Tron [TRX] stalls at $0.15 – Are bullish signals emerging?

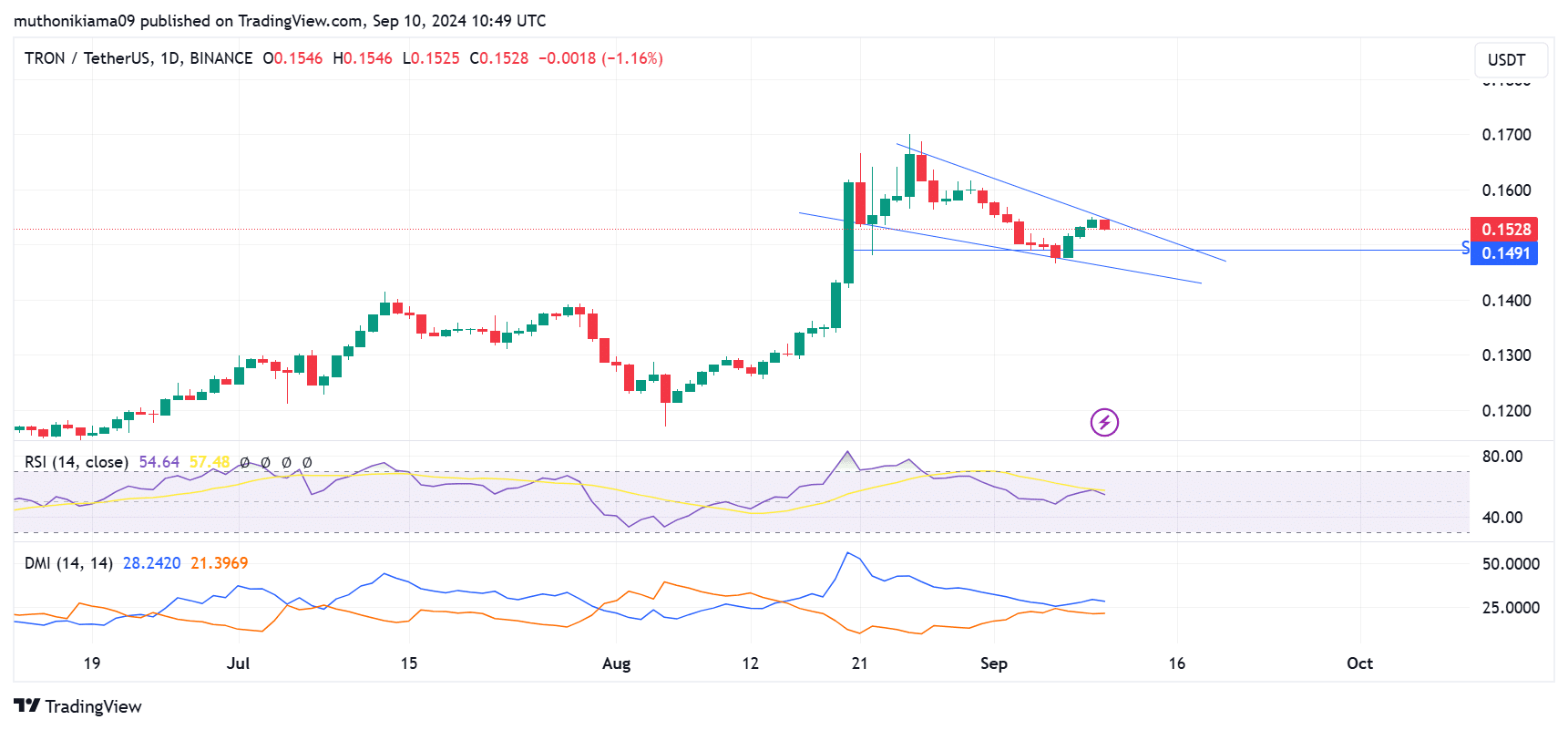

- TRX stagnated at $0.15 after attempting a breakout above the upper trendline of the falling wedge pattern.

- A breakout is possible if new buyers enter the market.

The broader crypto market rebounded on Tuesday, with Bitcoin [BTC] leading the rally with an over 3% gain to reclaim levels above $57,000. However, Tron [TRX] has failed to react to the positive market sentiment.

TRX was down slightly by around 1% in the last 24 hours. During this period, the altcoin’s price oscillated between $0.152 and $0.155.

Despite the underperformance, a bullish falling wedge pattern has emerged on the TRX daily chart.

TRX is currently attempting a breakout above the upper trendline. This attempt has coincided with a price consolidation, indicating that traders are waiting for a more decisive move before entering the market.

Buyer hesitance can also be seen in the Relative Strength Index (RSI). After converging with the signal line, the RSI line has failed to confirm an upward move, signaling that buyers are hesitant.

A crossover of the RSI line above the signal line will present a buying opportunity, which will support TRX’s breakout above the falling wedge pattern.

A bullish divergence has also emerged in the Directional Movement Indicator. The positive DI is currently above the negative DI, which suggests that while buyers remain hesitant, selling activity has eased.

If bulls step in and confirm a breakout, the next target for TRX will be $0.17. Conversely, if the upper trendline proves to be a strong resistance level and a breakout fails, TRX will likely drop to test support at $0.149.

On-chain data shows mixed signals

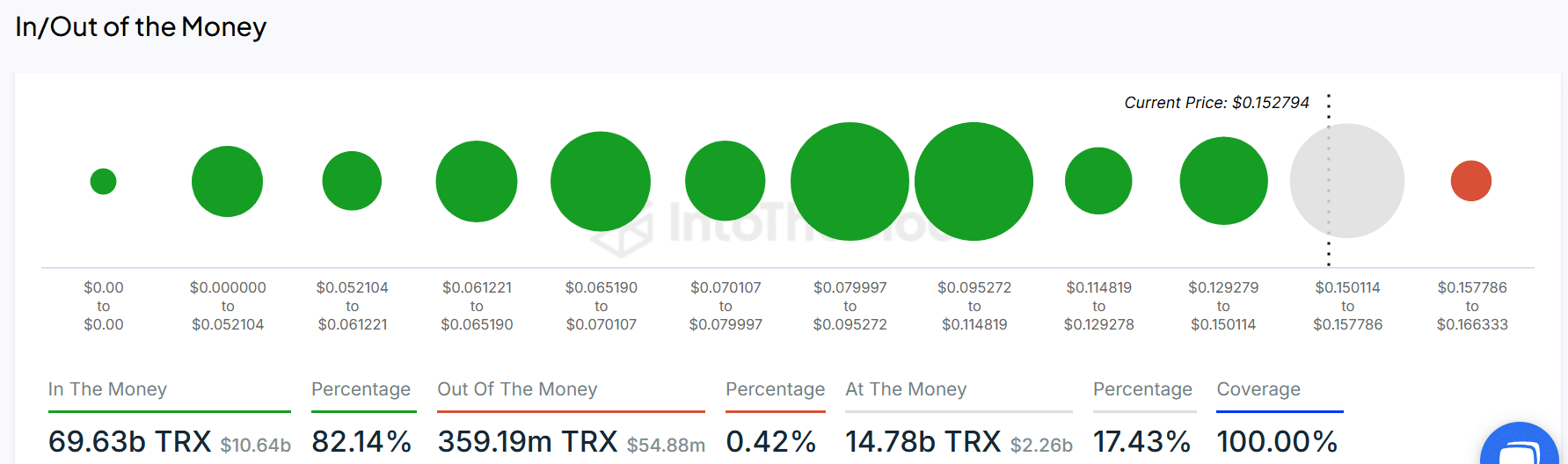

Data from IntoTheBlock showed that 96% of TRX holders were making money at press time prices, while only 2% were in losses.

This data showed that Tron does not face a high risk of profit-taking if it rebounds from its current price, as traders might choose to hold to maximize gains.

However, more than 5.4 million addresses are yet to become profitable. These wallets bought TRX between $0.15 and $0.16, and they can sell to mitigate losses if the uptrend fails.

If this scenario arises, TRX could continue to consolidate at $0.15 if new buyers fail to enter the market.

A further look at network activity proves a bearish thesis. Tron is the second-largest blockchain after Ethereum [ETH] by Total Value Locked (TVL).

However, its TVL has dropped from $8.7 billion to the current $7.9 billion within two weeks, according to DeFiLlama.

Read Tron’s [TRX] Price Prediction 2024–2025

A drop in TVL can have a negative effect on price, as it reflected reducing utility for TRX.

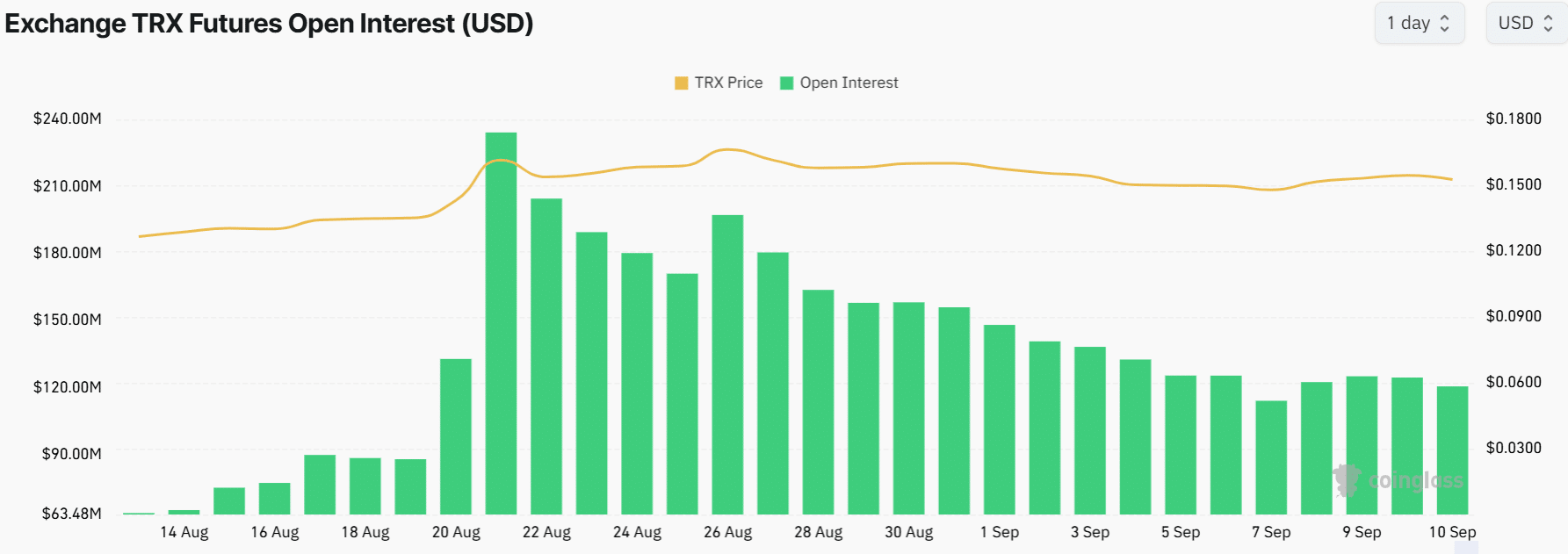

Open Interest also showed waning interest in TRX, as it dropped by nearly half to $120M after reaching a multi-month high above $234M in late August per Coinglass.