This is why BTC could witness some volatility in the days to come

- The market was in the lower bound of an equilibrium phase.

- Trading volumes have softened, emphasizing investors’ preference to accumulate and HODL coins.

Since reaching yearly highs last month, Bitcoin [BTC] has traded in a narrow trading range of $30,000-$31,000. The stagnation has lowered investors’ enthusiasm and raised questions on the sustainability of last month’s market rise, built on growing institutional interest in crypto assets.

Is your portfolio green? Check out the Bitcoin Profit Calculator

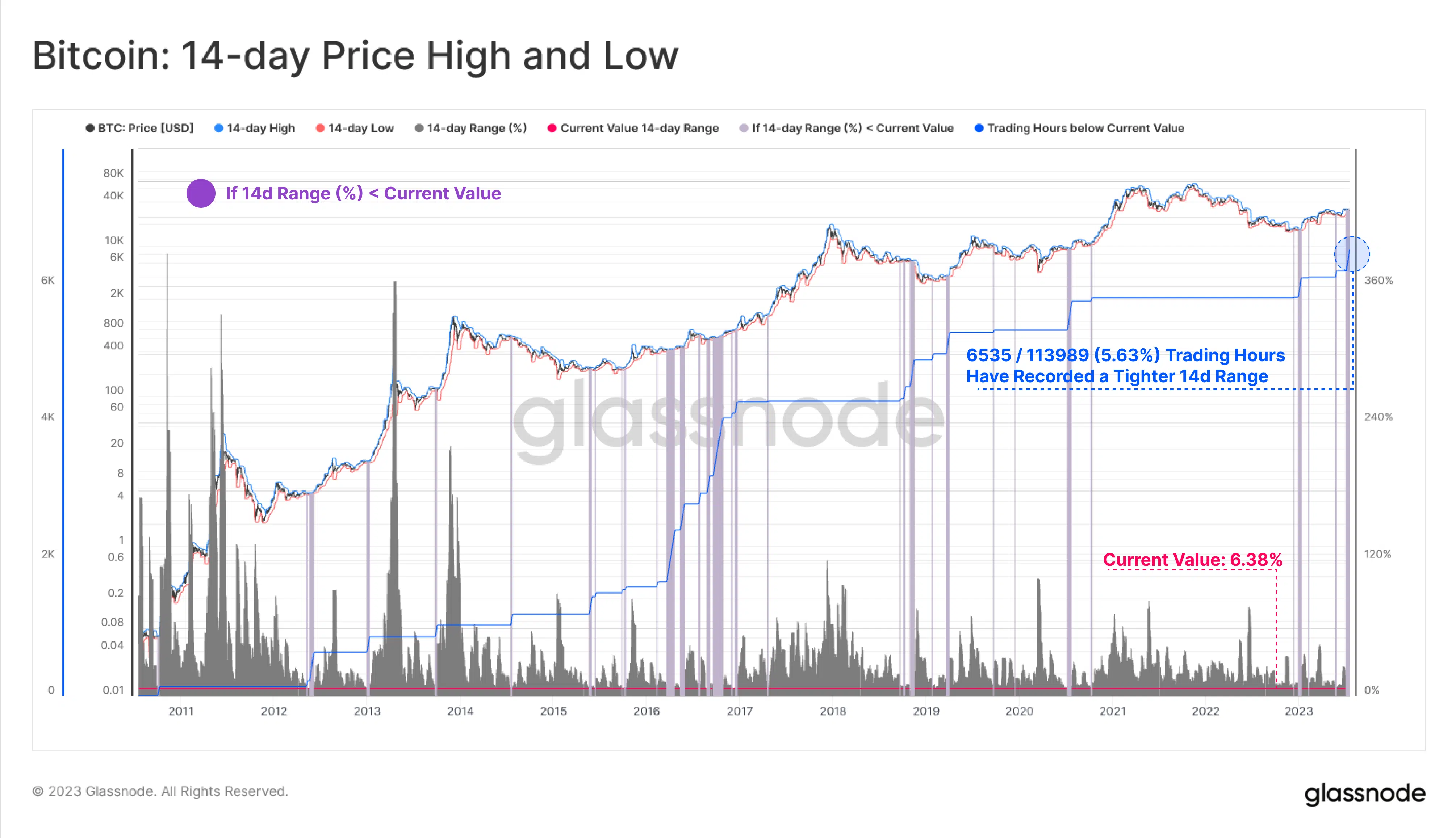

However, this extended lull in trading activity could soon give way to a period of volatility. As per on-chain analytics firm Glassnode, BTC’s 14-day price range increased to 6.38% over the past week.

Glassnode underlined that with just about 5.6% of the total trading hours recording a narrower range than this value, there was a likelihood for a big move for BTC in either direction in the days to come.

Trading activity plummets

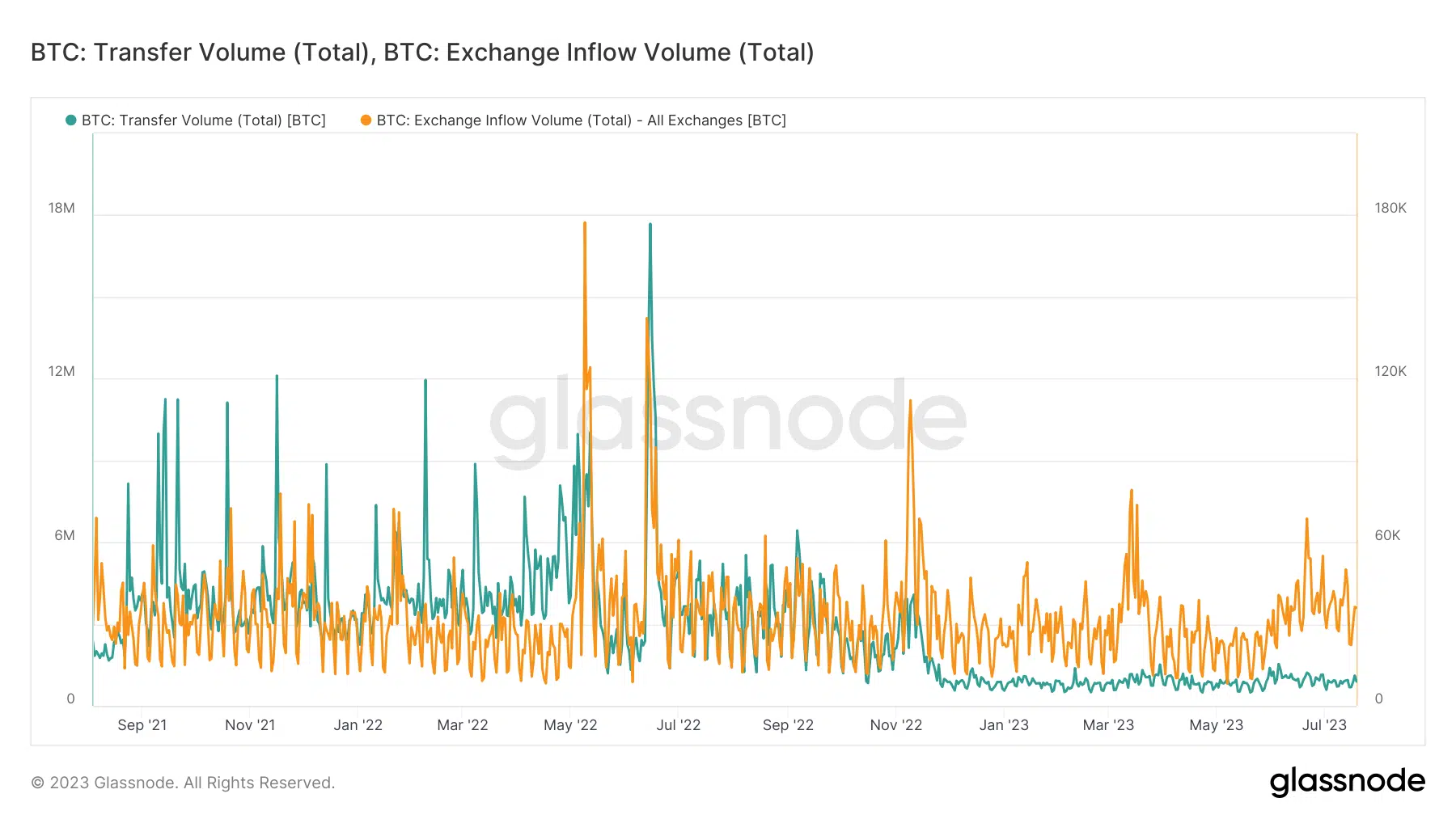

On-chain transfer volume is the total number of coins transferred in successful transactions. This number decreased significantly since the euphoria seen during the start of last month’s market rally.

Combining this with the falling exchange inflows, it was evident that trading volumes have softened. This emphasized investors’ preference to accumulate and HODL coins.

Market in a state of equilibrium

In one of the earlier articles published by AMBCrypto, it was highlighted how the market had entered a stage of equilibrium. This phase, also known as the ‘re-accumulation period’, has historically followed recovery from the lows of a bear market. Additionally, the market has conformed to a sideways trend for extended periods of time.

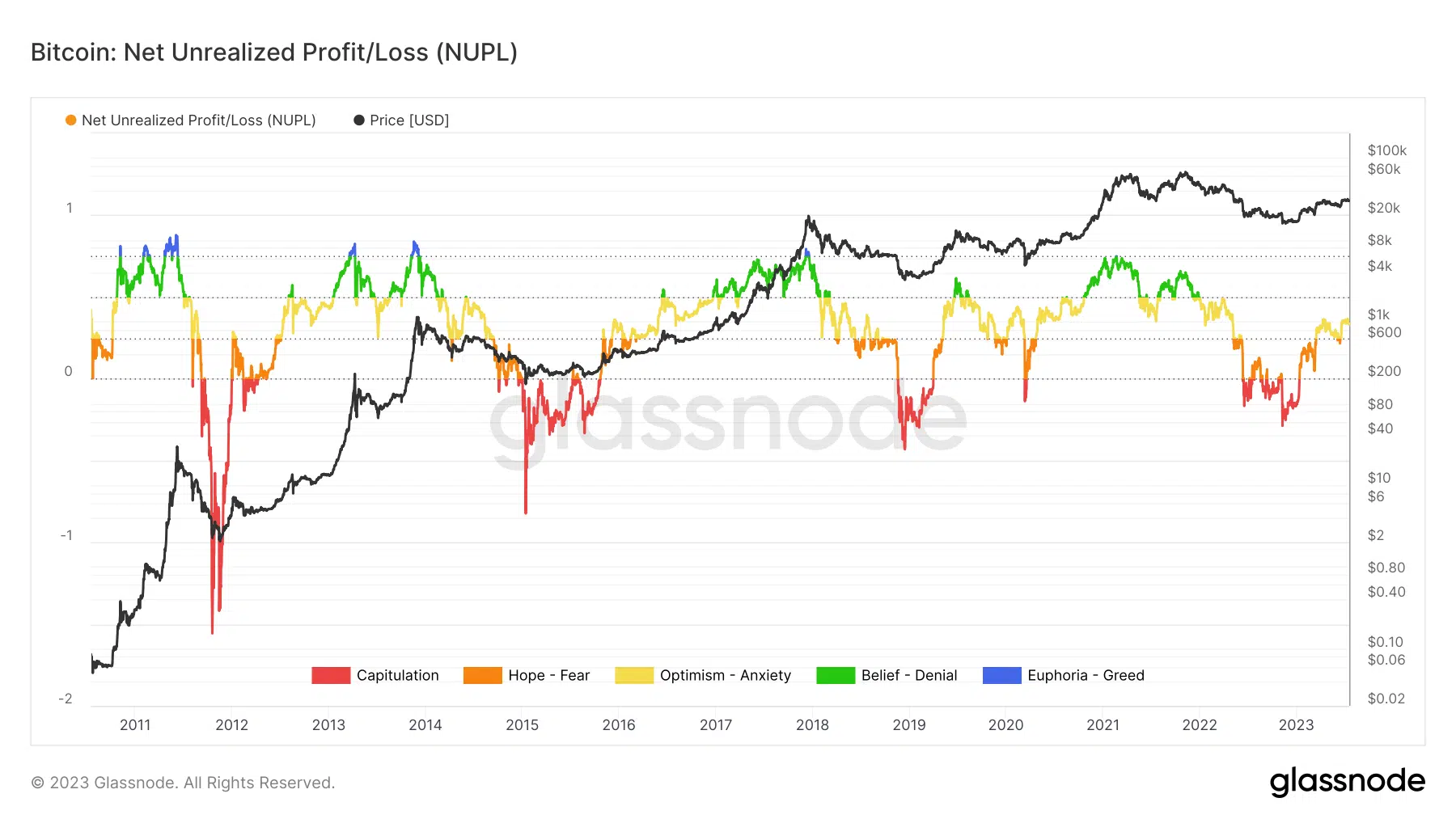

The Net Unrealized Profit/Loss (NUPL) metric backed up these deductions. This indicator gauges if the network as a whole is currently in a state of profit or loss.

At the time of publication, the reading of the metric was 0.33, which as per Glassnode, was the lower bound of the equilibrium phase.

However, the phase could witness a disturbance given the low volatility and narrow trading ranges.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Tesla HODLing Bitcoins

High-profile investors like Elon Musk’s Tesla have also not given up on its BTC holdings. In its Q2 earnings report, the EV giant revealed that it continued to hold about $184 million worth of BTC on its balance sheet. Tesla’s digital asset holdings remained unchanged for the fourth consecutive quarter.

Thus, traders only have to wait and watch if the confidence in BTC converts to a strong bull rally.