THORChain’s monthly volume surpasses $1 billion

- THORChain’s monthly volume in August rallied above $1 billion.

- Following a significant uptick in RUNE’s value, profit-taking activity commenced, putting downward pressure on prices.

Decentralized liquidity network THORChain [RUNE] closed August with its highest monthly volume in the last year, exceeding $1 billion.

Monthly volume growth on @THORChain: A Dynamic Uptrend

?In August, @THORChain witnessed a remarkable surge in its monthly volume, surpassing 1 billion USD!

?A key driver behind this growth was the implementation of streaming swaps – increased strategic options for the user. pic.twitter.com/LIuoDMUaBx— House of Chimera (@HouseofChimera) September 2, 2023

Realistic or not, here’s RUNE’s market cap in BTC’s terms

The surge in volume was attributed to the launch of Streaming Swaps, a new feature that lets the protocol’s users break down a single swap into multiple sub-swaps executed over time.

It was launched primarily to help reduce price slippage, which is the difference between the expected price of a trade and the actual price at which it is executed.

In addition to Streaming Swaps, THORChain also expanded to some major networks in August, including Cosmos [ATOM] and Avalanche [AVAX].

Also, during the month, the protocol announced the launch of its lending protocol, which lets users lend native Layer 1, such as Bitcoin [BTC] and Ethereum [ETH], to THORChain, and borrow a USD-denominated debt.

Lending is live.

Params, Disclosure, Risks, How-to Thread

?

— THORChain (@THORChain) August 21, 2023

Tides are turning against RUNE

While the rest of the market trended downward and sideways in August, RUNE recorded gains due to its low positive correlation with BTC. Within the 31-day period, the token’s value rallied by 66%, according to data from CoinMarketCap.

However, the token’s price peaked at $1.7 on 22 August when profit-taking activity began. Exchanging hands at $1.4 as of this writing, RUNE’s price has since declined by 17%.

Readings from RUNE’s Moving average convergence/divergence (MACD) indicator observed on a daily chart revealed that the token’s sellers initiated a new bear cycle on 22 August.

The MACD line crossed below the trend line, and the indicator has since been marked by downward-facing red histogram bars.

Further, the re-emergence of RUNE bears resulted in a decline in the token’s momentum indicators. For example, its Money Flow Indicator (MFI) has since fallen below its center line, to be pegged at 34.06 at press time.

Also, in a downtrend, RUNE’s Relative Strength Index (RSI) was 51.61, gearing to slip below the 50-neutral line. The decline in these key momentum indicators signaled a reduction in the token’s accumulation.

It showed that investors who had aped in while the token rallied in August have begun to let go of their holdings for profit.

How much are 1,10,100 RUNEs worth today?

Short traders in ruins

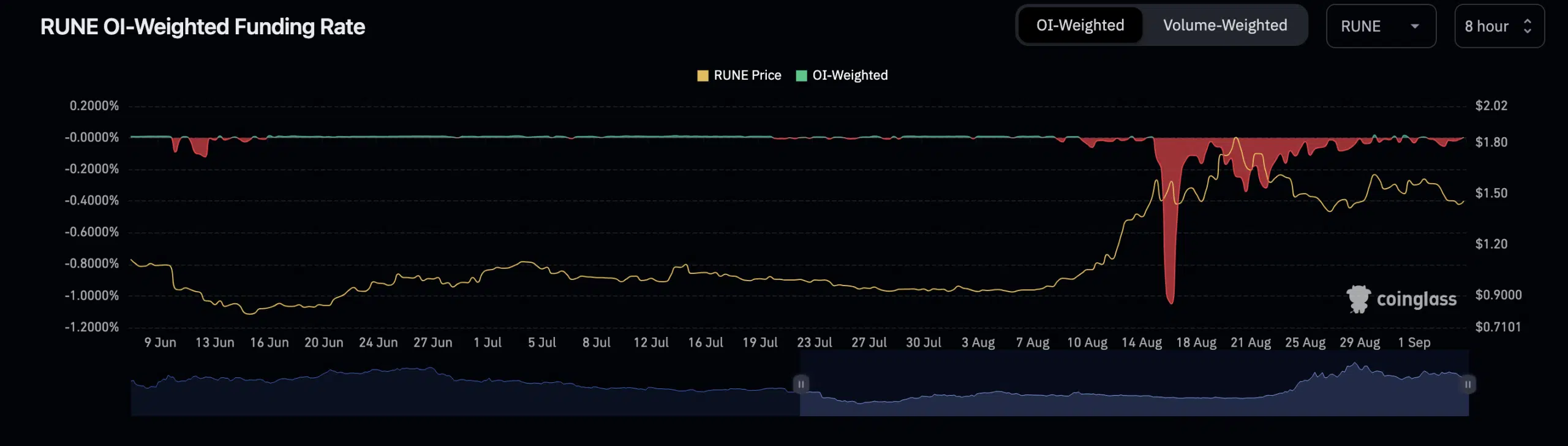

While RUNE’s price climbed in August, funding rates across cryptocurrency exchanges in the alt’s futures market were negative. This showed that in spite of THORChain’s multiple feature updates and price growth during the month, many continued to bet against its price.

However, as RUNE’s price surged, these short positions faced liquidations.