Toncoin’s battle for $4: Why $3.93 is a key level to watch

- Toncoin retraced to $2.45, a key demand zone last tapped in March 2024, before staging an aggressive recovery.

- $4 level has proven to be a pivotal resistance, triggering multiple rejections.

Toncoin’s [TON] 19.54% monthly rally has positioned it as the top-performing high-cap asset. However, its brief deviation above the $4 level faced swift rejection, indicating potential local exhaustion.

On the flip side, market structure suggests a sentiment shift, with investors transitioning from anxiety to denial.

In market psychology, denial is a phase where participants dismiss early signs of trend exhaustion, anticipating continuation instead.

With this in mind, can Toncoin prevent a mass capitulation and trigger a supply squeeze, or is the current rally setting up for distribution?

TON’s current market standing — Battling $4 resistance

On its 1D price chart, Toncoin retraced to $2.45, a key liquidity zone last tested in March 2024. The subsequent recovery was impulsive, yet the $4 reclaim has proven to be a strong resistance.

The latest breakout attempt saw TON briefly pierce above $4, only to face swift sell-side absorption, indicative of a liquidity grab.

This rejection, despite the absence of clear overextension signals, reinforces local distribution dynamics.

Consequently, shorts capitalized, triggering forced liquidations of $340 million in open positions. The resulting deleveraging event contributed to the pullback, bringing TON back to $3.80 at the time of writing.

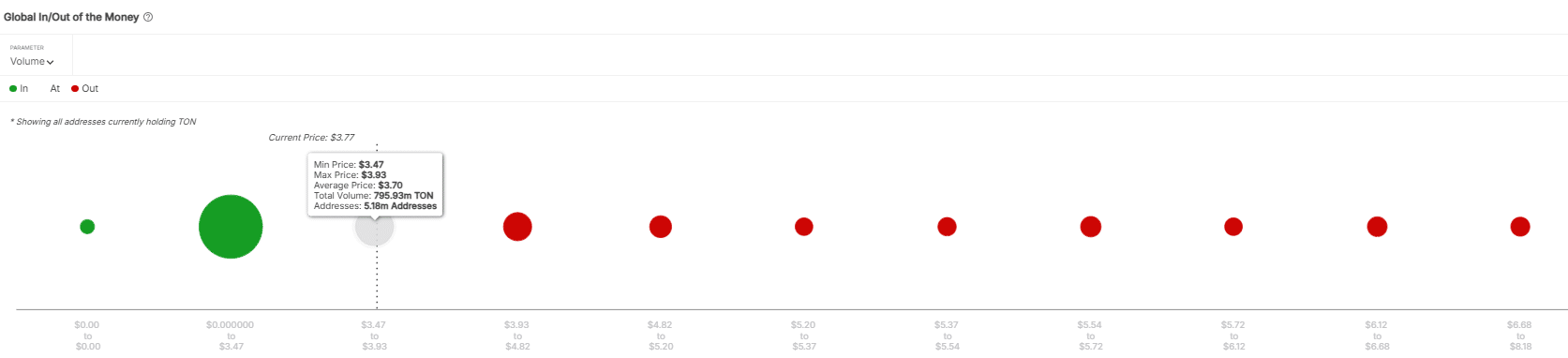

Now, TON is staging another push toward $4. However, the $3.93 supply zone remains a key inflection point, where 5.18 million addresses collectively hold 795.50 million Toncoin.

A rejection at this level could catalyze cascading sell pressure, putting 3.12 billion TON at risk of distribution.

In fact, failure to sustain bullish momentum may induce another short squeeze, extending consolidation within a liquidity trap.

Yet, there’s a silver lining. The market sentiment is shifting into the denial phase. The big question is : Will TON investors exhibit conviction in a breakout, or is a deeper re-accumulation phase inevitable?

Assessing Toncoin’s next move : HODL or capitulate?

Whales currently control 66.77% of Toncoin’s total supply, making their actions a key market signal. Over the past week, whale net inflows surged by 2159.82%, a clear indication of significant accumulation.

In fact, this accumulation aligns with Toncoin’s breakout from its $3.35 consolidation range, suggesting increased buy-side interest.

The sharp uptick in whale activity suggests that large holders are positioning for a continuation of the bullish trend, potentially disregarding any signs of trend reversal.

If this pattern holds, even after a retest of $3.93, a move past the $4 resistance zone appears increasingly probable, especially with a 7.70% increase in Open Interest (OI) in the derivatives market.

However, failure to maintain support at $3.93 could trigger cascading liquidations, putting the current open positions at risk.

To confirm a move above $4, capitulation must be absorbed. While the prevailing signals are bullish, monitoring these critical levels closely will be crucial in the near term.