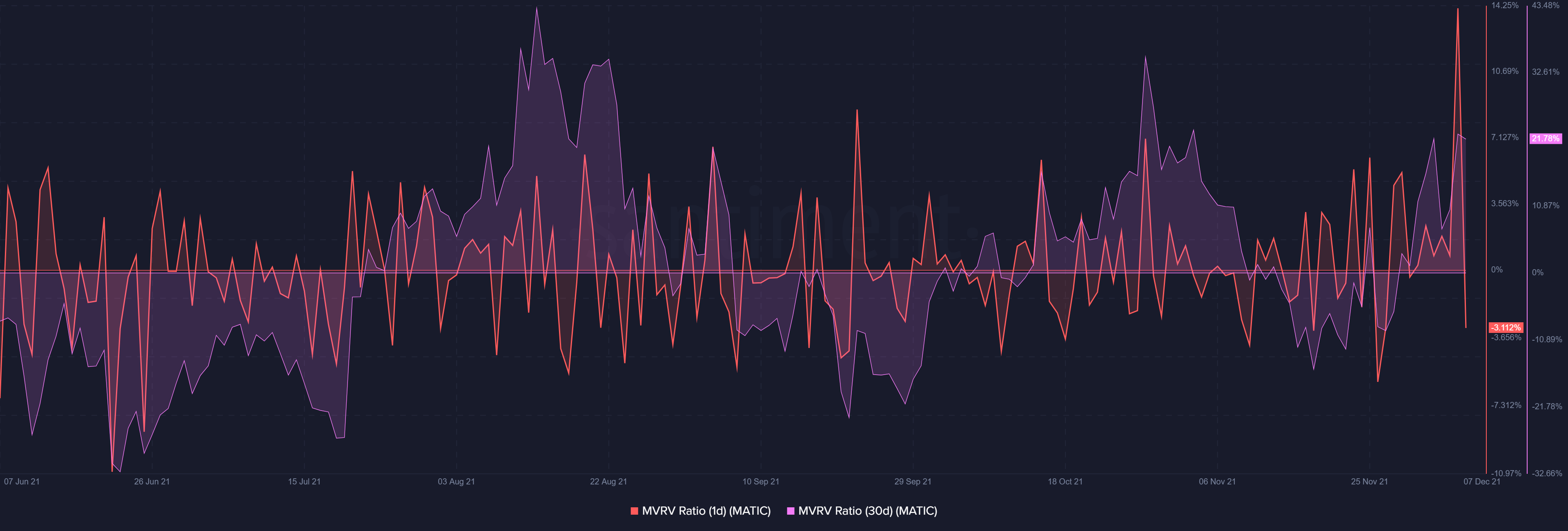

Further, while its short-term MVRV presented anomalies, the long-term MVRV was nowhere near highly heated zones, which was a good sign too.

MATIC started rallying last week after crypto exchange-traded product (ETP) issuer 21Shares announced it’s listing a product linked to the alt on Euronext exchanges in Paris and Amsterdam. However, while MATIC’s on-chain metrics look bright, the retail crowd was still not too big on the coin.

MATIC’s comparatively low trade volumes were proof of the same. Thus, a push from the retail crowd would be key to MATIC’s race to an ATH, in absence of which could hinder its chances of crossing the $2.7 mark.