TreasureDAO exits Arbitrum gaming program: Impact on ARB?

- TreasureDAO has introduced a proposal to migrate its Web3 gaming ecosystem from Arbitrum to ZKsync.

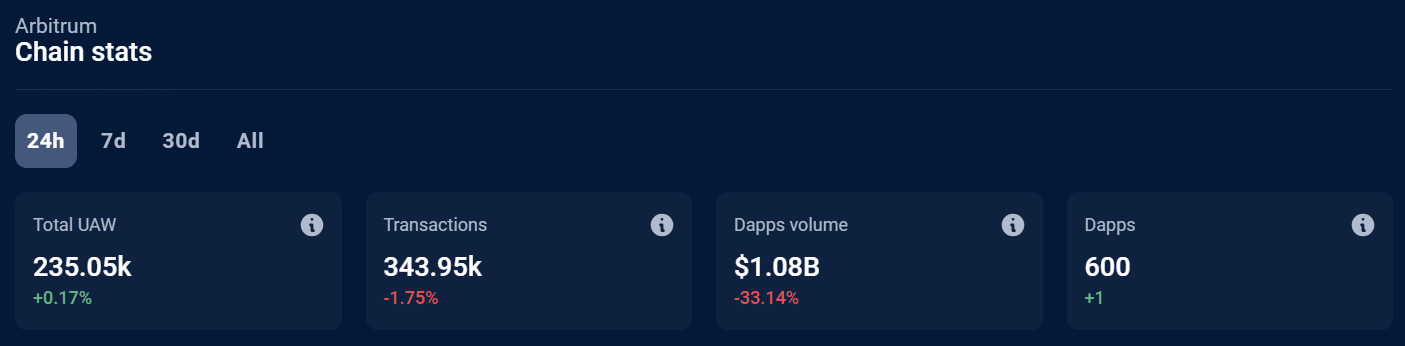

- Arbitrum dApp volumes have dropped by 33% in the last 24 hours.

TreasureDAO has announced plans to migrate its Web3 gaming ecosystem from Arbitrum [ARB]. In a voting proposal, the DAO noted that ZKsync was better suited to meet its gaming needs.

Per the statement, most of the liquidity on the Arbitrum ecosystem came from decentralized finance (DeFi) and not gaming. Additionally, Arbitrum’s program to support Web3 games was being implemented at a slow pace.

The DAO said,

“We have been disappointed with the pace of the Arbitrum Gaming Catalyst Program (GCP) to begin catalyzing and supporting gaming on Arbitrum.”

Treasure is the largest gaming protocol on Arbitrum with a Total Value Locked of $6.42M per DappRadar. This is nearly three times higher than the second-largest gaming project on the layer-2 network.

The proposal has coincided with a significant drop in dApp activity on Arbitrum. DappRadar shows that in the last 24 hours, volumes have dropped by 33% to $1.08 billion.

Arbitrum price struggles

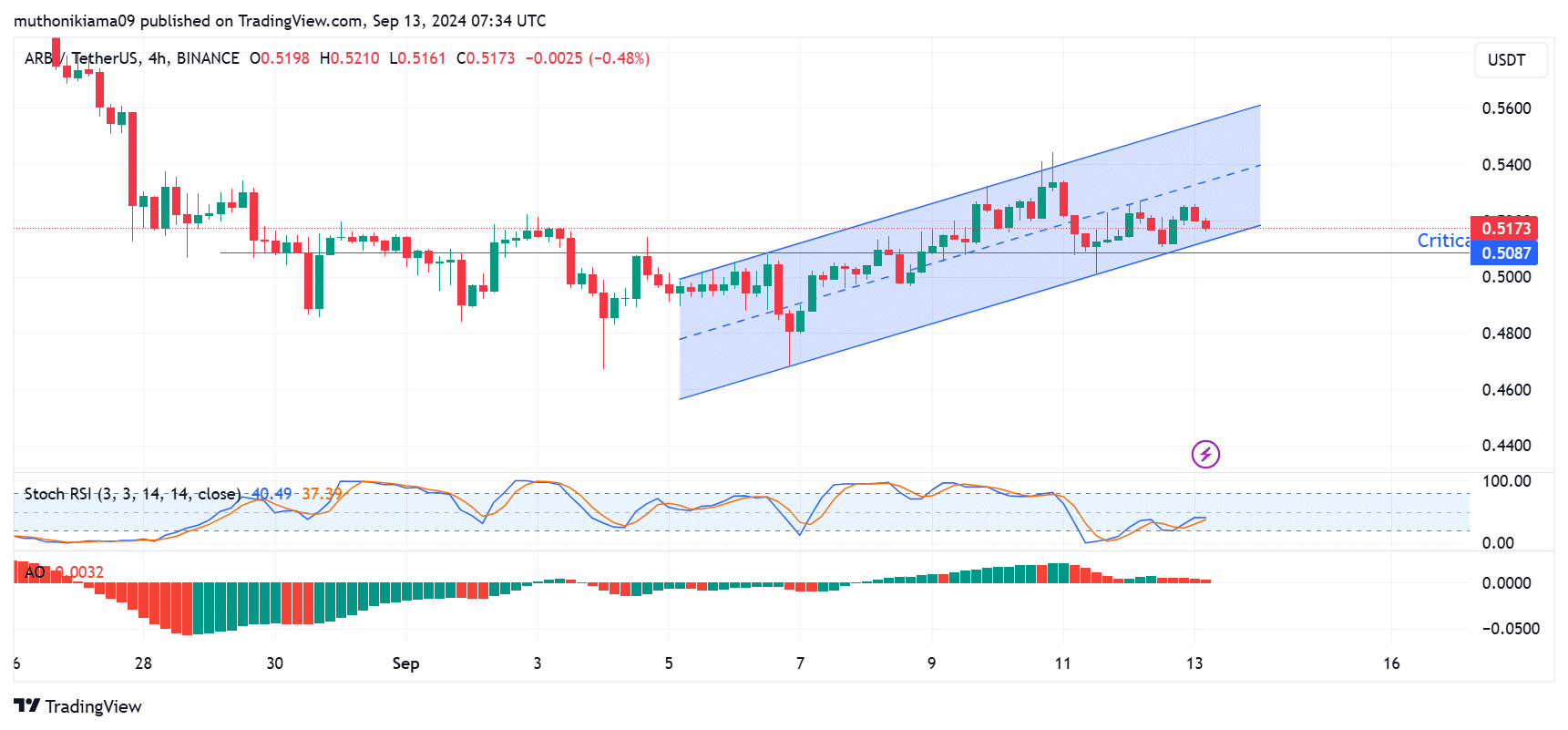

ARB price was facing headwinds after a 0.5% decline to trade at $0.517 at the time of writing. The gloomy performance stemmed from choppy price moves across the broader market as traders showed uncertainty.

Arbitrum was trading within a parallel channel, which showed that bullish momentum is in play. However, the uptrend was weakening as ARB fell below the midline of this channel.

The bullish thesis will be invalidated if ARB breaks below the channel and breaches the critical support at $0.508.

This is a multi-month support level, given that each time it has failed to hold, ARB has registered significant declines.

The Stochastic Relative Strength Index (RSI) was at 40, indicating that sellers have the upper hand at press time. Moreover, the Awesome Oscillator (AO) bars were flashing red, showing potential downward movement.

However, bears were yet to take control of the price action, as the Stochastic RSI line was above the signal line.

For ARB to invalidate the bearish thesis, it needs to reclaim levels above $0.55 for a bullish breakout above the upper trendline.

An uptick in network activity could support a bullish recovery. Recently, Ethereum co-founder, Vitalik Buterin, praised Arbitrum for being ahead of other layer 2s in terms of maturity.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Data from L2Beat showed that Arbitrum was the largest layer-2 network by TVL.

However, in the last 24 hours, it has underperformed against its largest competitors, Optimism [OP] and Base, whose TVL has increased by 3% and 4%, respectively.