Tron investors could emerge as Q2 winners but only if TRX stays true to this path

- Tron’s upcoming staking upgrade may be the secret strategy for attracting liquidity.

- TRX slows down as volumes dwindle and traders wait on the sidelines for the fog to clear.

The Tron network achieved milestone after milestone in March. But how long can it sustain this positive growth trend? Recent updates suggest that it can potentially eke out a bit more growth thanks to one major reason.

Is your portfolio green? Check out the Tron Profit Calculator

Tron’s [TRX] latest monthly report also highlighted three of the most important developments that took place in March. The TRC-20 version of USDT soared to a new historic high of more than $44.1 billion, allowing it to tap into more transaction revenue.

The network also added support for USDT on the social network Telegram. Perhaps the weightiest and most important of the three major announcements that may have an impact on Tron in the near future could be the upcoming launch of Tron stake 2.0.

?Check out the #TRON Monthly Report of March 2023!

✅#TRON Stake 2.0 is coming soon.

✅Telegram now supports #TRC20–#USDT payments.

✅The circulating supply of #TRC20–#USDT on the #TRONNetwork reached a record high of over 44.1B.More? pic.twitter.com/6hkmMUki4l

— TRON DAO (@trondao) April 3, 2023

Why is stake 2.0 important and will it have a positive impact on Tron? The upgrade is reportedly expected to boost staking flexibility. Furthermore, the network could also enable different staking durations from as low as 3 days.

One of the major benefits of the upgrade is that it will allow users to earn higher rewards. In short, the upgrade may make staking on the Tron network more appealing.

Tron stake 2.0 may trigger more demand for TRX

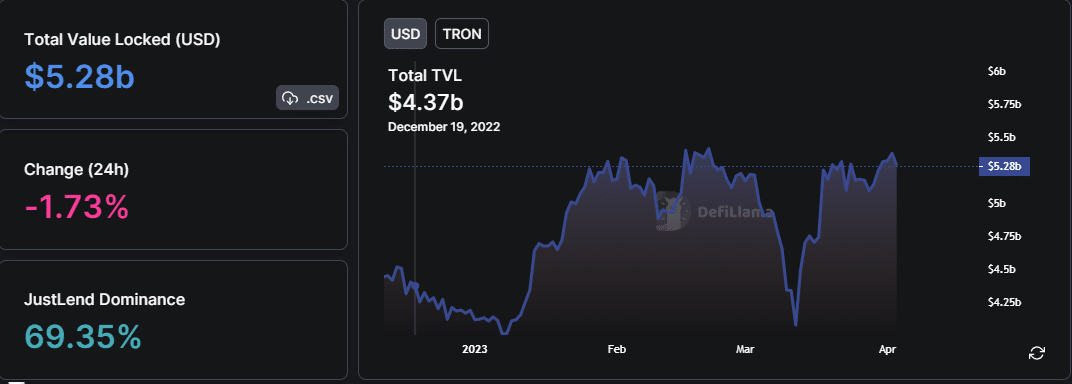

If Tron succeeds, then its native token TRX may benefit from a higher TVL as more people would want to stake their coins. TRX’s TVL achieved a significant bounce since the start of 2023, confirming a strong flow of liquidity under favorable market conditions.

But what does this all mean for TRX’s price action? A more efficient staking platform will not only encourage more staking but also potentially boost the demand. Long term hodlers might be more confident with the prospects of higher rewards and more flexibility as far as staking goes.

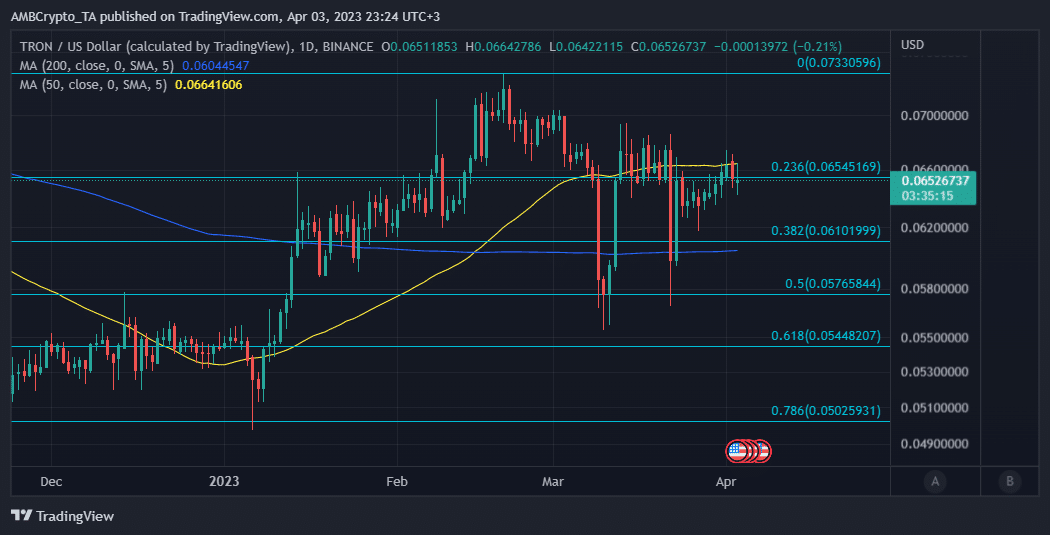

Additionally, TRX’s price action attempted another rally towards the end of March but low volumes restricted its potential upside. It consolidated around the $0.065 price level at press time which was in line with the 0.236 Fibonacci retracement line.

How many are 1,10,100 TRXs worth today

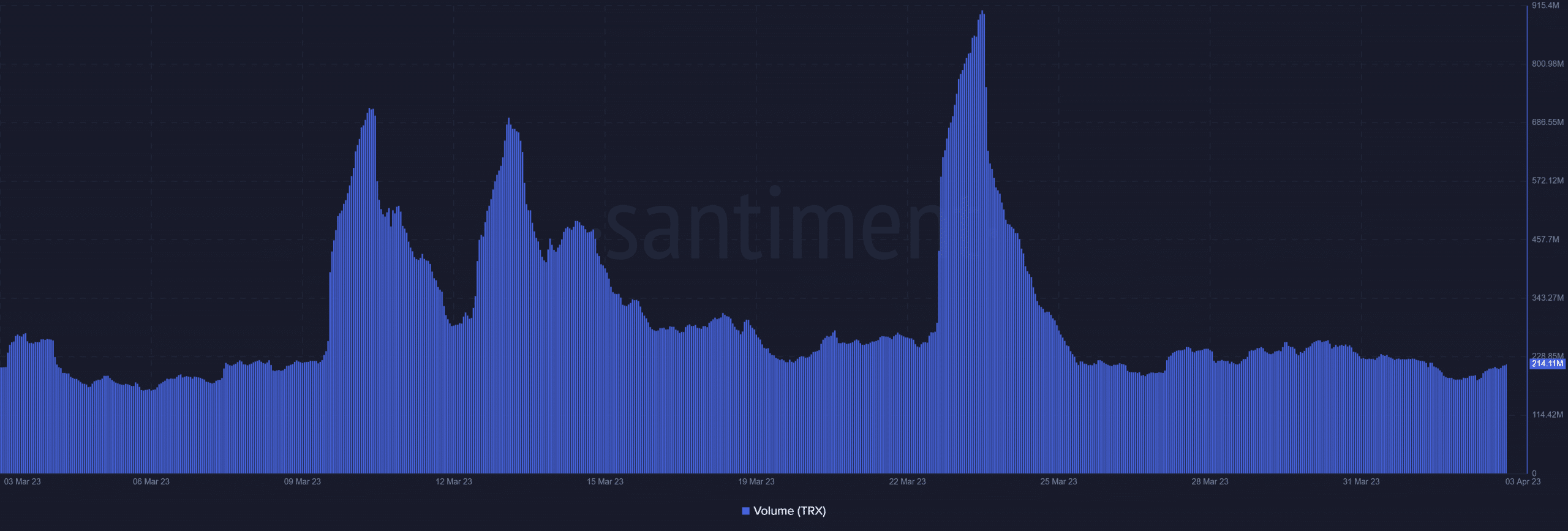

TRX’s next Fibonacci support levels could be around the $0.061 and $0.058 price zones. A retest of the upper Fibonacci retracement level would result in a retest of its February high near the $0.073 price level. So far the volumes in the market remain low, hence the subdued price movements.

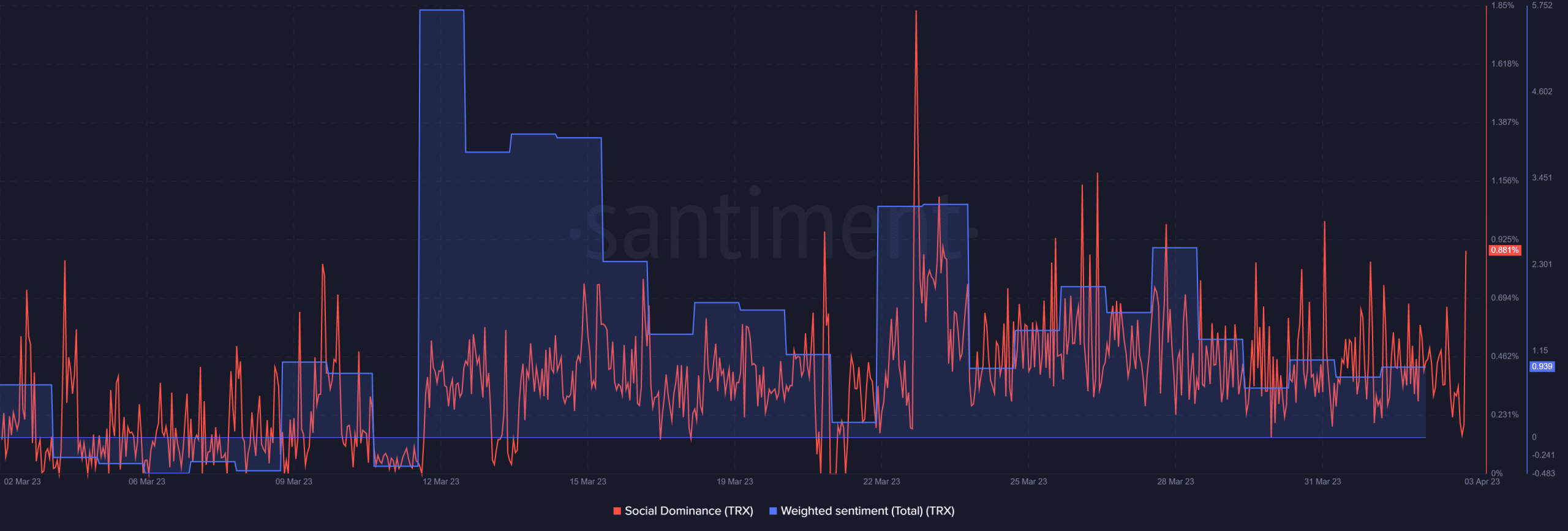

The low volume could also be a reflection of the current market conditions where investors are standing on the sidelines waiting for a clear sign. The same outcome explains why the weighted sentiment was still low at press time. It also suggested that some investors were leaning towards bearish expectations.

Meanwhile, social dominance continued to slide at the time of writing. Perhaps a sign that investor attention might be shifting elsewhere.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)