Tron: Bulls are primed to break through

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Tron saw its H4 market structure flip bearishly.

- This might not presage much more than a minor dip before the bulls seize control again.

Tron [TRX] saw its Total Value Locked (TVL) rise to $7 billion, and the network appeared to be robust. Investor confidence was also growing as the coin trended higher in the second half of October.

Read Tron’s [TRX] Price Prediction 2023-24

A previous price analysis by AMBCrypto noted a bearish divergence and suggested that a retracement to the $0.0869 mark could occur. While we did see a minor dip, it was not as deep as expected. This reflected intense bullish sentiment in the market.

Tron is at a local resistance, but the HTF uptrend is many months old

In mid-October, TRX retraced its late September rally and almost retested the 78.6% Fibonacci retracement level. This level was at $0.0845 and TRX approached it in mid-October. Since then, the bulls were able to drive a strong uptrend and broke past the local resistance at $0.0883.

At press time, TRX was trading at $0.0911. The Fib extension levels pointed to the $0.093 and $0.0962 levels as the 23.6% and 61.8% extension levels where bulls can look to take profits.

Additionally, the $0.0944 level marked the high during the TRX rally in June and July that began at $0.0645.

The RSI on the H4 chart was back near neutral 50. The market structure favored the bulls, but the recent higher low’s breach at $0.0905 meant the structure has shifted.

Yet the DMI signaled a strong uptrend was still in progress with the ADX (yellow) and +DI (green) above the 20 mark.

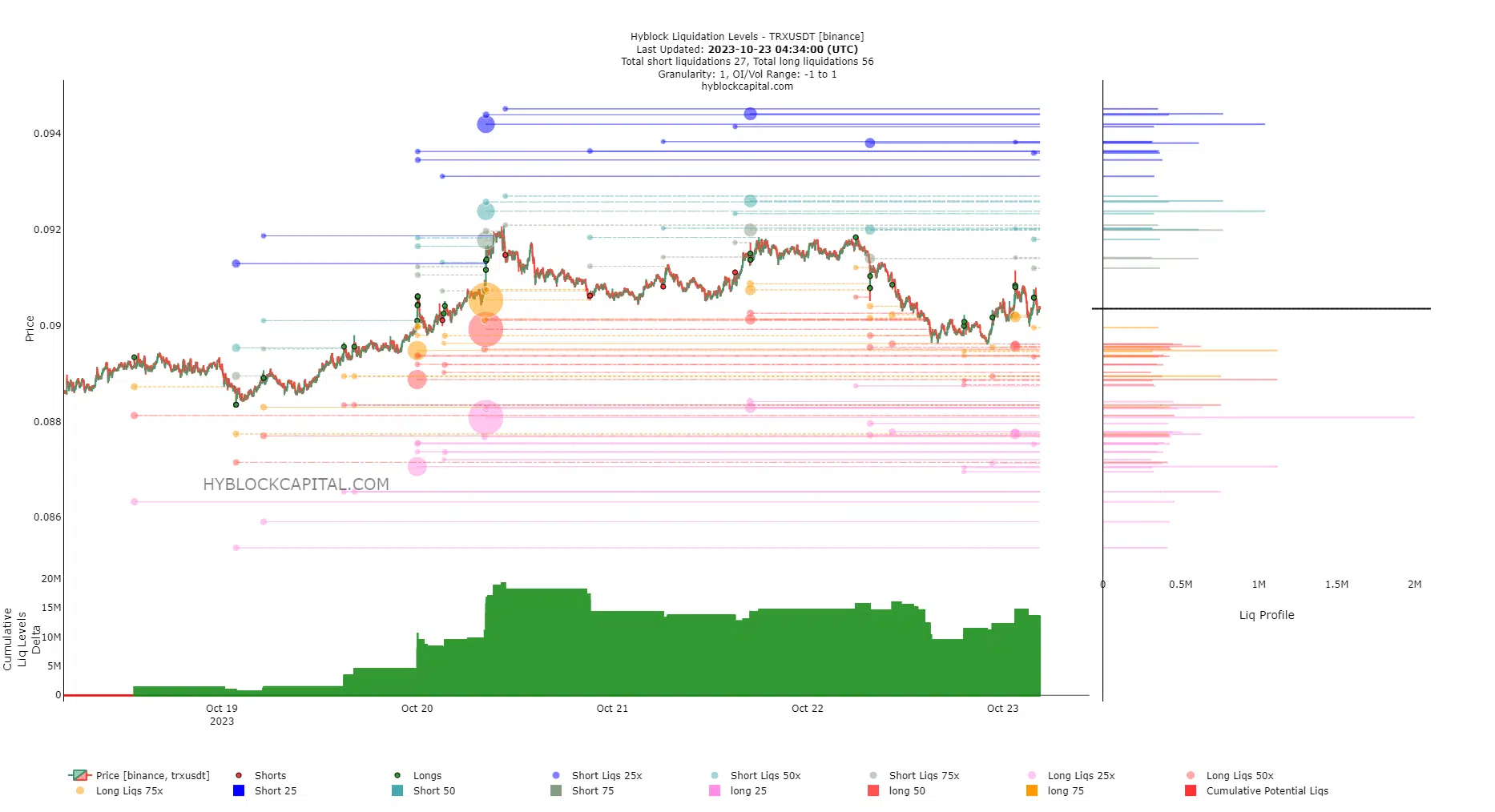

Should traders beware of a southward liquidity hunt to wipe out short positions?

Source: Hyblock

How much are 1,10,100 TRXs worth today?

The Cumulative Liq Levels Delta stood at +$15.89 million. To the south, the $0.089 level had close to a million dollars worth of short liquidations, with more at the $0.0088 level. The long position liquidations were not as big.

Therefore, it was possible that TRX would see a short-term retracement lower to hunt these liquidation levels. Traders could wait for a dip and a shift in the lower timeframe market structure before going long.