This Ethereum metric hasn’t budged despite the price drop!

Just over a week ago, Ethereum, the world’s largest altcoin, was trading at a level well above the $4,100-level. At the time of writing, however, ETH had dropped as far down as $2,200, its bull run noting a major retracement just when many in the community expected it to breach $5,000.

In fact, at press time, ETH had seemingly lost almost 25% of its value in just over 4 hours.

What contributed to such corrections? And, is ETH likely to remain at the said levels in the near term? The latter is the biggest question in the minds of most people in the community right now.

According to a recent Santiment Insights report, however, both long-term bullish and bearish cases can be made for Ethereum’s price projections, with a host of on-chain metrics available to back both assertions. Ethereum’s supply on exchanges, for instance, is one such metric, with the same falling on the charts in correspondence with the altcoin’s price.

A fall in the asset’s price can be accompanied by a hike in the aforementioned metric since a lot of holders move their ETH onto exchanges with the purpose of selling them. This hasn’t happened of late, however. Instead, supply has fallen, a sign of ETH holders continuing to hold on to their ETH with long-term expectations in their heads.

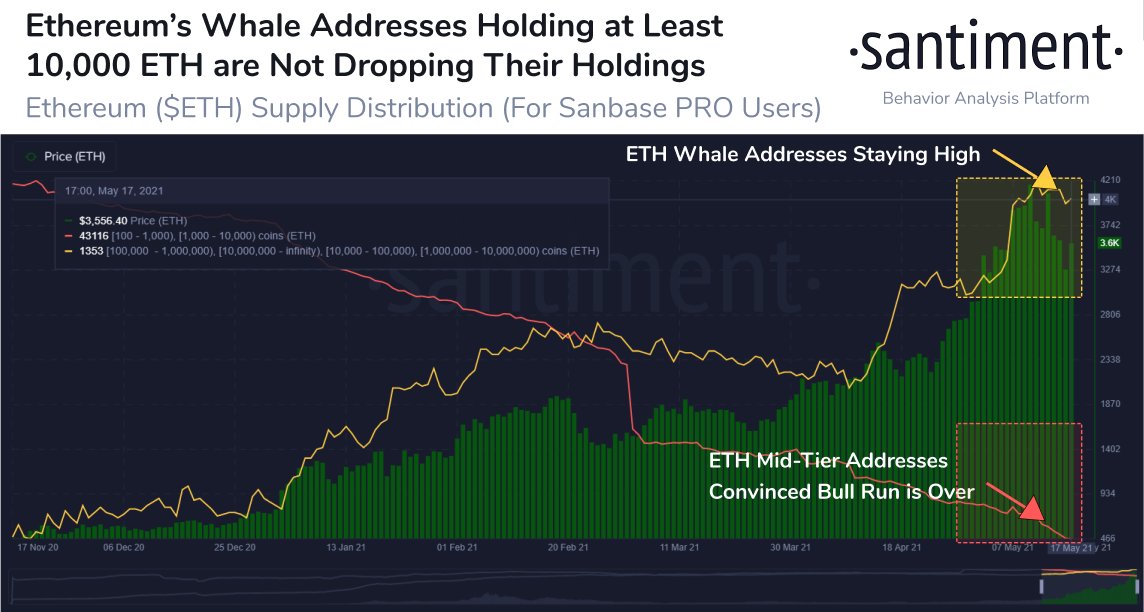

The same finding can be supplemented by the two other findings. For starters, Santiment tweeted a few days ago,

“#Ethereum’s largest addresses have not budged on the recent volatility that dropped the price to as low as $3,144 today. There are just 8 less addresses with 10k+ $ETH than there were a week ago.”

What’s more, such confidence in ETH’s price potential isn’t unique to whales, with retail investors joining in as well. In fact, according to a recent observation by Glassnode, the number of ETH addresses holding 0.1+ coins climbed to an ATH less than 24 hours ago.

Finally, the total value of ETH staked in the 2.0 deposit contract also hiked to an ATH of 4,657,570 ETH.

Source: Glassnode

These are all bullish signs, right? Well, yes they are. However, there are a few neutral and bearish signs here as well, each of which should be treated with caution by investors, especially by those who remain optimistic about ETH’s price prospects over the next few weeks.

Consider the aforementioned Santiment finding on whale addresses, for instance. Yes, that’s a bullish sign, but the caveat attached to the same is the finding that mid-tier addresses, or addresses with 100-10k ETH, are at a three-year low. In fact, according to Santiment, these addresses are “convinced that the bull run is over.”

Source: Santiment

Ethereum’s active addresses and active deposits have fallen recently as well, a slide that corresponded with ETH’s previous depreciation on the price charts. Even when other long-term metrics such as MVRV were taken into consideration, a metric that measures the average profit/loss of all the coins currently in circulation, it was observed that it was unusually high and close to the overbought zone. What this implied was “that average trader returns need to cool down to reduce risk of entering at this position.”

Source: Santiment

Ergo, in light of all the price signals right now, the only certainty in the Ethereum market is uncertainty, a sentiment fueled by not just ETH’s own price performance, but that of Bitcoin, the world’s largest cryptocurrency as well.

Over the past month or so, ETH, not BTC, has been driving the growth of the wider market. Now that Ethereum has fallen and fallen hard, it would be interesting to see if the altcoin consolidates once it finds some stability. If not, more corrections may be due.