Time for XRP holders to play this leverage game, thanks to Fed

XRP managed to deliver a healthy rally from mid-September as the sentiment shifted in favor of the bulls. Its upside resulted in a resistance retest of May 2022. But, alas, whales have started contributing to short-term sell pressure.

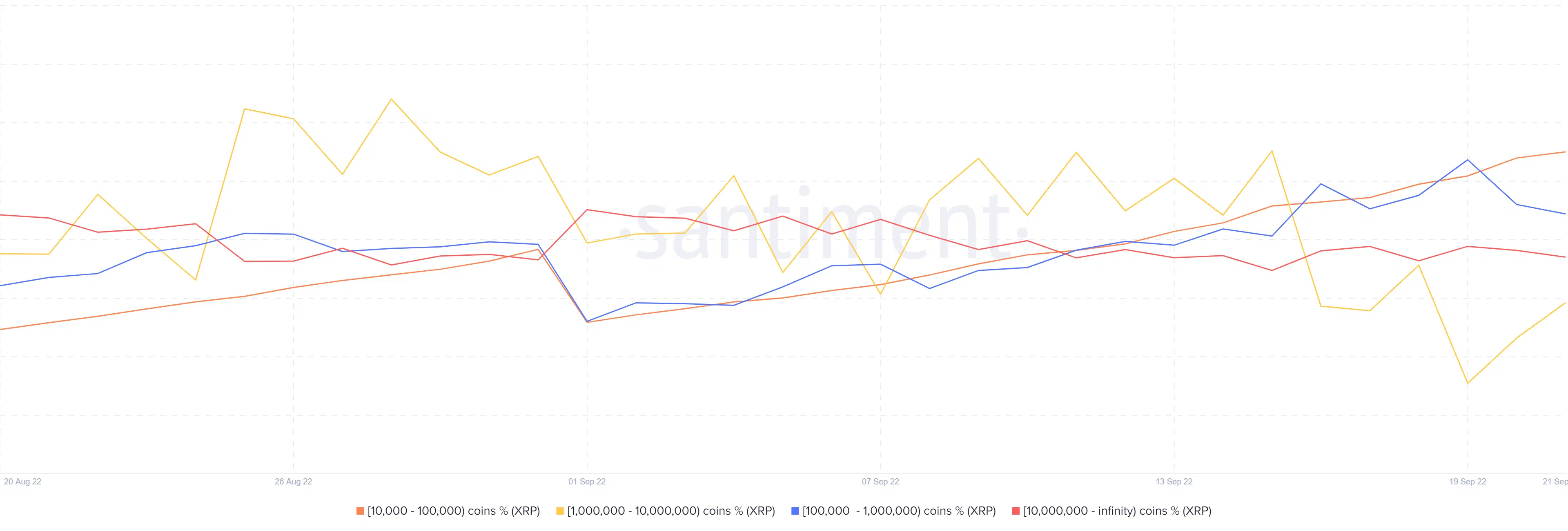

XRP whales have so far had a huge impact on its performance. For example, the largest whales holding more than 10 million coins had a net increase from 15 to 19 September.

This whale category controls more than 70% of XRP’s total supply. Whales in the same category have reduced their balances in the last two days.

XRP whales holding between 100,000 and one million coins have similarly contributed to selling pressure in the last two days. However, addresses holding between one and 10 million coins have been on a buying spree. Thus, limiting the potential downside.

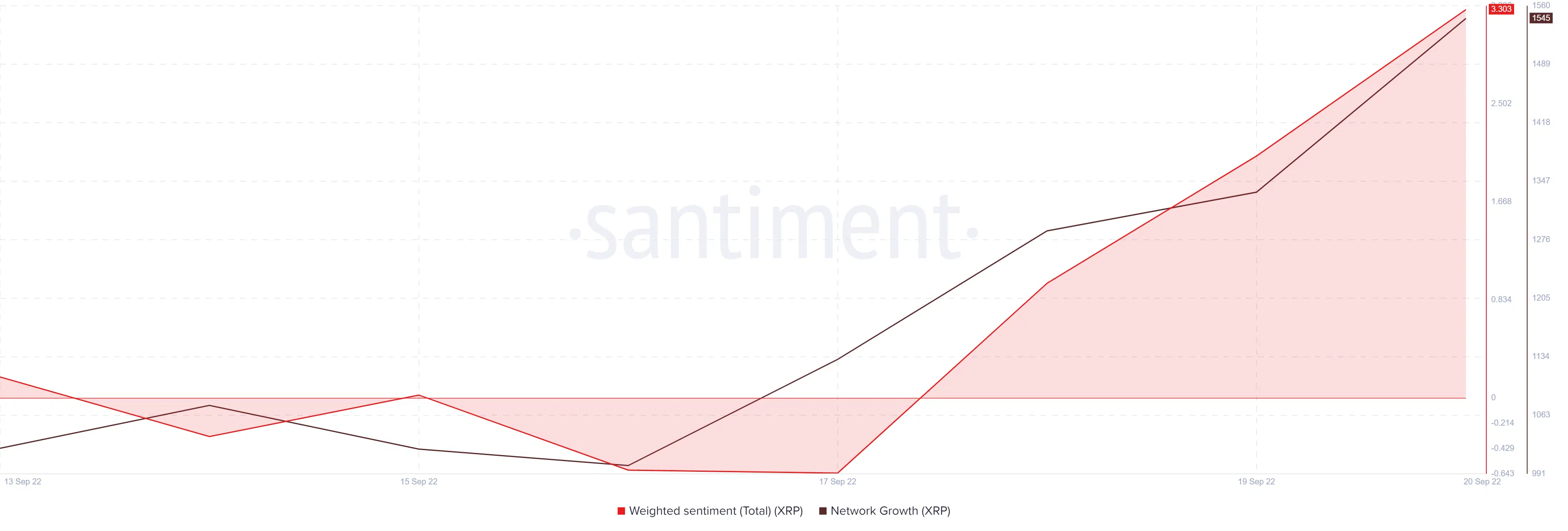

A strong sentiment shift and favorable network growth aided XRP’s bullish mid-month performance. The total weighted sentiment metric pivoted around 16 September, soaring from negative to positive.

A similar network growth pivot may have contributed to the bullish outcome. These metrics didn’t shift in the last 24 hours of press time despite an opposing price action outcome.

XRP managed to rally by as much as 29% from its mid-month levels after demonstrating higher relative strength.

There was an attempt

That being said, it is important to note here that XRP’s price action registered a slight pullback in the last 24 hours, confirming significant sell pressure.

This was in line with the aforementioned whale outflows. The move upward occurred after XRP retested a long-term support level.

Well, XRP’s current sell pressure suggests that it might be headed for a sizable pullback. However, the prevailing supply on 21 September was low, possibly because buy pressure from some of the whales provided more friction for the bears.

Interestingly, the Federal Reserve on 21 September raised benchmark interest rates by another three-quarter of a percentage point. Following this, XRP was down by 0.50% on 22 September.

The bearish outcome is likely to trigger a deeper retracement. Investors should consider that XRP’s price action is headed for a support and resistance squeeze zone. A potential breakout might, thus, be drawing close despite the recently failed attempt.