Altcoin

TRON ‘beats’ Ethereum on THIS front after stablecoin supply evens out

TRON has seen growth in stablecoin transfers, lending, and daily network transactions.

- Stablecoins on TRON network stabilized at $62 billion

- Lending on the network accounted for 55% of the TVL

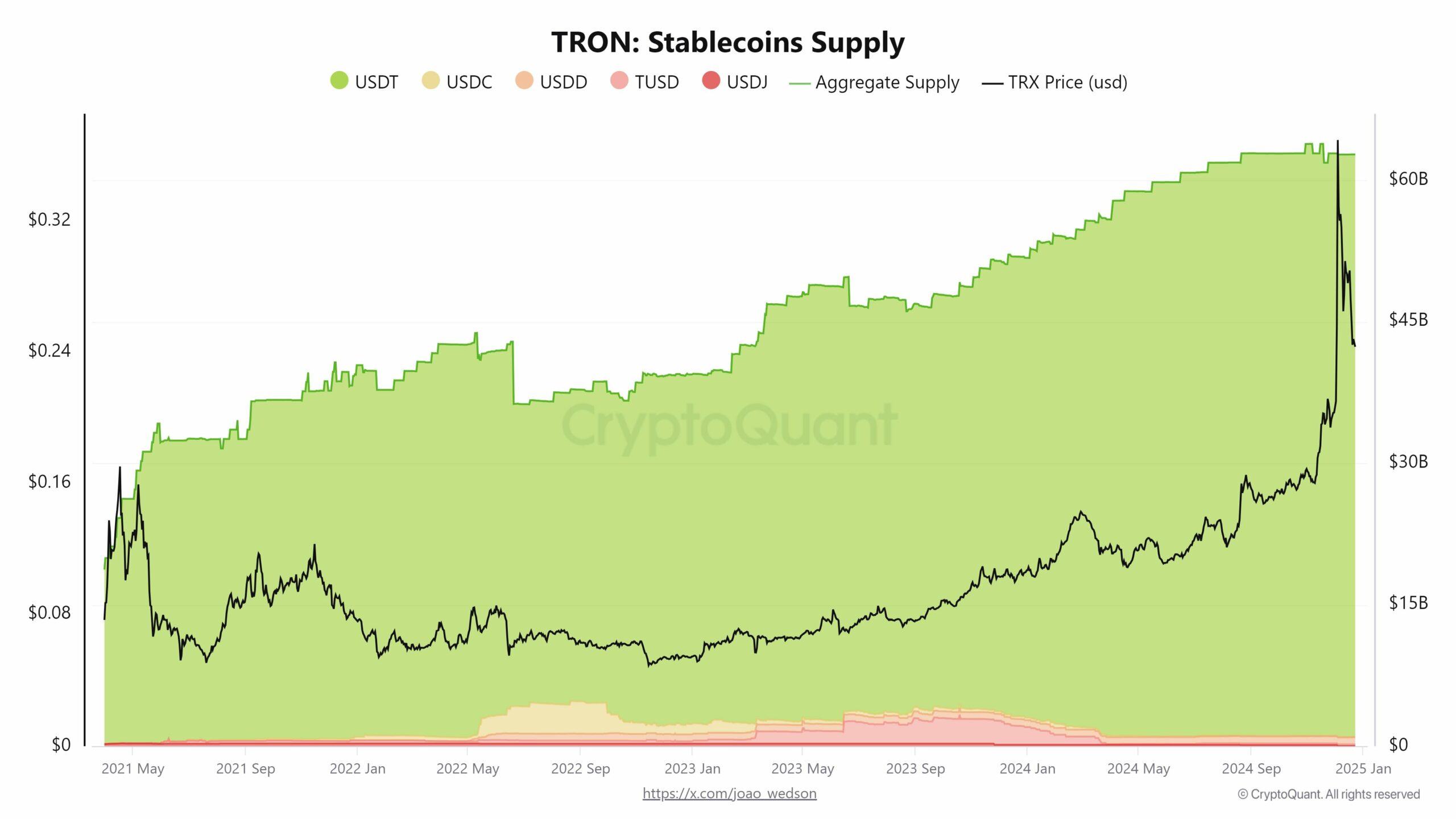

The stablecoin supply on TRON, specifically USDT, hit a stable level of $62 billion, indicating a pause in minting activities. This stabilization in the minting and supply of stablecoins suggested a balanced market, one where demand met supply efficiently – A sign of maturity in the ecosystem.

Including USDT, a consistent aggregate supply level with minor fluctuations corresponded with changes in market dynamics.

Excluding USDT, the lesser volume yet steady hike in other stablecoins like USDC, USDD, TUSD, and USDJ, supported the diversity and growing stability of the ecosystem. The scenario indicated matured market condition on the network, one where significant disruptions were less likely and investor confidence could be strengthened.

Further analysis of the Ethereum (ETH) and TRON stablecoin transfer dynamics depicted ETH’s market dominance in stablecoin transactions challenged by TRON’s increasing share.

While Ethereum has maintained significant activity in USDT transfers, TRON captured 64% of the market – An uptick of 57% from the previous month.

This shift underlined TRON’s growing appeal in the stablecoin sector, likely attributed to its lower transaction fees and faster processing times via the TRC20 protocol. This also alluded to a competitive landscape, while also highlighting its own potential to reshape stablecoin transactions significantly.

Lending on the TRON network

Lending activities also shaped the network’s financial landscape, contributing over half of the network’s total value locked (TVL) since 2022. JustLend spearheaded this trend, offering users opportunities to engage in decentralized finance (DeFi) by providing and earning on loans without intermediaries.

This surge in lending not only increased user participation, but also enhanced TRON’s overall liquidity and financial stability.

By facilitating secured loans through collateral, these platforms ensured lender security and mitigated default risks. JustLendDAO reinforced TRON’s DeFi ecosystem by offering accessible financial services.

This development solidified it as a strong contender in the DeFi space. This was evidenced by its ongoing growth in TVL and diverse financial activities like payments and cross-chain operations.

This growth trajectory has highlighted TRON’s ability to maintain its role in the rapidly evolving DeFi sector. It promises a future for its ecosystem and lending service participants.

Daily network transactions

TRON also held the runner-up position to Solana (SOL) on the daily network transactions front. Outpacing other major chains like ETH illustrated its capability in handling large transaction volumes efficiently.

It was further quantified by TRON’s monthly transaction figures, which consistently surged above others. In fact, it registered counts of 182 million, 167 million, and 135 million over recent months.

Collectively, these highlighted TRON’s strong position in the blockchain arena. By often surpassing peers in monthly transactions, it has now cemented its DeFi status.