TRON: Will these developments propel TRX’s trend reversal? Analyzing…

- Justin Sun mentioned that TRON may be seen as a valuable virtual asset for development in Hong Kong.

- TRX’s price registered a decline, but a few metrics and market indicators suggested a trend reversal.

TRON [TRX] published its weekly highlights on 25 February, in which it mentioned all the notable developments in its ecosystem over the past seven days. The most significant update was related to its earlier-announced AI development fund. Moreover, TRON Academy also announced a partnership with BostonHacks last week.

?Check out #TRON Highlights from this week (Feb 18, 2023 – Feb 24, 2023).

?We'll update you on the main news about #TRON and #TRON #Ecosystem. So stay tuned, #TRONICS! pic.twitter.com/2ZaA6Tahi6

— TRON DAO (@trondao) February 25, 2023

Read TRON’s [TRX] Price Prediction 2023-24

Additionally, Justin Sun, the founder of TRON, posted a tweet in which he mentioned that Hong Kong’s proposed regulations for virtual asset trading could have a big impact on TRON, and the blockchain can benefit from it.

Hong Kong's proposed regulations for virtual asset trading could have a big impact on #TRON.

Read more here?https://t.co/MAOo5aDtnm

— H.E. Justin Sun 孙宇晨 (@justinsuntron) February 24, 2023

As per the tweet, TRON can stand out from other virtual assets because of its ability to achieve the admission requirements of the new regulations, which aim to improve investor protection and transparency in the virtual asset market. Sun further added that as a blockchain platform with innovative features and growth potential, TRON may be seen as a valuable virtual asset for development in Hong Kong.

Though Sun expects TRON to reach new heights in the coming years, the near-term scenario was different, as a few metrics were against TRX, and so was its price action.

These metrics can be troublesome

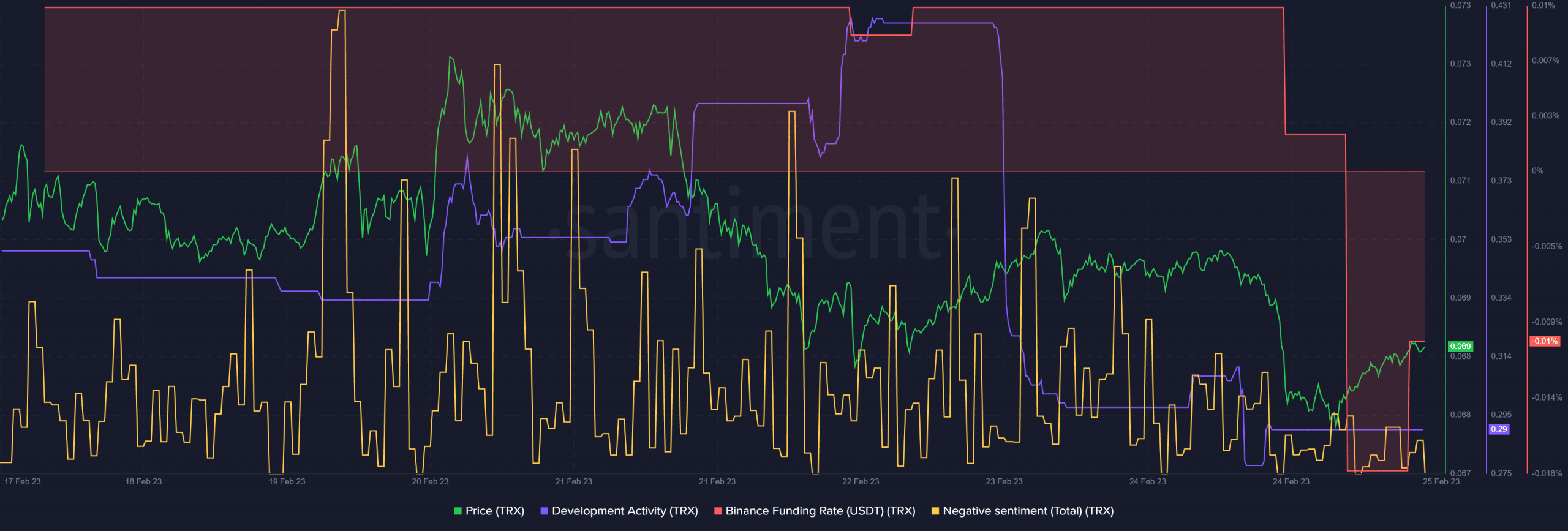

CoinMarketCap’s data revealed that TRX’s price declined by 2.5% in the last seven days, and at the time of writing, it was trading at $0.06859 with a market capitalization of over $6.28 billion. TRX’s development activity also registered a decline compared to last week, which was a negative signal. Negative sentiments around TRX spiked, reflecting less confidence among investors in the token.

After being in constant demand in the derivatives market, things changed on 25 February as TRX’s Binance funding rate dipped.

As per LunarCrush, TRX’s bullish sentiment declined by 8% last week, which suggested that its price might fall further. Though most of the metrics were negative, TRX’s Galaxy Score increased considerably in the last few days, which is a massive bullish signal.

Is your portfolio green? Check the TRON Profit Calculator

Bulls to take over the market soon?

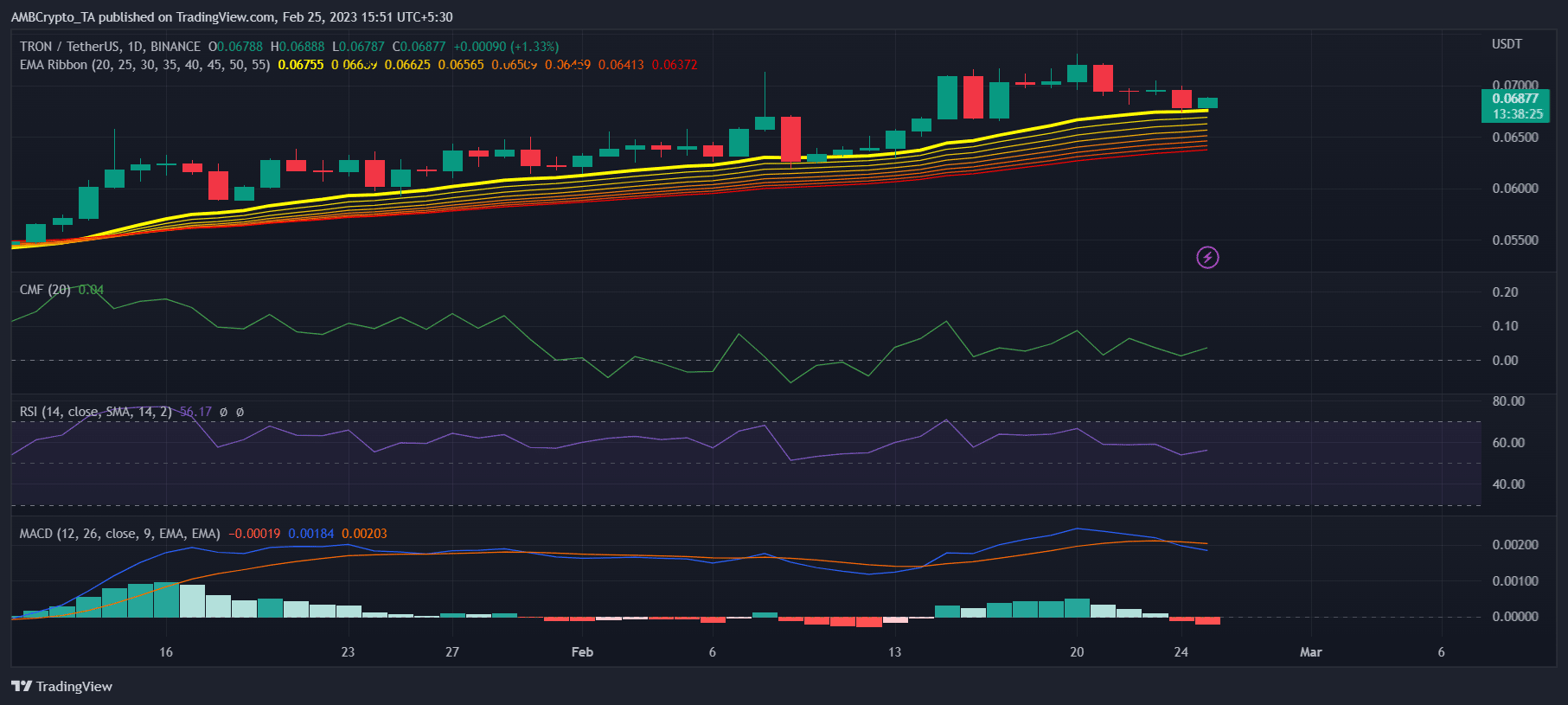

A look at TRX’s daily chart suggested that the bulls might gain an advantage in the market, increasing the chances of a price uptick in the coming days. For instance, TRX’s Relative Strength Index (RSI) registered an uptick and was heading further up from the neutral zone. The Chaikin Money Flow (CMF) also followed a similar trend, which looked bullish.

Additionally, the Exponential Moving Average (EMA) Ribbon revealed that the bulls had the upper hand, as the 20-day EMA was well above the 55-day EMA. However, the MACD gave reasons for concern as it displayed a bearish crossover.