‘Trump has positioned himself as the candidate that’s pro-Bitcoin:’ Exec

- BTC is facing a massive supply from Mt. Gox and German authorities, says Marathon CEO

- The executive viewed Trump as pro-Bitcoin but advocated a bi-partisan approach to crypto issues.

Former U.S., president Donald Trump continues to gain support from the crypto community. Inasmuch, Bitcoin [BTC] miner Marathon Digital CEO Fred Thiel has become the latest executive to back Trump.

In a recent interview with Yahoo Finance, Thiel said,

“Former president Trump has positioned himself as the candidate that’s pro-Bitcoin. He believes that all Bitcoin should be mined in the US and has been open to Bitcoin miners and people in the space’

On the contrary, Thiel noted that Biden’s administration has been very ‘hostile’ to Bitcoin through various agencies like the SEC.

55 million BTC voters at stake

However, Thiel added that Biden’s administration has been backing down from its hostility after realizing a large voting block was at stake. The executive said,

‘I’m sensing thawing of the cold from Biden’s administration as they realize there are 55 million voters in this country who care about crypto.’

The executive further urged both sides to embrace issues related to Bitcoin and crypto.

Several crypto figures have endorsed Trump. Last week, asset manager Ark Invest’s CEO, Cathie Wood, backed Trump as pro-business.

“I am a voter when it comes to economics. And on that basis, Trump’

When asked about current BTC price action after slipping below $60K, Thiel mentioned many factors impacting the largest digital asset.

From macro expectations to selling from German authorities, BTC miners, and Mt. Gox repayments, Thiel added,

“What we’re seeing right now is a lot of supply in the market and $1.2 billion outflows from the ETFs.’

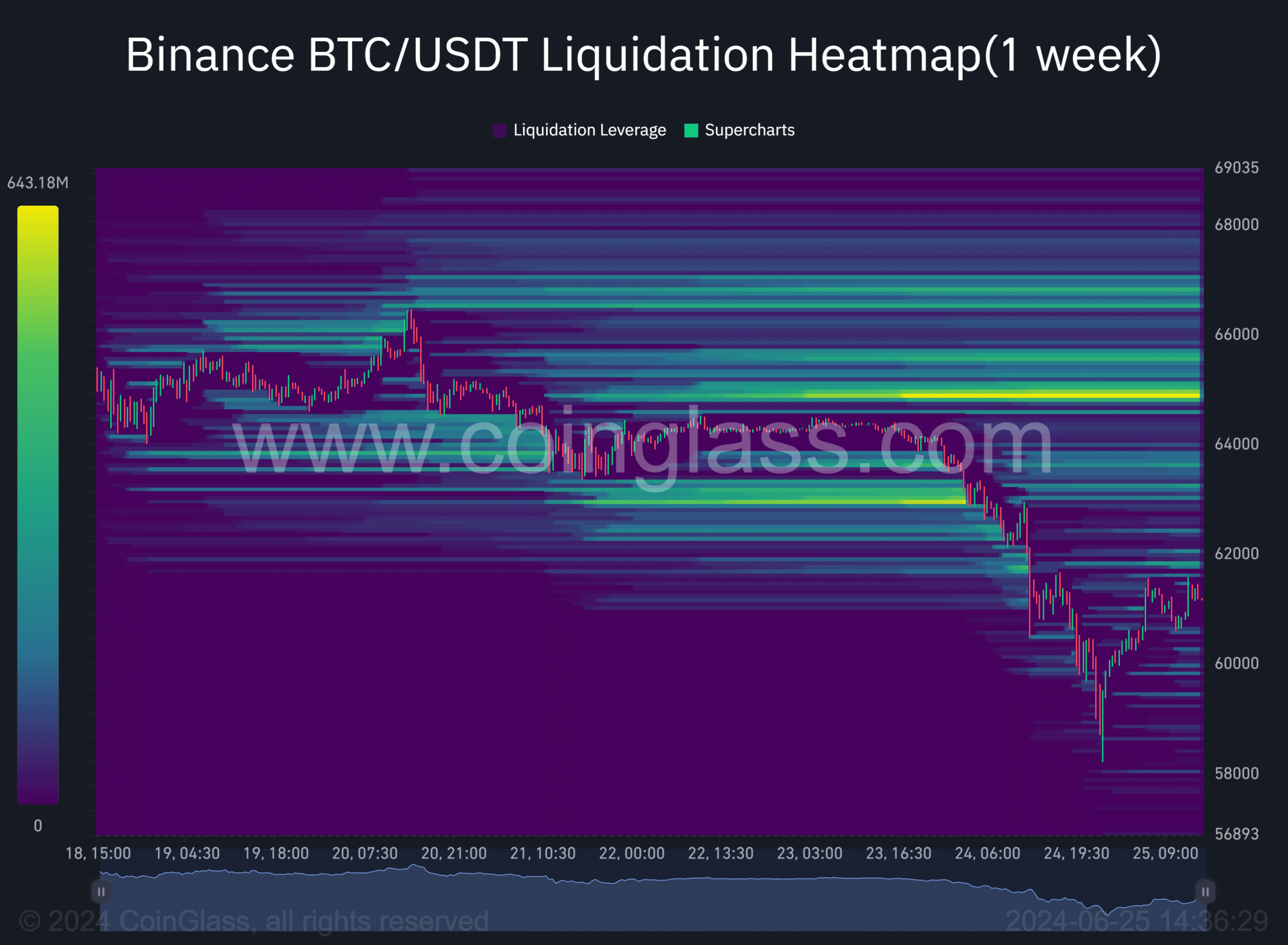

The executive mentioned $57K as a key support level and $68K and $69K as key hurdles for BTC to clear. During the Monday intraday trading session, BTC dropped to $58.4K before reclaiming $60K.

Despite the upcoming fears about Mt. Gox repayments, QCP Capital analysts suggested the update could have less impact based on option market data.

‘We see little activity in the July options market, suggesting the market is not anticipating volatility around the distribution itself’

Additionally, most market liquidity was on the upside on the weekly charts, especially at $64K, underscoring a move toward the cluster (orange) could be possible.