U.K’s crypto-users are growing in number, but do they even understand the asset class?

The United Kingdom’s approach to cryptocurrency regulations has been measured, but it has matured in the post-Brexit financial landscape. Even though the U.K didn’t ban the whole crypto-sector, there were still some hiccups on the way, however. Looking at how things currently stand, did the crypto-community in the U.K evolve? Here’s a recent study to highlight the same.

The country’s main regulatory body, the FCA, recently published an in-depth report to provide an overview of cryptocurrencies and their use in the U.K. The research note titled “Crypto asset consumer research 2021” incorporated various factors to account for the current market frenzy. As per this report, various attributes recorded an uptick whereas there were a few concerns as well.

Our new research finds an increase in ownership but a decline in understanding of #cryptoassets https://t.co/Tp9UijRAui

— Financial Conduct Authority (@TheFCA) June 17, 2021

Crypto-holdings

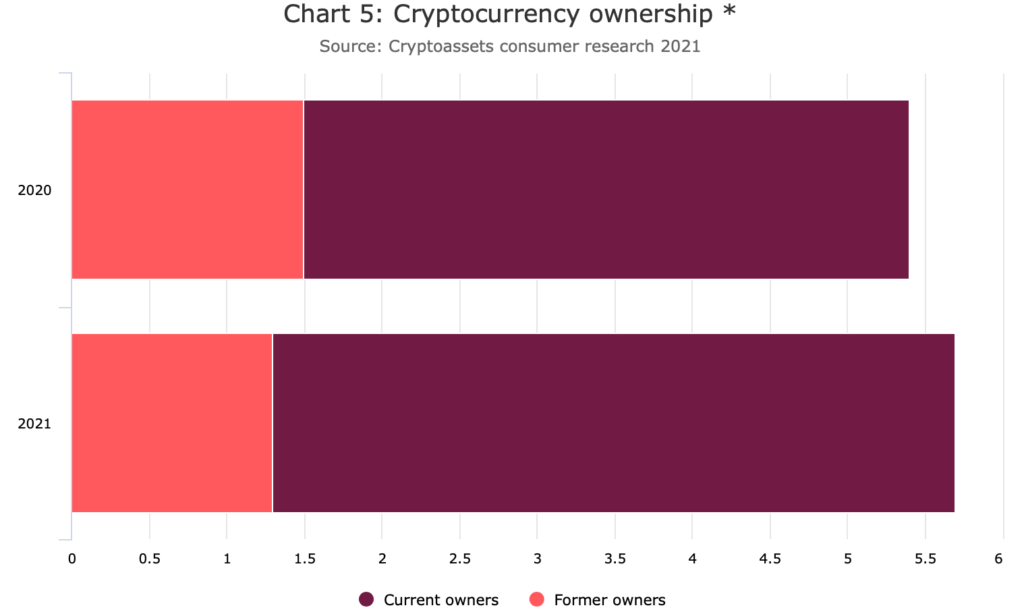

Talking about the former first, around 2.3 million adults in the U.K currently hold crypto-tokens in their portfolios, a significant hike from 1.9 million in 2020. The number of current owners too surged from about 3.9% to 4.4% of adults.

What’s more, the ownership volume findings too painted a similar picture. As per the study, the average median holdings rose to 300 British pounds ($420) from 260 pounds ($370) in 2020. Out of these holdings, Bitcoin had a majority share, with 82% of the respondents recognizing BTC, compared to 78% last year.

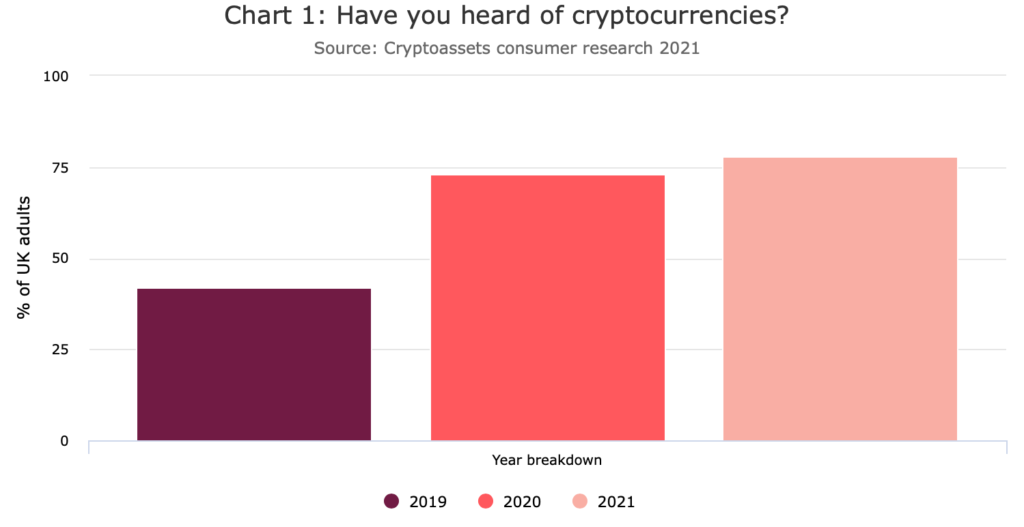

Public awareness

With respect to the latest boom in crypto-developments in the U.K, it’s natural to witness the roaring demand in the crypto-space. This parameter, likewise, noted a surge as 78% of adults were up to date, a significant incline from 2019 and 2020.

Quite the contrary now.

However, roaring awareness doesn’t always equate to understanding the underlying asset. Such is the case here.

“Only 71% of those who had heard of crypto correctly identified its definition from a list of statements. This was a statistically significant decline of 4% from 2020.”

According to the FCA,

“This suggests there may be a risk of consumers engaging with cryptocurrency without a clear understanding of it.”

Can this be one of the reasons?

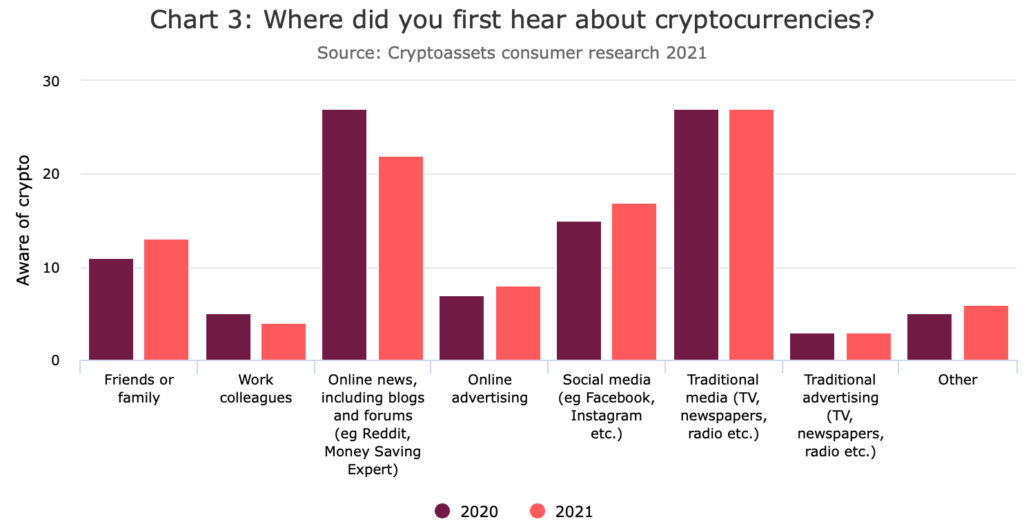

Looking further, traditional media (TV, newspapers, radio, etc) are still the most common source (27%) for the U.K residents to take the first step in this domain. Does this imply that many still rely on the different broadcasts to directly jump onto the crypto-frenzy bandwagon instead of understanding its core? Well, certainly the data points in the said direction.

Here’s what Sheldon Mills, the FCA’s Executive Director of Consumers and Competition, said in a recent discussion regarding the same.

“It is important for customers to understand that, because these products are largely unregulated, if something goes wrong they are unlikely to have access to the FSCS (Financial Services Compensation Scheme) or the Financial Ombudsman Service.”