Tron: TVL and price rise, but for how long?

- Tron’s TVL pushed to new heights amid a show of resilience from the bulls.

- Recent upside showed signs of whale demand.

We have been keeping tabs on Tron [TRX] and its native cryptocurrency this year, and there is no doubt that both have performed exceptionally well. TRX in particular seems to be detached from the rest of the market, allowing it to extend its rally, with limited pullbacks.

How much are 1,10,100 TRXs worth today?

Tron isn’t showing any signs of slowing down, even as other coins enjoyed healthy demand in the last two weeks. Its TVL, one of the best measures of organic growth, just achieved a new all-time high of $7.78 billion.

The positive TVL growth reflected the robust liquidity that was flowing into the Tron ecosystem. It signaled that the market was gaining more confidence in Tron’s future, hence more investors were willing to lock their funds for the long-term.

The TVL growth automatically goes hand in hand with robust demand for Tron’s native cryptocurrency, TRX. The latter has also been experiencing explosive demand, which is responsible for its extended rally in the last two weeks.

Will TRX embark on yet another relief pullback?

TRX’s price chart revealed that it has resumed the bullish trajectory initially observed in September. It embarked on a bit of a retracement in the first week of October, resulting in a $0.084 monthly low. It has since bounced back by as much as 11% to its $0.094 press time high.

TRX could be headed for another major pullback. There were multiple signs at press time, which suggested that such an outcome could be in the cards. For example, its RSI and MFI were well into overbought territory, thus demand should technically slow down.

According to the price chart, TRX’s press time price level was also of historical relevance. The same price point has acted as a resistance zone (take profit level) multiple times in the past. This raised the likelihood of a bearish pivot by a considerable margin.

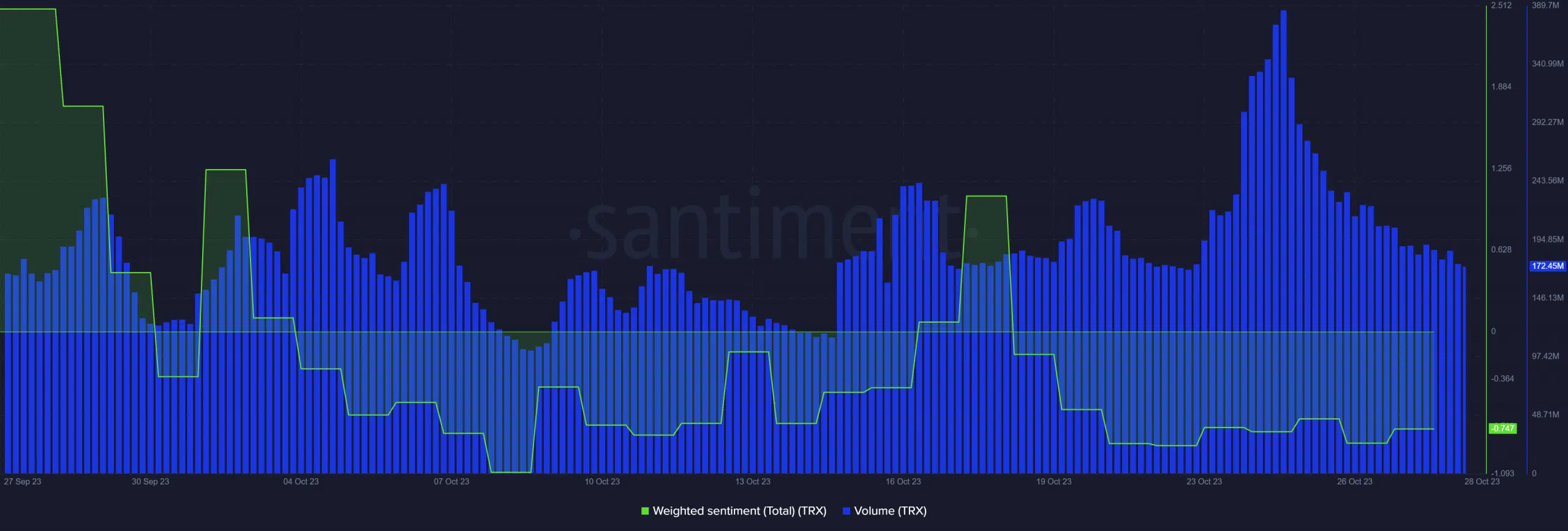

Tron’s on-chain data revealed that volume has been slowing down after peaking on 24 October. However, the price has been rallying even after the volume peak, indicating that whales and institutions could be driving up the price.

Realistic or not, here’s TRX’s market cap in BTC’s terms

At press time, Tron’s Weighted Sentiment metric was closer to its monthly low compared to its monthly high. This was a sign that there are expectations of a pullback.

Despite the above findings, it is clear that TRX’s price action was more in tune with demand from whales rather than retail during this time period. This could also signal that a retracement may not necessarily yield substantial downside.