Traders expecting SHIB’s reversal should read this

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

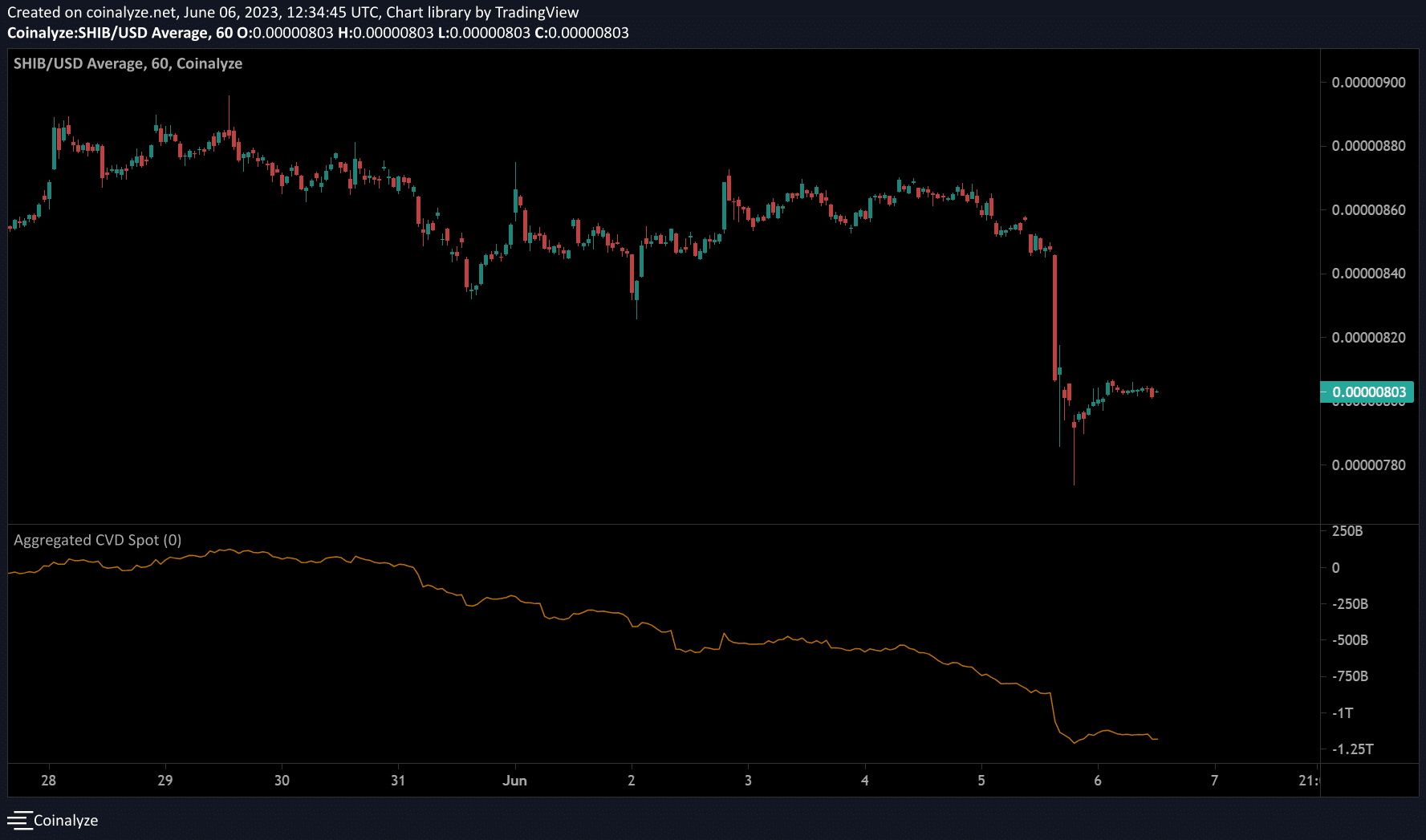

Shiba Inu [SHIB] sustained over 5% losses on Monday, 5 June, dropping to its December lows. The plunge followed Bitcoin’s [BTC] sharp drop from $26k to $25k amidst a Binance lawsuit that unnerved the crypto market.

Despite the Crypto Fear and Greed index firmly on the “Fear” position at press time, current price levels weren’t a decisive buying opportunity with a weak BTC.

How much are 1,10,100 SHIBs worth today?

Besides, a more downside move couldn’t be overruled, especially if the next week’s FOMC meeting takes another hawkish stance.

Will sellers extend gains?

A weak BTC below $26.6k could offer SHIB sellers more edge in the market. At press time, the Relative Strength Index (RSI) hit the oversold zone. This highlighted the recently elevated selling pressure the memecoin was under.

In addition, the On-Balance Volume (OBV) dipped further, suggesting a limited demand and trading volumes for a strong rebound capable of smashing the range low of $0.00000833. Since 8 May, SHIB oscillated between $0.00000833 and $0.00000911 but breached the range after the US SEC-Binance lawsuit.

The drop left behind a Fair Value Gap (FVG) zone of $0.00000816 – $0.00000845 (white). Moreover, the range low also aligned with the FVG, which could make it a solid bearish area.

A negative price reaction from this level could set SHIB to retrace to lower support levels of $0.00000748 and $0.00000698. These levels can act as short-selling targets in such a downswing scenario.

A close above the FVG zone will invalidate the above bearish thesis. Such an upside move could ease at the mid-range level of $0.00000872 or the range high.

CVD spot on a steady decline

Is your portfolio green? Check out the SHIB Profit Calculator

Since late May, SHIB’s Cumulative Volume Delta (CVD) spot has been steadily declining. This meant that buying volumes eased as selling pressure intensified.

As such, sellers have firmly controlled SHIB’s market for a while. The trend could persist unless BTC inflicts a trend reversal.