This Tron [TRX] metric surges: Will bulls regain momentum?

![This Tron [TRX] metric surges: Will bulls regain momentum?](https://ambcrypto.com/wp-content/uploads/2023/02/trx-michael-e1676522273304.jpg)

- TRX was finally on an upswing due since mid-January.

- Proposal 83 could be behind the spike in daily transactions.

Tron [TRX] was finally showing bullish excitement at press time after struggling for directional footing since mid-January. Nonetheless, the reason why the bulls were back in control might just be as interesting as the rally itself.

Is your portfolio green? Check out the Tron [TRX] Profit Calculator

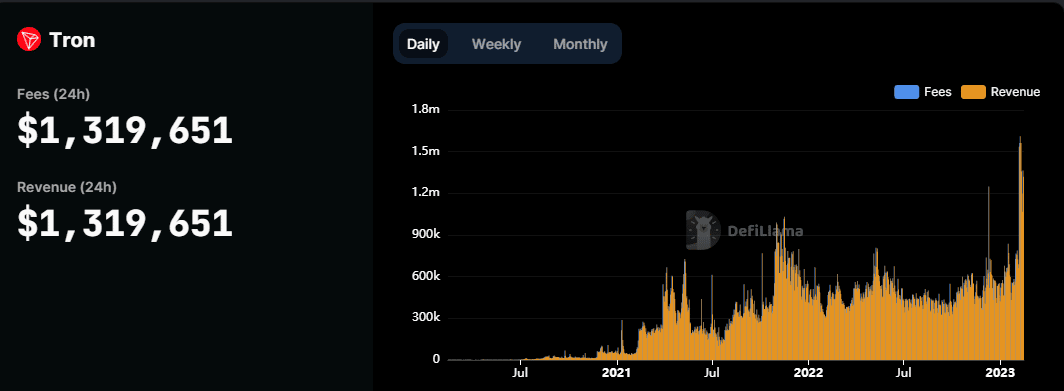

Recent findings revealed that Tron’s daily transaction fees registered a strong surge in the last 24 hours until the time of writing. Moreover, a quick look at DeFiLlama showed that fees peaked at $1.56 million. This was the largest amount of daily transaction fees that Tron had recorded in the last two years.

Initial reports suggested that the surge in fees was linked to Tron’s recently passed Proposal 83. The latter sought to enable a dynamic energy model as the new mechanism for energy charging in smart contracts. The surge in daily transaction fees became apparent just days after the proposal was passed, suggesting that the implementation was already having an impact on the network.

As a consequence, staking TRX became more profitable. This may explain the surge in demand for TRX, coupled with the right timing of the market. The rest of the cryptocurrency market was also off to a healthy mid-week performance, hence making it easier for the bulls.

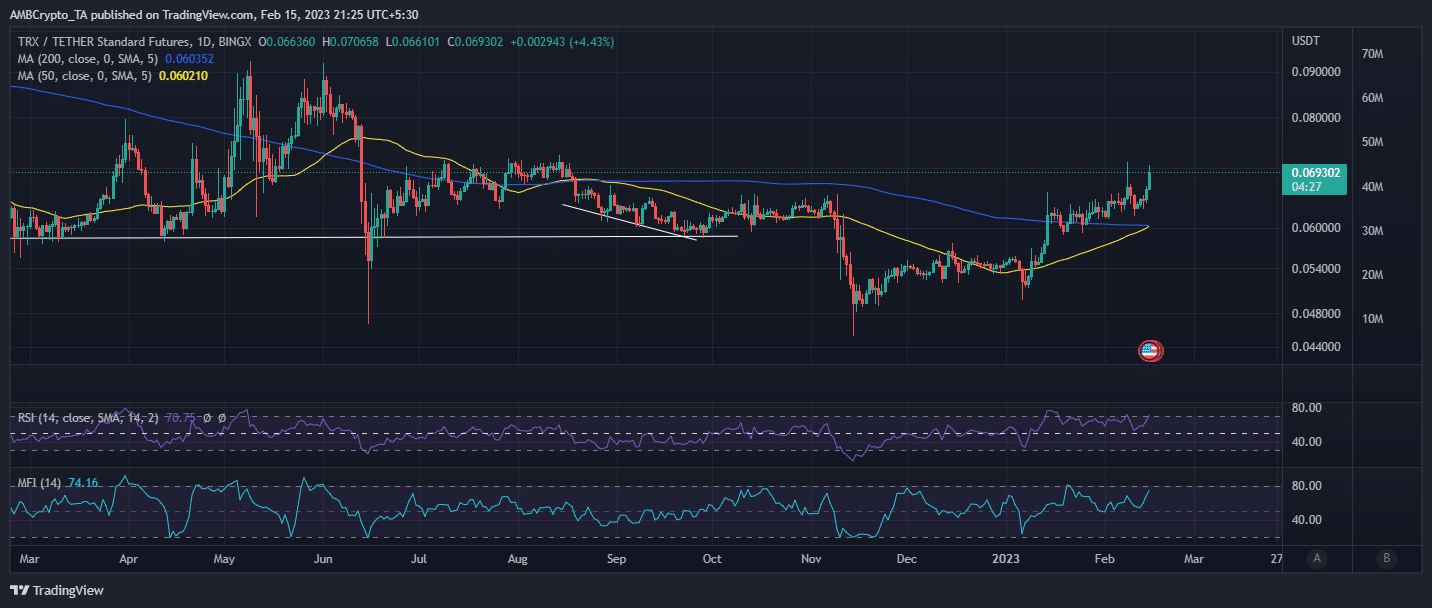

TRX traded at $0.069 at press time after a 4.49% upside within the last 24 hours. This rally put it within the same range as its press time ATH, so sustained demand may push it to a new high.

But what are the chances of a new local high? An extended upside is more plausible, especially as the 50-day MA was crossing above the 200-day MA at the time of writing. TRX’s ability to sustain the upside would require favorable sentiment and substantial volume.

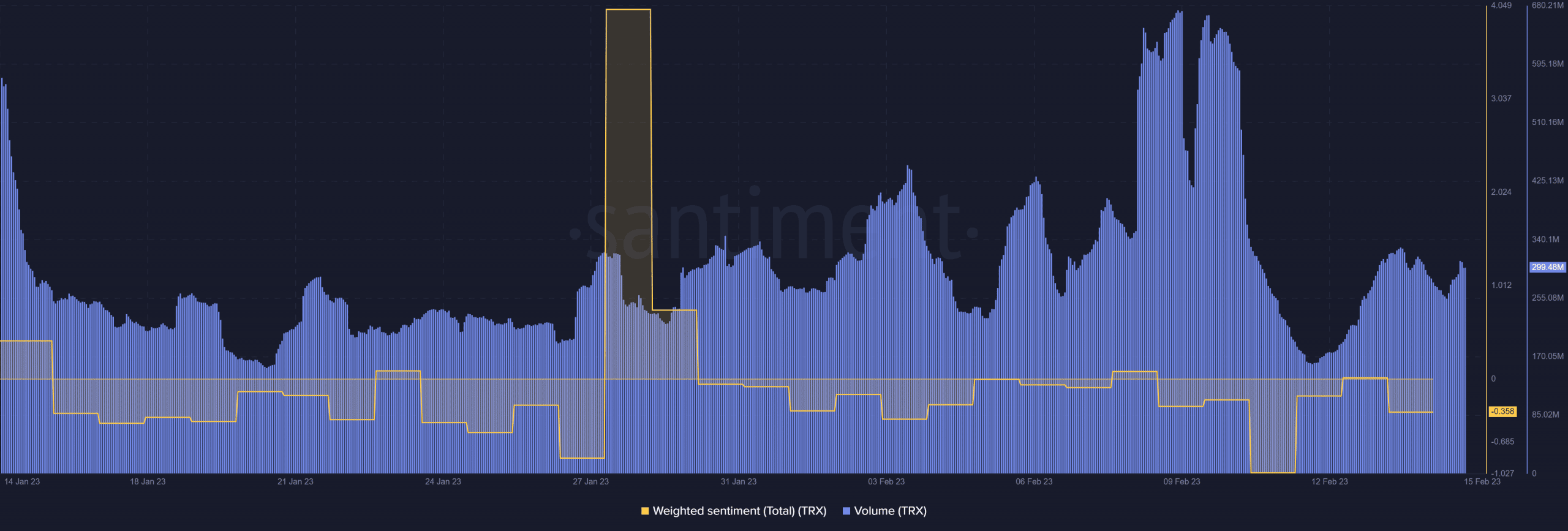

TRX’s weighted sentient achieved a slight recovery from its four-week low during the same period. However, it was low relative to its monthly high and remained within the bearish range.

Realistic or not, here’s TRX market cap in BTC’s terms

TRX’s on-chain volume trod a similar path as the weighted sentiment during the same period. A potential reason for this was that the whales had largely supported the rally. Thus, the possibility of retail demand in the next few days could not be discounted, as healthy social dominance would probably make TRX more visible to retail buyers.

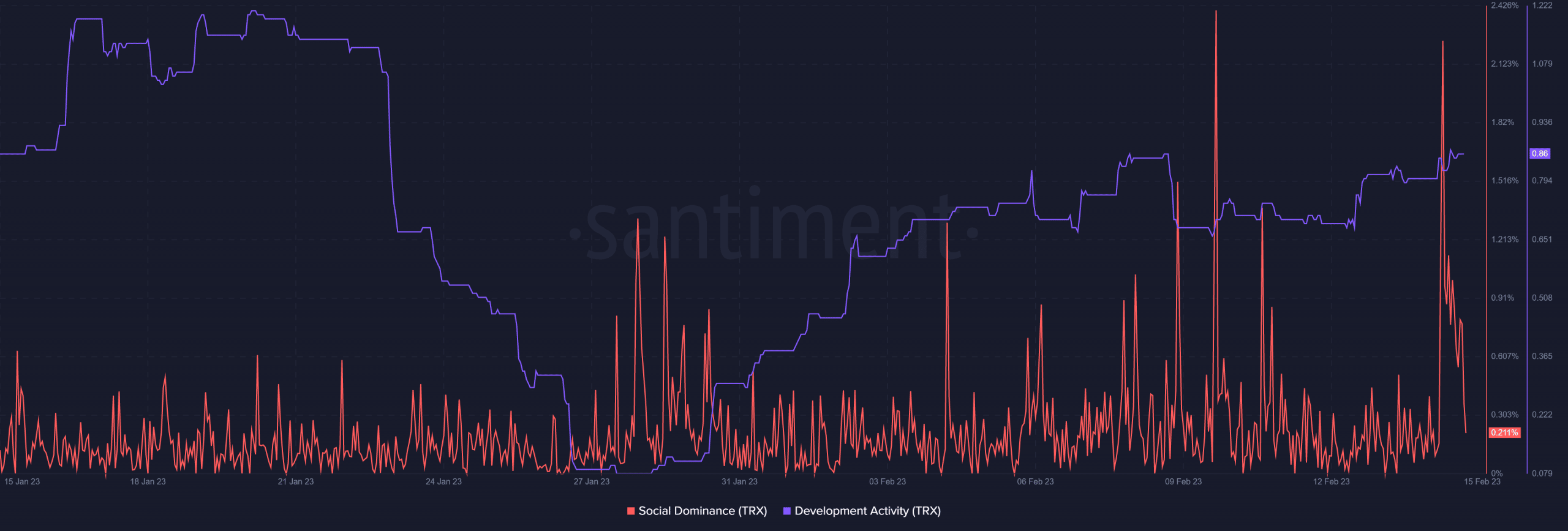

At press time, the social dominance metric had its second highest monthly peak in the last 24 hours. In addition, development activity was gaining steadily, which might support favorable sentiment as well.