Though USDC regains market confidence, this area still concerns investors

- USDC’s market cap dropped to 18-month lows as depeg impact extended.

- The demand for the stablecoin saw some recovery fueled by demand in smart contracts.

Circle [USDC] experienced robust outflows in the last two weeks of March, which initially triggered a depeg. It eventually regained its dollar peg and has since then remained stable until press time. However, it continued to experience outflows, which have shrunk its market cap by a sizable margin so far. USDC’s market cap fell as low as $32.50 at the end of March.

Realistic or not, here’s USDC’s market cap in BTC’s terms

The last time USDC’s market cap was this low was in April 2022, hence it has fallen to an 18-month low. It is also not the only aspect of the stablecoin that has been negatively affected. According to Glassnode, USDC’s transaction volume has also been severely affected, falling to a nine-month low.

? $USDC Transaction Volume (7d MA) just reached a 9-month low of $300,956,391.56

Previous 9-month low of $301,341,768.00 was observed on 21 October 2022

View metric:https://t.co/UR3yK7fM1y pic.twitter.com/frKp3PsnVj

— glassnode alerts (@glassnodealerts) April 2, 2023

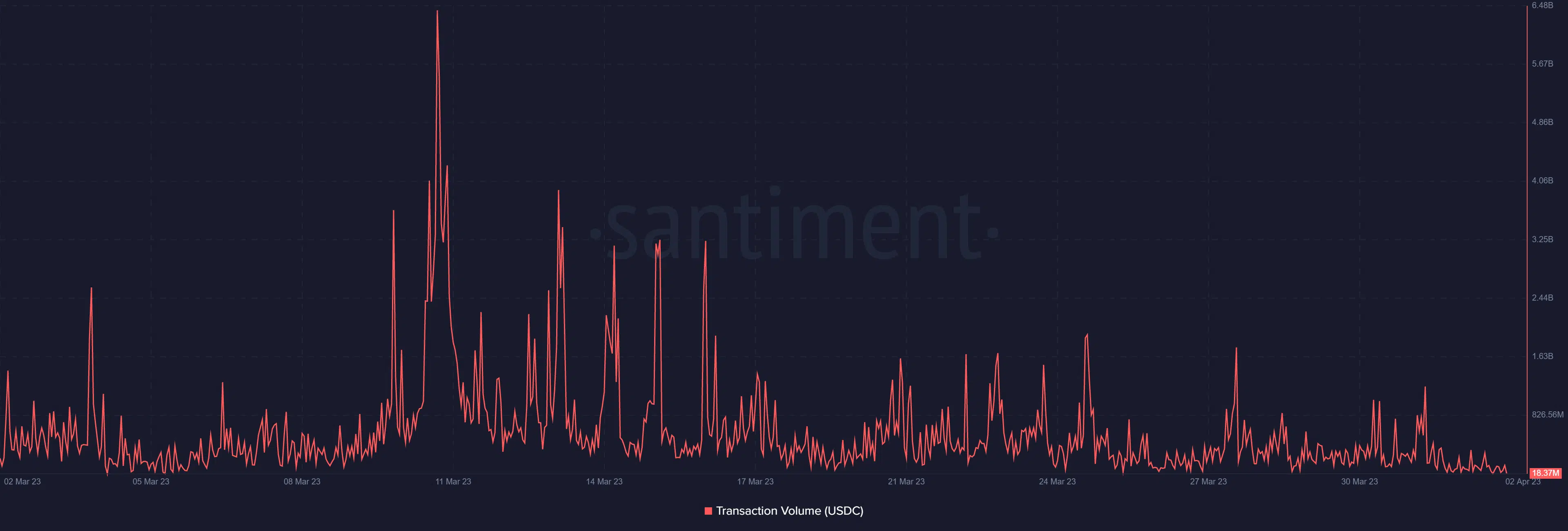

A look at USDC’s transaction volume metric on Ethereum [ETH] confirmed a slowdown, as the stablecoin’s daily transaction volume fell below $2 billion in the last five days.

Demand for USDC sees uptick in this key area

Although USDC’s demand continued to take a hit, as highlighted by the market cap and weighted sentiment, there is one area that showed promise. The percentage of USDC locked in smart contracts has bounced back and was at an 11-month high at press time.

? $USDC Percent Supply in Smart Contracts just reached a 11-month high of 42.806%

Previous 11-month high of 42.690% was observed on 04 May 2022

View metric:https://t.co/eCjboyzLH7 pic.twitter.com/h4CAPks3Vr

— glassnode alerts (@glassnodealerts) April 2, 2023

This observation confirmed that USDC was recovering, especially in DeFi. This may help soften its fall and perhaps even help turn things around in the mid to long term. Could the recent woes turn out to be a blessing in disguise?

Some may view USDC’s depegging as a good sign because it exposed a point of weakness due to SVB’s exposure. However, that point of weakness has not been dealt with and the stablecoin has regained its peg. Exchange flow data revealed that there have been significant exchange flows in the last seven days. This included healthy outflows, which may suggest demand recovery.

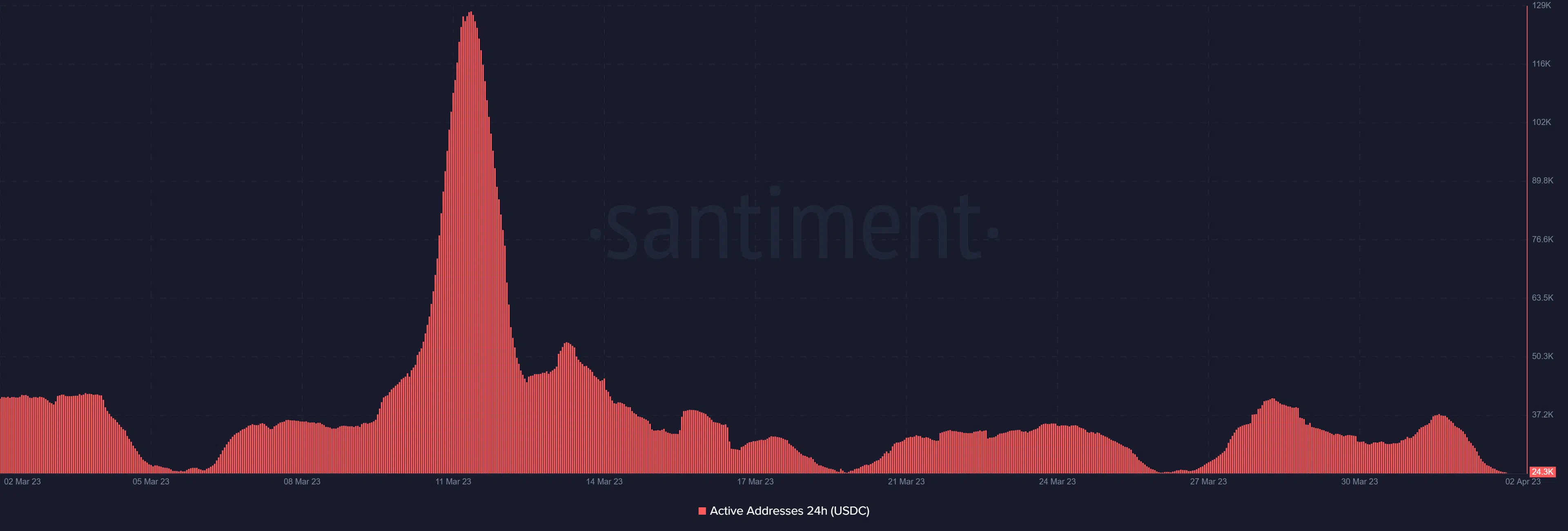

The exchange flows were backed by noteworthy address activity. The number of daily active addresses trading with USDC dropped since the SVB incident. Perhaps USDC’s recovery inspired confidence among users. A more favorable outcome than UST’s situation months prior.