Altcoin

Tron decouples from Bitcoin, Ethereum: New ATH coming?

TRX’s Long/Short Ratio currently stands at 2.22, the highest since late September 2024.

- Tron’s Futures Open Interest jumped by 20% suggesting that traders’ long positions have been continuously rising.

- 68.95% of TRX traders held long positions, while 31.05% of investors held short positions.

Tron [TRX] broke out from a major resistance level of $0.157 among the bullish market sentiment among traders.

At press time, TRX was currently trading near the $0.161 level after a price surge of over 2.56% in the past 24 hours.

During the same period, its trading volume jumped by 25%, which shows how investors and traders are participating in the asset following the recent breakout.

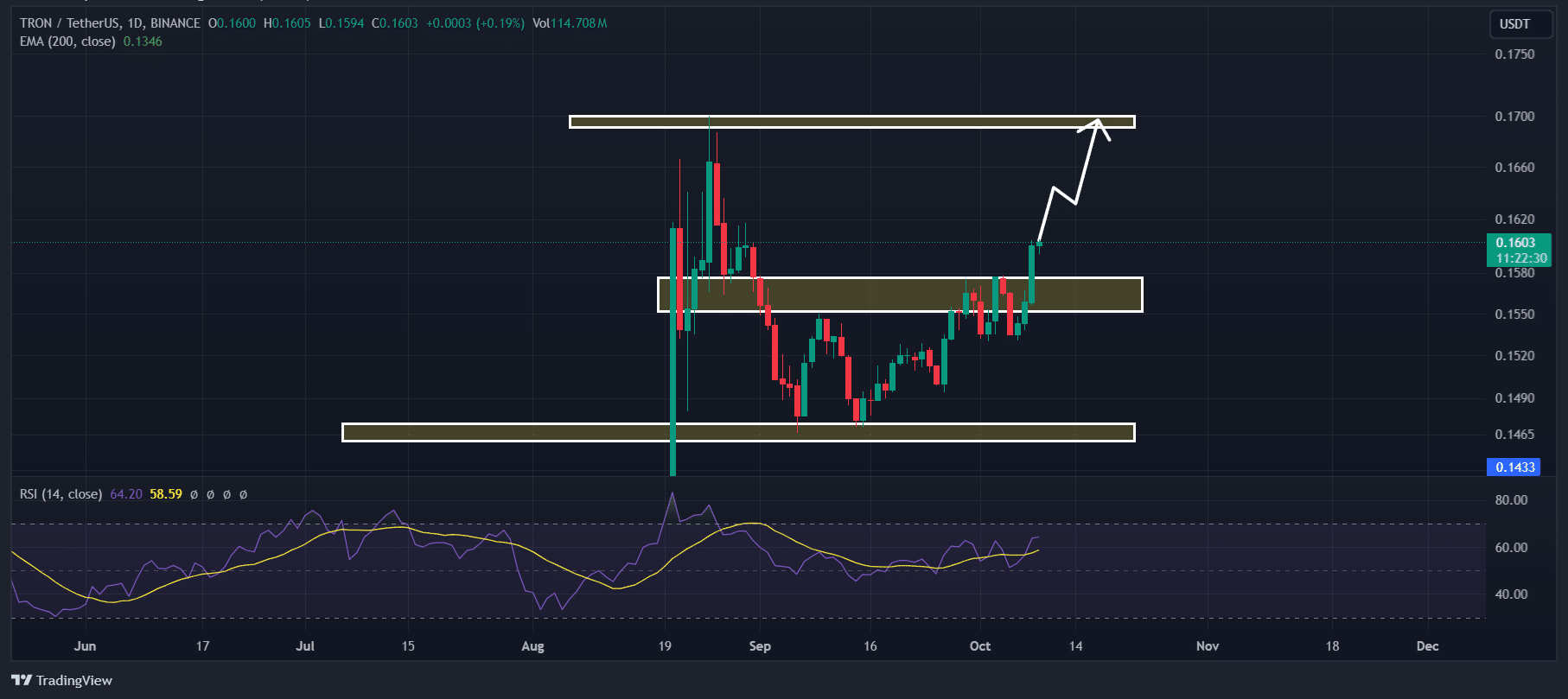

TRX technical analysis and key levels

AMBCrypto’s technical analysis suggests that TRX is bullish and may rally significantly in the coming days.

Following its successful breakouts from the strong resistance level of $0.157, there is a high possibility that TRX’s price could easily break its all-time high and set a new record.

Technical indicators such as the Relative Strength Index (RSI) and the 200 Exponential Moving Average (EMA) further support this bullish outlook for the altcoin.

Bullish on-chain metrics

In addition to this positive outlook from technical analysis, on-chain metrics indicated that bulls were favoring holding on to the altcoin, instead of selling off.

According to the on-chain analytics firm Coinglass, TRX’s Long/Short Ratio was 2.22 on the 12-hour time frame, the highest since late September 2024. This indicated bullish market sentiment.

Additionally, TRX’s Futures Open Interest jumped by 20%, and has been steadily increasing since then. This suggested that traders’ long positions have been continuously rising over the past 24 hours.

Read Tron’s [TRX] Price Prediction 2024–2025

At press time, 68.95% of TRX traders held long positions, while 31.05% held short positions.

Combining all the on-chain metrics and technical analysis, it appears that bulls are currently dominating the asset and the sentiment is positive, which could lead to a massive upside rally in the coming days.