This might be a good sign for Bitcoin’s mid-term trajectory

Bitcoin has been humbly oscillating above the $32,500 support level since the beginning of this month. However, BTC’s value slumped by almost 5% in two days and was soon testing the said level again at press time. While BTC’s spot market is still more or less dormant amid the Binance conundrum and other factors, derivatives contracts have started to present certain anomalies.

Though it is not certain that the news of Binance being temporarily suspended from the U.K’s financial system was a major driver behind the latest Bitcoin price drop, the oddities presented in the derivatives market pose a troubling sign for the top crypto’s future.

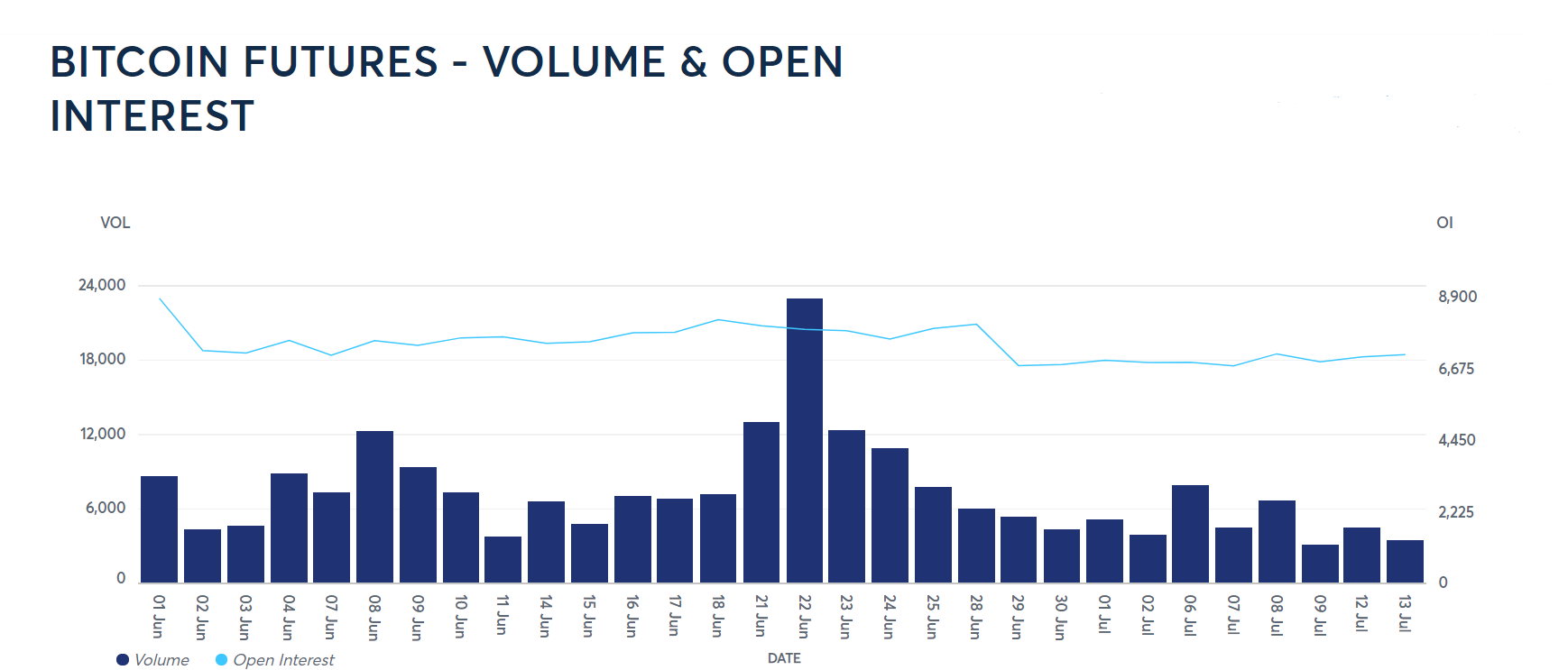

According to the CME Group, Bitcoin Futures’ volume noted a figure of 3156 on 9 July, the lowest since the beginning of June. Consequently, there was a downtick in Open Interest followed by a sustained upward slope. Moderately rising Open interest can underline additional inflows and interest coming into a market. However, its almost flatlined trend might also be an indication of a sustained bearish trend for BTC.

Source: CME group

Due to the lack of a fluctuating funding rate, Bitcoin quarterly Futures have been largely preferred by whales and arbitrage desks. However, when traders go for perpetual contracts or inverse swaps, usually a fee is charged which varies depending on which side demands more leverage. Additionally, fixed-date expiry contracts typically trade at a premium from regular spot market exchanges.

What’s more, positions data suggested that the number of short contracts saw a two-fold increase over the last week while longs remained largely dormant as Bitcoin traded below $32.5k at press time. In the last 24 hours from the time of writing, the sentiment remained largely bearish with an increase in short contracts.

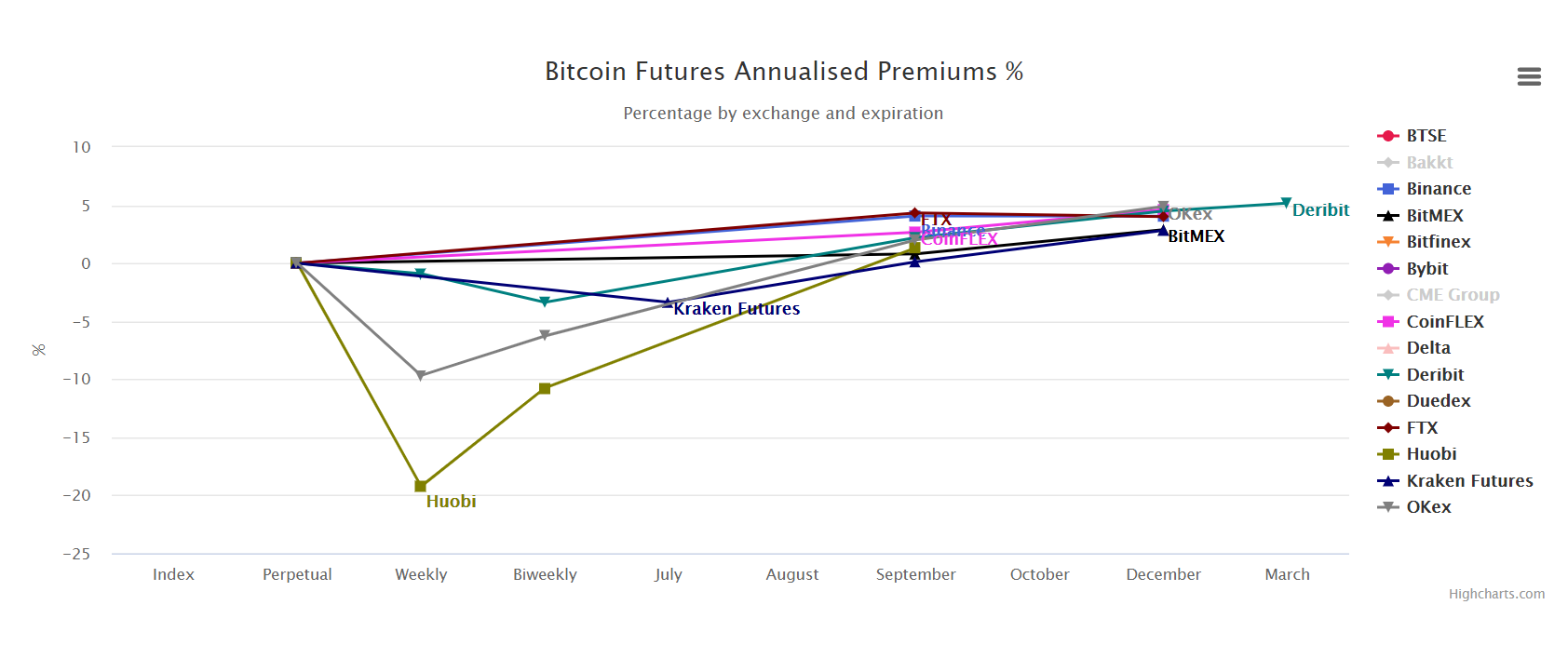

On the contrary, looking at Bitcoin Futures’ annualized premiums gave a healthier market picture in the long run. In September, the contract is trading with a 2.2% annualized premium on Deribit, with the same seen jumping to 4.48% in December. Likewise, an upward curve can be seen for most exchanges with annualized premiums above 4% for December.

This picture is indicative of a healthy market as a longer settlement period would usually cause sellers to request a more significant premium.

Source: Bitcoinfuturesinfo

Apart from that, there is a decent ‘Cash and Carry’ activity coming from arbitrage desks as they’re buying Bitcoin while simultaneously shorting the Futures contract. With their net exposure being flat, it doesn’t necessarily point towards a negative future scenario. This activity, however, does limit the premium on Futures contracts.

What’s the larger picture?

At this point, it is better if investors measure the 3-month Futures premium which is staying above 4% annualized. The flat or slightly inverted Futures’ cannot be interpreted as a major bearish indicator looking at a long-term perspective. However, if it does fall below that, it might depict a lack of interest in leverage longs and point towards a bearish future.

The average September annualized premiums of some of the exchanges have been oscillating around 3%, which is unsettling but not surprising after an almost 50% market correction. However, this does highlight a general lack of confidence from buyers in Bitcoin’s short-term price.