TRON holders are ‘in profit,’ but what next for TRX’s price?

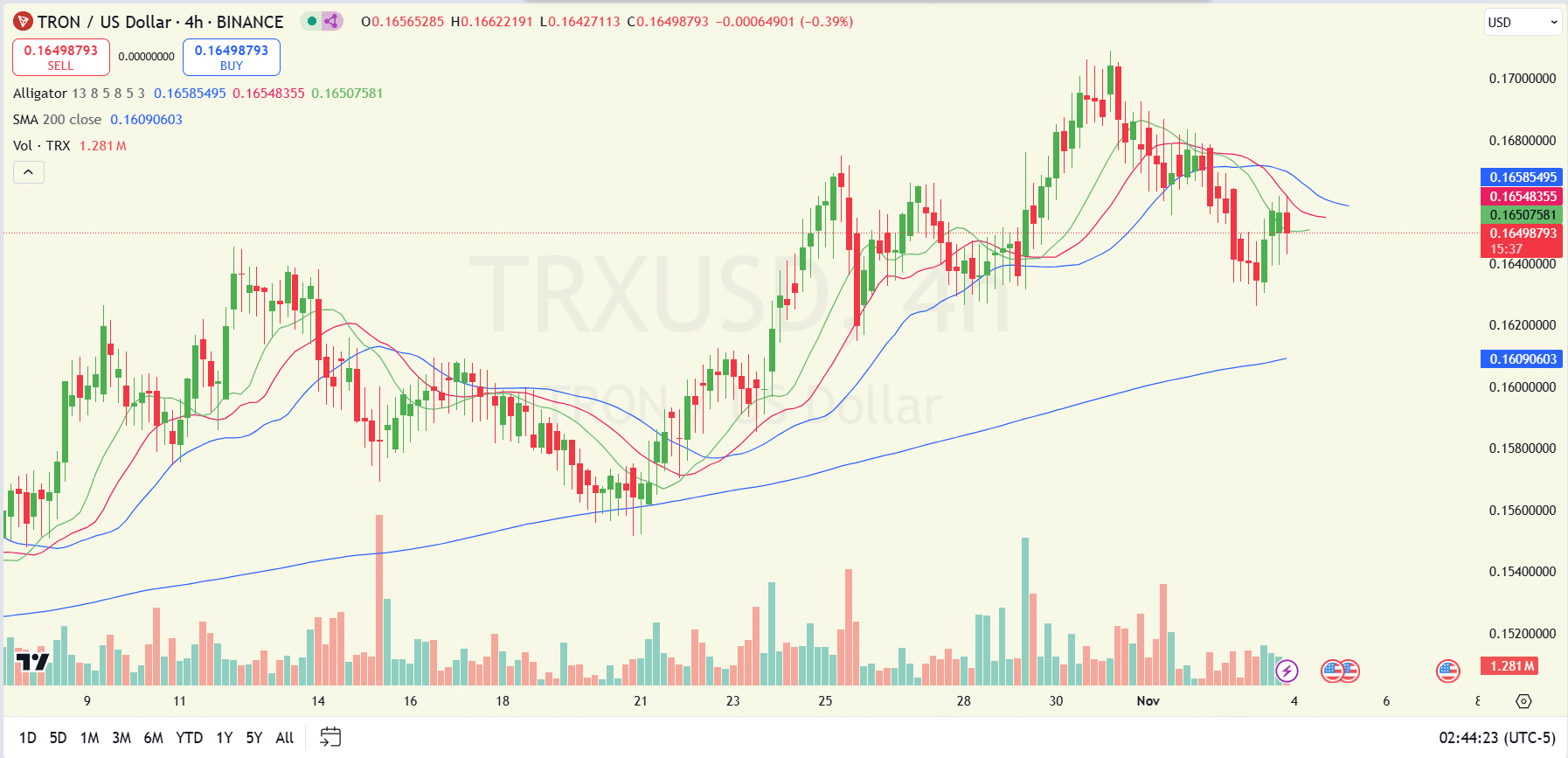

- At the time of writing, TRX was trading above its 200-SMA, showing a long-term bullish trend

- Token burns alluded to a deflationary mechanism for the altcoin

TRON (TRX) has recently registered a minor price dip on the charts, dropping from $0.1678 towards the beginning of the month to $0.1654 – A 1.8% decline.

And yet, the altcoin’s market cap climbed by 0.59%, with the 24-hour trading volume surging by 20.49% too – A sign of growing investor interest. These metrics, together, highlighted the sustained optimism around the altcoin’s ecosystem.

Here, it’s worth noting that TRON, fueled by strategic initiatives like token burns, is designed to reduce supply and encourage long-term value growth.

Analyst projections remain bullish too, indicating a logarithmic price surge that can push TRON towards the $1.11 target. The $0.1635 support level has historically catalyzed northbound movement. And, a successful retest of this level will invite further bullish action, setting up a possible hike to $0.18 this week.

Technical indicators point to sustained rally

In October 2024, TRON executed a major token burn, removing over 149.6 million TRX tokens from circulation. These had an estimated market value of approximately $25 million.

This burn is part of Tron’s commitment to reduce token supply, fostering scarcity, which can positively affect price stability over the long term.

On the daily chart, the altcoin’s price has been above the 200 SMA line since the start of August. What this means is that the SMA line’s position has continued to reinforce a long-term bullish trend for the altcoin.

Volume levels were moderate, showing no major spikes at press time. This pointed to a steady, low-volatility environment for TRX traders.

The Alligator indicator’s three lines (green, red, and blue) seemed to be converging too, hinting at a consolidation phase. This setup can be interpreted as a sign that TRX has been gathering strength, possibly preparing for its next move.

TRON holders enjoy profits, less than 1% at loss

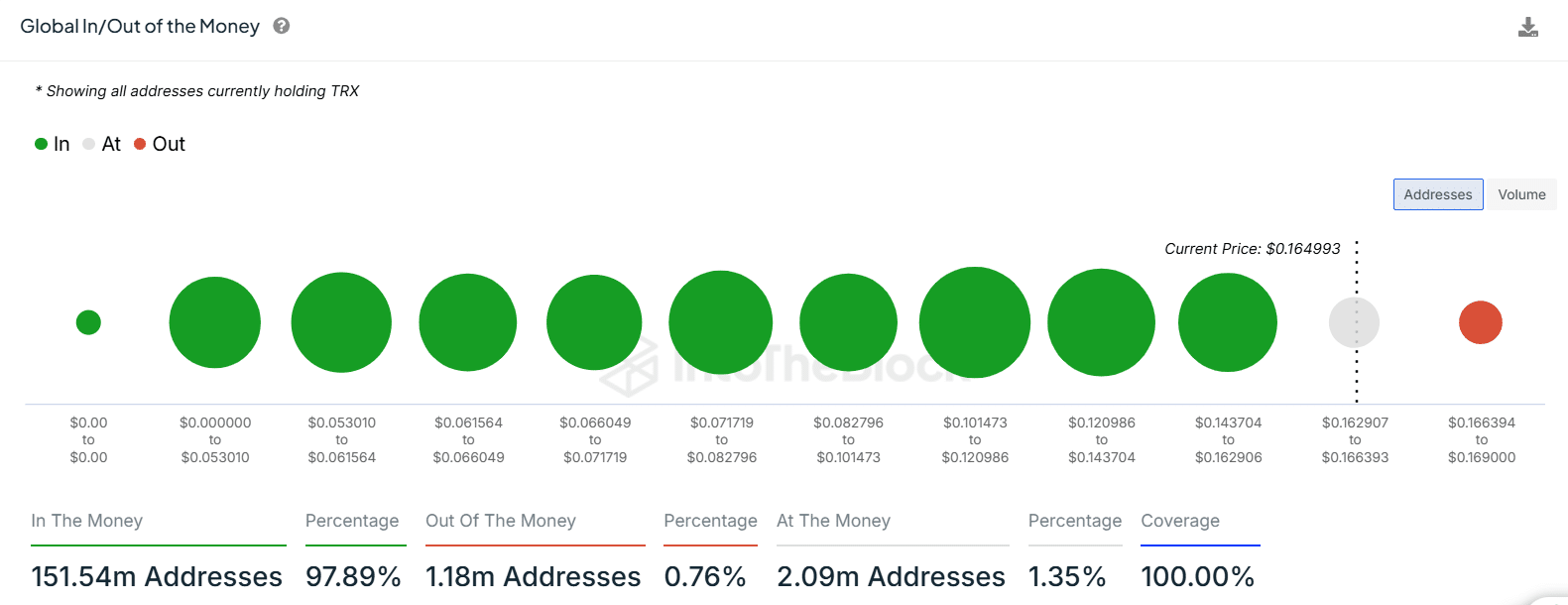

At the time of writing, approximately 97.89% of all addresses holding TRX were “In the Money,” indicating that these holders were in profit relative to their purchase price.

Only a small percentage, 0.76% of addresses were “Out of the Money,” meaning that these holders were at a loss at the altcoin’s press time price levels.

Meanwhile, 1.35% of addresses were “At the Money” – A level where the purchase price is nearly equal to the crypto’s press time trading price.

Such a high percentage of profitable addresses is a sign of strong market confidence in TRON, with a majority of investors benefiting from recent price trends.

High liquidation levels around $0.165

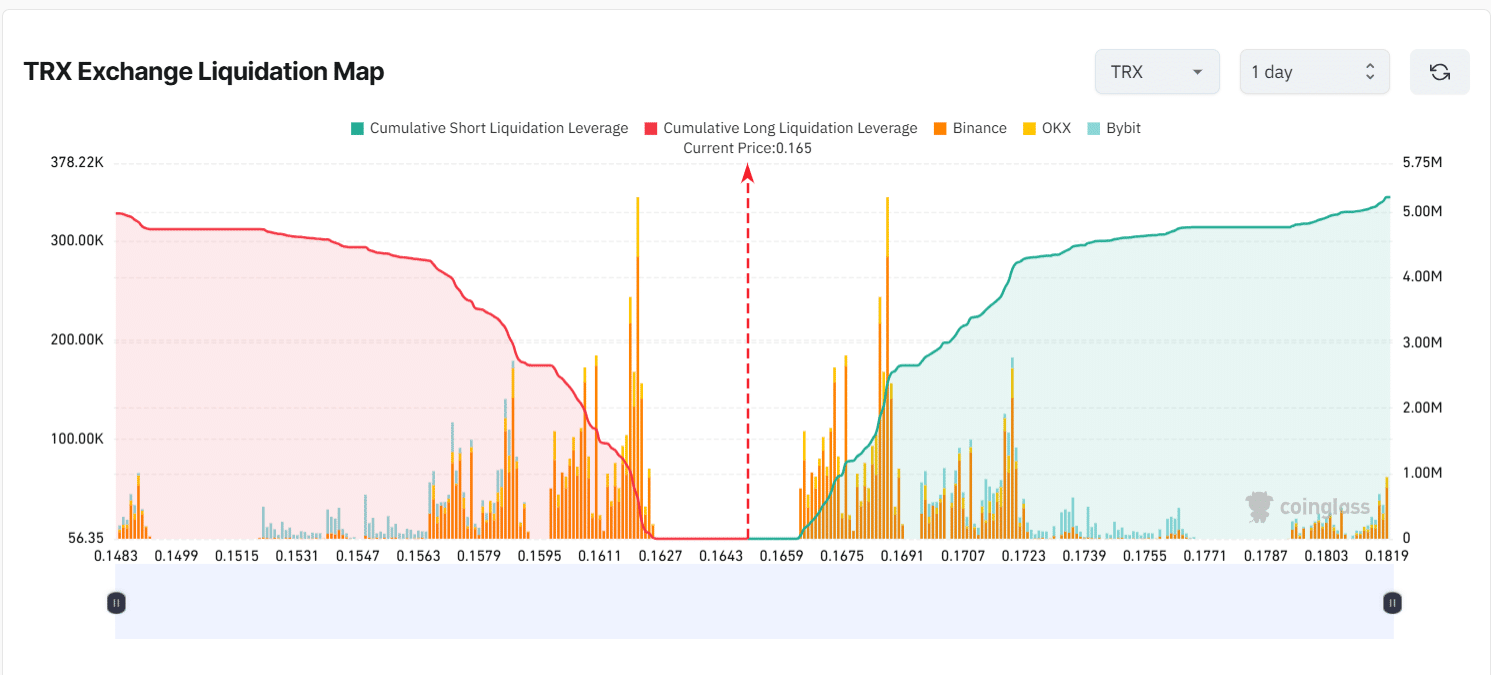

At the time of writing, there seemed to be a balanced distribution of long and short liquidation levels around TRX’s press time price of $0.165.

On the left side, cumulative short liquidation leverage (red area) began to build up significantly below $0.164. These are likely to intensify if the price drops. What this means is that short positions were heavily leveraged around these levels.

Conversely, on the right side, cumulative long liquidation leverage (green area) picked up above $0.166, with leverage growing considerably beyond $0.170.

This concentration suggested where long positions might face liquidations if TRX’s price rises sharply.