Trump’s ‘Liberation Day’ tariffs set to shake crypto – Is Bitcoin ready to bounce?

- Eric Trump’s endorsement amplified retail confidence as policy uncertainty fuels decentralized asset interest.

- Institutional accumulation and bullish technicals align, suggesting that BTC is primed for a breakout.

Donald Trump’s declaration of “Liberation Day” marks a pivotal shift in U.S. trade policy, sparking speculation across global markets and within the crypto industry alike.

These tariffs, positioned as a strategic move to renegotiate foreign trade dynamics, have introduced fresh uncertainty into the macroeconomic landscape.

However, rather than weakening crypto, some believe the move could boost demand for decentralized assets. Analysts suggest that potential market tightening might prompt central banks to ease monetary policy.

Therefore, Bitcoin [BTC] could benefit from reduced interest rates and renewed investor interest in non-sovereign stores of value. As global capital adjusts, the crypto market’s response will hinge on how swiftly policy shifts unfold.

Is Eric Trump’s Bitcoin endorsement driving momentum?

Eric Trump’s recent remarks have added fuel to the Bitcoin narrative. In a Fox Business interview, he stated,

“It’s cheaper, faster, more transparent, and it can’t be canceled… that’s why I love Bitcoin.”

His words reflect a growing distrust in traditional finance, especially as he cited de-banking and cancel culture as key motivators for his family’s crypto involvement.

Additionally, Eric highlighted the WLFI project and the USD1 stablecoin, expressing confidence in their contribution to stabilizing the U.S. dollar. His bold statement, “The best days of BTC are ahead,” spread rapidly across social media, strengthening bullish sentiment.

Therefore, public support from politically influential figures could be a powerful catalyst for retail investor enthusiasm. His comments, while personal, align with a broader narrative of institutional pushback against centralized systems.

BTC price action outlook – Is Bitcoin flashing bullish signs?

At press time, Bitcoin was trading at $84,606.67, registering a 0.75% gain in the past 24 hours. The recent rebound follows an earlier dip triggered by Trump’s tariff announcement.

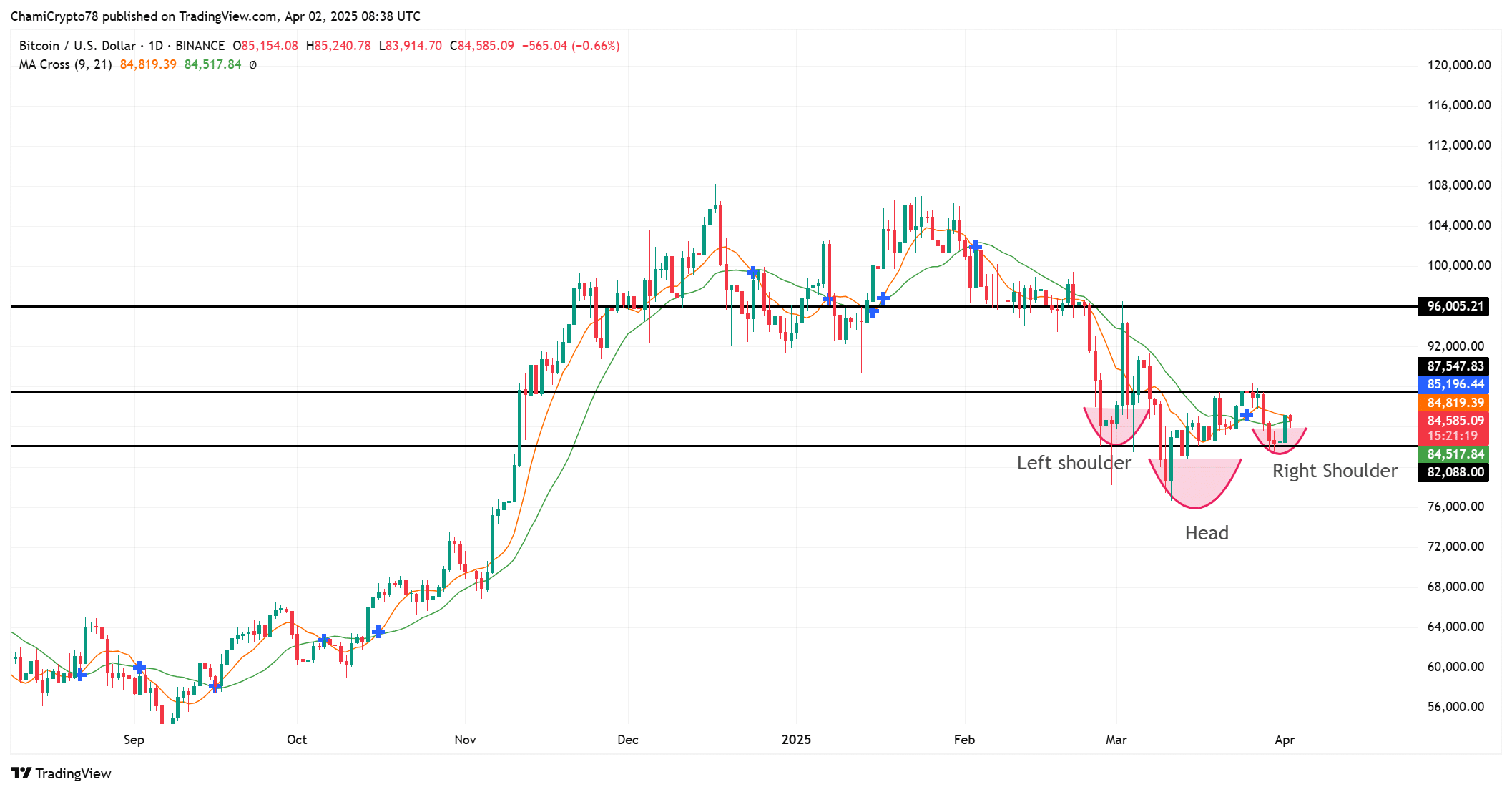

More notably, at the time of writing, the BTC chart reveals an inverse head and shoulders pattern, a bullish formation indicating a potential reversal. The neckline sits near $87,547, which acts as a key resistance zone. If bulls manage to break above that level, price action could surge toward the $96,005 mark.

Furthermore, the 9/21 Daily Moving Average crossover shows that buying momentum is strengthening. Therefore, technical indicators suggest that BTC might be preparing for a breakout. Traders are eyeing volume spikes for confirmation.

BTC whale activity – are institutions accumulating despite uncertainty?

Institutional demand for Bitcoin is showing steady growth. Metaplanet recently added 160 BTC worth $13.3 million to its portfolio, bringing its total holdings to 4,206 BTC. Similarly, GameStop raised $1.48 billion to allocate specifically toward Bitcoin for its treasury.

In another major development, Texas lawmakers proposed a bill advocating a $250 million BTC investment for state reserves, signaling increasing political support.

These actions highlight growing confidence in Bitcoin as a valuable store of wealth and a strategic asset. Despite market volatility, large entities are ramping up accumulation efforts, with whale activity driving long-term market trends.

Will Trump’s tariffs crash or fuel crypto?

While Trump’s “Liberation Day” tariffs initially caused volatility across crypto markets, the broader implications suggest a different outcome.

Current on-chain trends, institutional accumulation, and favorable technical indicators point toward resilience rather than decline. Moreover, growing political endorsements and macroeconomic shifts could position Bitcoin as a hedge against traditional market disruptions.