Tron signals a potential local bottom: What it means for TRX

- Tron’s price heatmap signaled a potential local bottom.

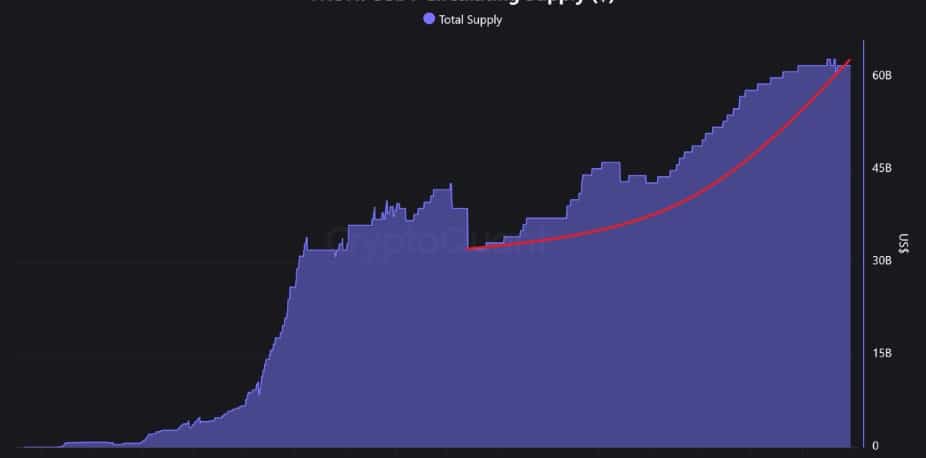

- USDT supply on Tron blockchain has reached $61.67 billion, hiking by 28.7% in 2024.

Throughout December, Tron [TRX] has struggled to hold an uptrend after the November rally that followed the U.S. election.

Thus, over the past three weeks, TRX has dropped from a high of $0.45 to a low of $0.22.

The recent market conditions have left analysts talking over Tron’s future trajectory. As such, CryptoQuant analyst Burak Kesmeci has shared optimism suggesting a potential trend reversal, citing Tron’s local bottom.

Tron: Potential local bottom?

In his analysis, Kesmeci posited that Tron’s price heatmap might be indicating a potential local bottom.

According to him, Tron’s price heatmap has played a major supportive role during bull markets.

With the market currently experiencing a strong correction, this level would act as a support or potentially mark a local bottom.

When a local bottom appears, it suggests the end of a downtrend a potential start of an uptrend.

As such, the altcoin price heatmap shows various narratives. Firstly, the green trend that represents one year MA + 2 Sigma is 0.23, the purple trend is 0.40 while blue is 0.49.

These levels tend to increase upward with a surge in interest and demand during a bull rally. During this market cycle, the blue and purple trend levels act as resistance zones.

Therefore, the analyst observed that if Tron’s prices fall below the green trend, it could signal significant weakness for a bull cycle.

However, based on the current data, if Tron holds this level, it could result in the start of another upward momentum.

As demand increases, price may aim a move towards the resistance zones around 0.49 and 0.40. If the prices break above 0.40 trend levels, it will provide a strong market confidence, resulting in an upward pressure.

We can see this rising demand, especially for Tron blockchain, despite the TRX failure to hold an uptrend.

In fact, USDT supply on Tron Blockchain has surpassed $61 billion, signaling increased demand and adoption.

This has experienced a sustained uptrend, rising from $32 billion in 2022 to $61.76 billion in 2024. This marked a 28.7% growth throughout the year from $48 billion.

This growth is significant for Tron and its native token TRX. As such, Tron’s significant lead over other blockchains shows its potential to attract more users in the future.

When users rise and the altcoin gets more adoptions, it will in turn have a positive impact on its price charts.

What’s next for TRX?

If the demand for the altcoin holds as observed by the analysts, it could see more gains. Coupled with the rising usage of the Tron blockchain, TRX has potential for the future.

Read Tron’s [TRX] Price Prediction 2025–2026

If the trend reversal is imminent, as signaled by the price heatmap, TRX could attempt a move to $0.275 in the short term. A break above this level to push the altcoin to $0.3.

However, if the current trend holds, TRX will drop to $0.22.