This offbeat ‘strategy’ might explain MicroStrategy’s Bitcoin purchases

Not many assets can compete with Bitcoin. However, MicroStrategy has done something unexpected. The very company which holds the most Bitcoins in the world with 92,079 BTC in its wallet has beaten Bitcoin when it comes to being a better investment. Going forward, will MicroStrategy overshadow Bitcoin entirely? Or is Bitcoin about to become the sole cause of MicroStrategy’s existence?

MicroStrategy’s strategy about Bitcoin

MSTR (MicroStrategy) has been bullish about the king coin for years now. Ever since BTC started showing potential, MSTR has been acquiring it in volumes unparalleled. In a way, it has been building its entire future on Bitcoin’s back. This assertion is also based on the fact that the company has been selling its shares to acquire BTC. In fact, the most recent episode saw $1 billion worth of shares being sold for acquiring the cryptocurrency.

At the moment, it seems like that strategy has paid off since MSTR is presently performing better than BTC itself. MSTR returns beat BTC’s returns with a difference of almost 200%

MSTR returns better than BTC | Source: Ecoinometrics

But, not only is it selling shares, but the company has also been using other methods to quench its interest in the crypto. In fact, debt has become MSTR’s primary source for buying BTC. Of the $2.7 billion spent on purchasing the cryptocurrency, $2.15 billion has come from debt. The 3 debt offerings were the major source of the 92k BTC acquisition.

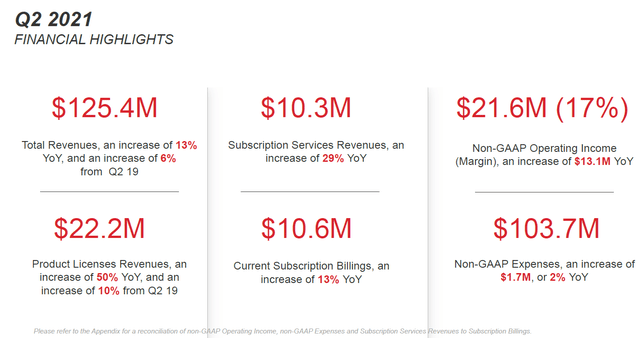

What’s more, according to the company’s Q2 report, MSTR’s business has been rising exponentially by double digits owing to their BTC acquisitions. But, could it be that MSTR is relying on BTC to increase its profits since it is the one pumping Bitcoin’s price?

MicroStrategy Q2 highlights | Source: MicroStrategy

MSTR ‘manipulating’ BTC?

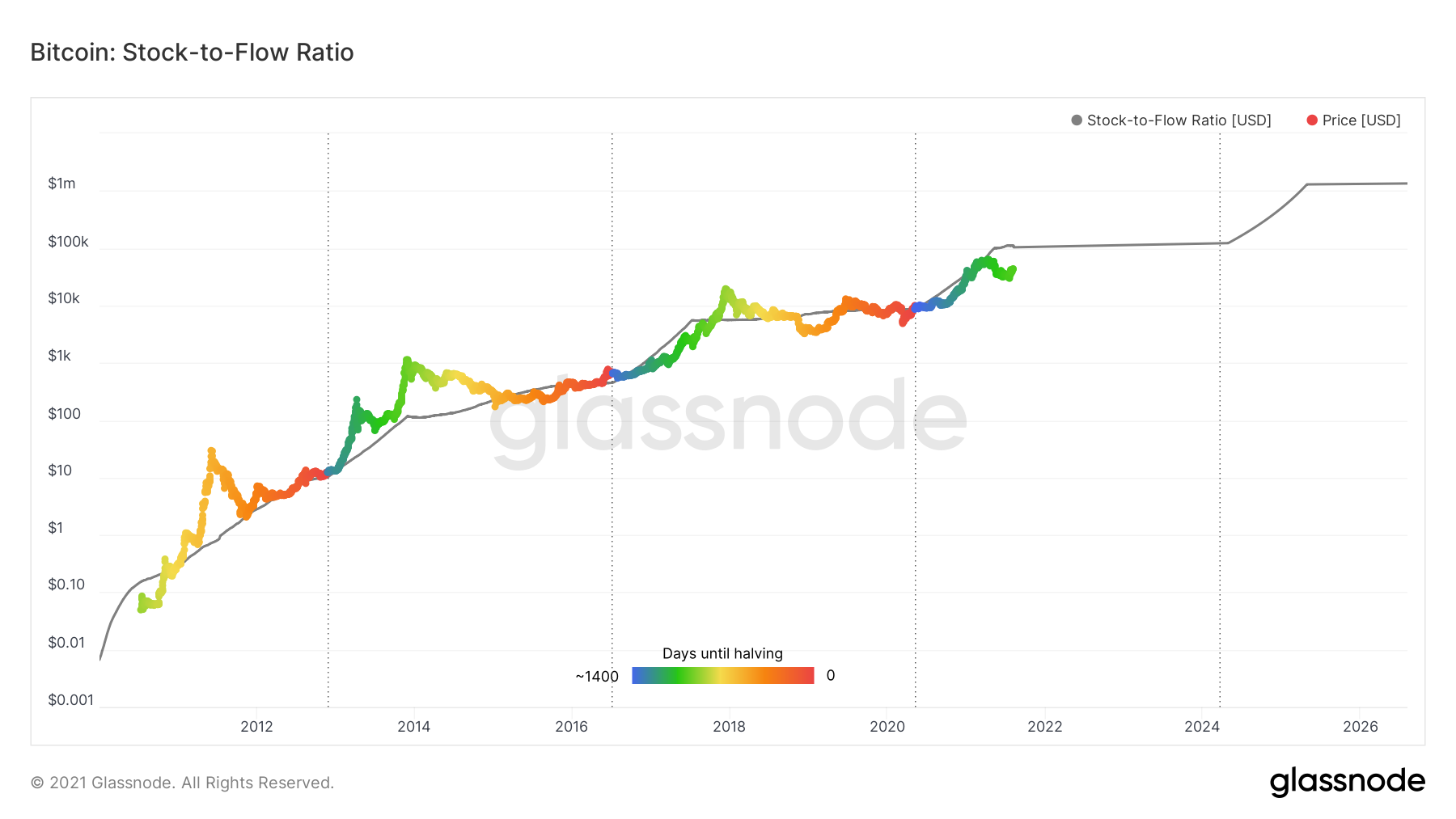

Not how you’d imagine it to. To understand this, observe the Stock-to-Flow (S2F) ratio here. The S2F model runs on the basis of scarcity. The scarcer the supply, the higher the price. Based on that algorithm, it predicts where Bitcoin’s price might be at a certain point in time.

However, since it deviated from its path recently, there’s a possibility that MSTR might be trying to correct that deviation. MSTR buying BTC in such huge numbers would create the necessary scarcity. This would, in effect, pump Bitcoin’s price.

Bitcoin S2F ratio | Source: Glassnode – AMBCrypto

Simply put – MSTR buys = BTC price goes up | BTC’s price goes up = MSTR holdings become profitable.

Thus, it can be argued that their codependency is the one thing that is ensuring longevity and profitability. This, in a lot of ways, also explains MSTR’s own bullishness about the cryptocurrency. Whether you, as an investor, invest in BTC or MSTR will depend on your standing about the future of currency.