This is how Bitcoin must perform to sustain its mining industry

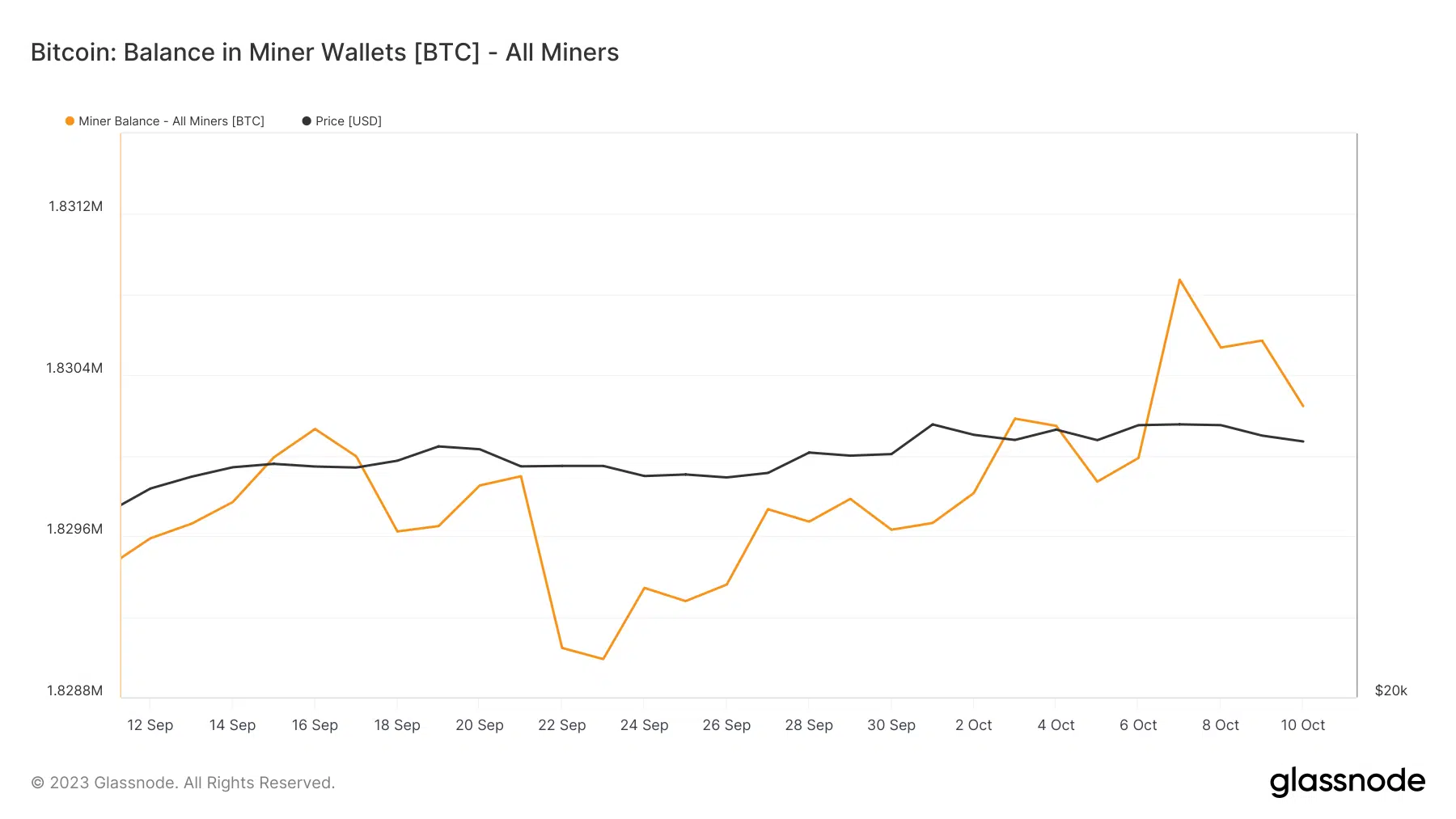

- Miners’ balance has gained upward momentum for the past few weeks.

- BTC was down by over 2% in the last 24 hours, and a few metrics looked bearish.

The Bitcoin [BTC] mining sector has been witnessing immense growth over the last few months. A possible reason for the growth could be the fact that miners were actually making a profit.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, things can change soon as BTC is expecting its next halving, which will reduce miners’ rewards to half.

Bitcoin’s mining industry is growing ahead of the halving

Notably, Coinwarz’s data revealed that BTC’s hashrate has surged considerably over the last few months. At press time, BTC’s hashrate stood at 517.41 EH/s. Additionally, James V. Straten, a popular crypto researcher and data analyst, pointed out that BTC’s difficulty has also continued to grow.

With #Bitcoin difficulty continuing to increase and hitting all-time highs, and a halving approaching in April.

The current all-in cost to mine #BTC is roughly around $24,000.

By the halving, miners may be under pressure if #Bitcoin is under roughly $40,000 next year.

— James V. Straten (@jimmyvs24) October 10, 2023

The reason behind this growth could be the profits amassed by miners. The current all-in cost to mine BTC is nearly $24,000, and at press time, BTC’s price remained above the $27,000 mark, revealing that miners were making a profit.

In fact, that might be the reason behind the sharp hike in miners’ balance as well, which reflected their willingness to hold BTC.

However, as BTC’s next halving approaches, it becomes important for BTC to raise its price in order to keep miners profitable. This is because after the halving, miners’ reward will be reduced to halving.

Straten mentioned in the tweet that by halving, miners may be under pressure if Bitcoin is under roughly $40,000 next year. Therefore, let’s take a look at BTC’s on-chain metrics to see whether BTC’s price can begin its bull rally anytime soon.

Will Bitcoin begin a rally?

The aforementioned data suggested that it was key for Bitcoin to raise its value over the upcoming months to maintain its growth in the mining sector. However, things on the ground did not suggest that BTC was about to initiate a bull rally.

In the last 24 hours alone, BTC’s price dropped by more than 2%. At the time of writing, it was trading at $27,039.44 with a market capitalization of over $527 billion.

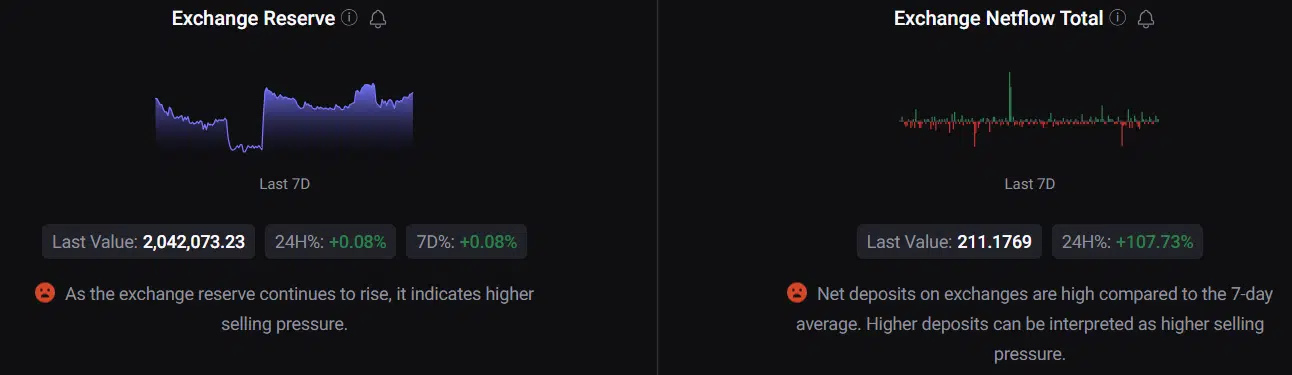

In fact, CryptoQuant’s data revealed that the king of cryptos’ was actually under selling pressure. This was illustrated by BTC’s Exchange Reserve, which has been increasing over the last few days.

Moreover, its net deposits on exchanges were also high compared to the last seven-day average, establishing the fact that BTC was under selling pressure at the time of writing.

Is your portfolio green? Check out the BTC Profit Calculator

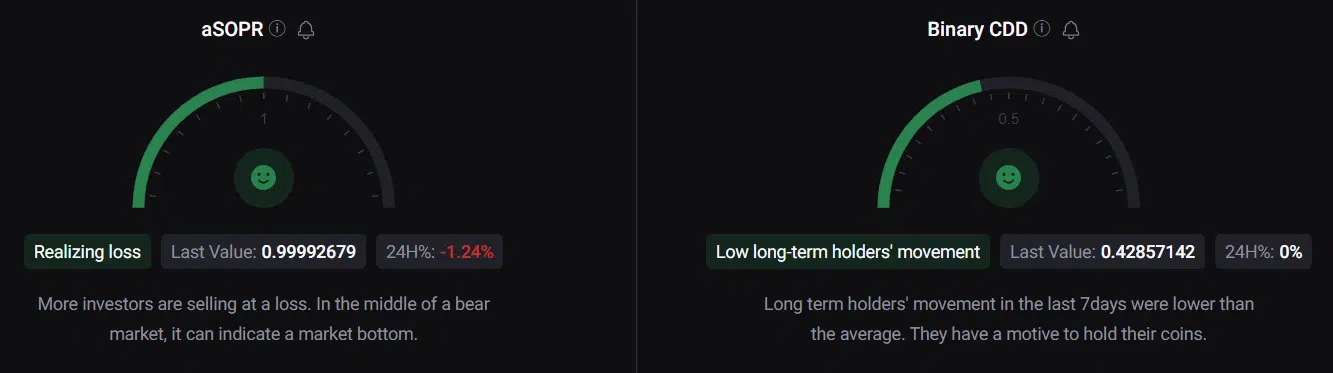

Nonetheless, nothing can be said with the utmost certainty, as a few of the metrics were bullish as well. For example, BTC’s aSOPR was green at the time of writing. This meant that more investors were selling at a loss, which generally indicates a market bottom.

Moreover, Bitcoin’s Binary CDD was also in the green, suggesting that long-term holders’ confidence in BTC was high.