Understanding Polygon’s midway stagnation as Optimism and Arbitrum…

- Polygon’s ecosystem grew, but its TVL could not compete with other L2 solutions.

- MATIC showed bearish signs despite rising prices.

Even though Polygon [MATIC] has been seeing growth in the DeFi space, other L2 solutions such as Arbitrum and Optimism [OP] have out-competed it in terms of TVL. However, this could change with the increasing activity of dApps on Polygon.

Is your portfolio green? Check out the MATIC Profit Calculator

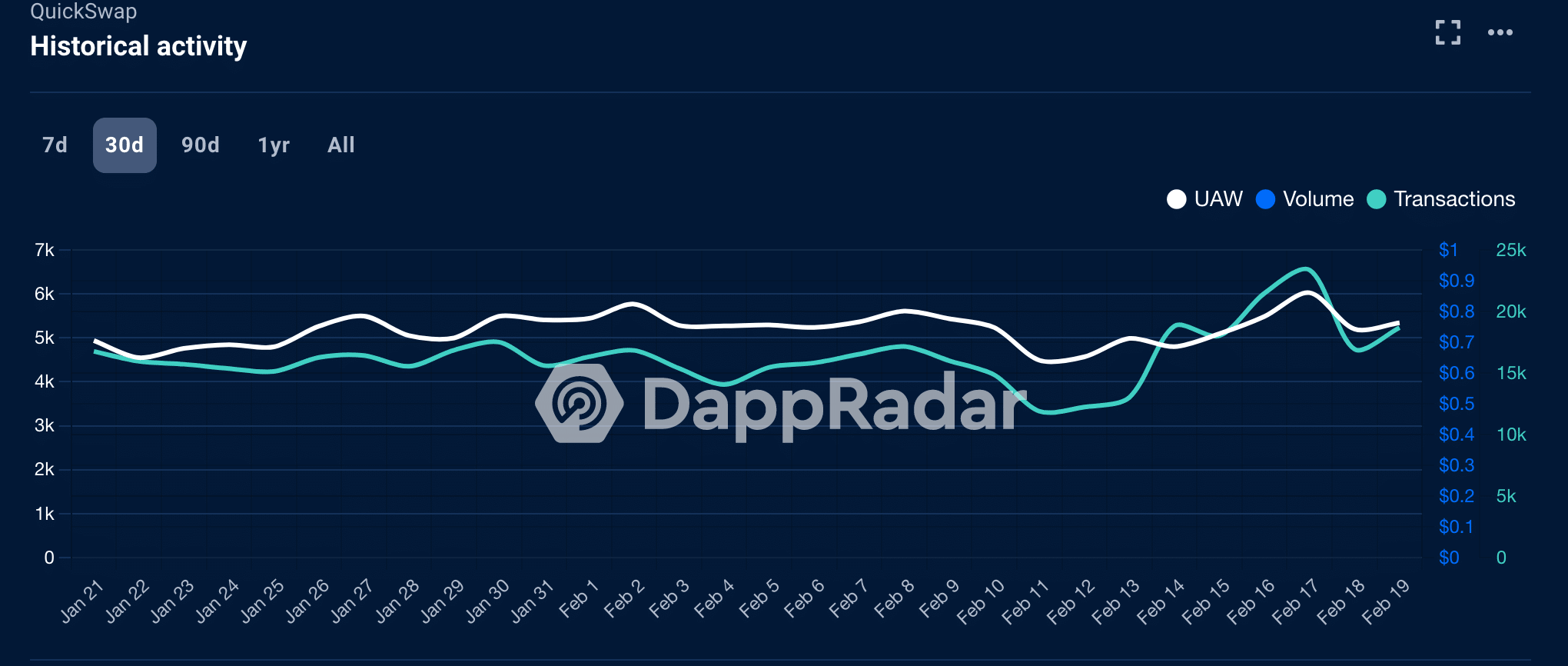

One such well-performing dApp has been QuickSwap. Notably, according to data released on 19 February, it was observed that QuickSwap could generate massive amounts of fees for multiple protocols.

Another dApp that showed progress was Planet IX, a play-to-earn dApp that witnessed a 22.07% surge in the number of unique active wallets on the protocol. Along with that, the number of transactions made on the platform also increased during this period.

The progress of these dApps helped improve the current state of Polygon’s ecosystem. Another development that aided Polygon would be the deployment of Compound v3 on the Polygon Mainnet.

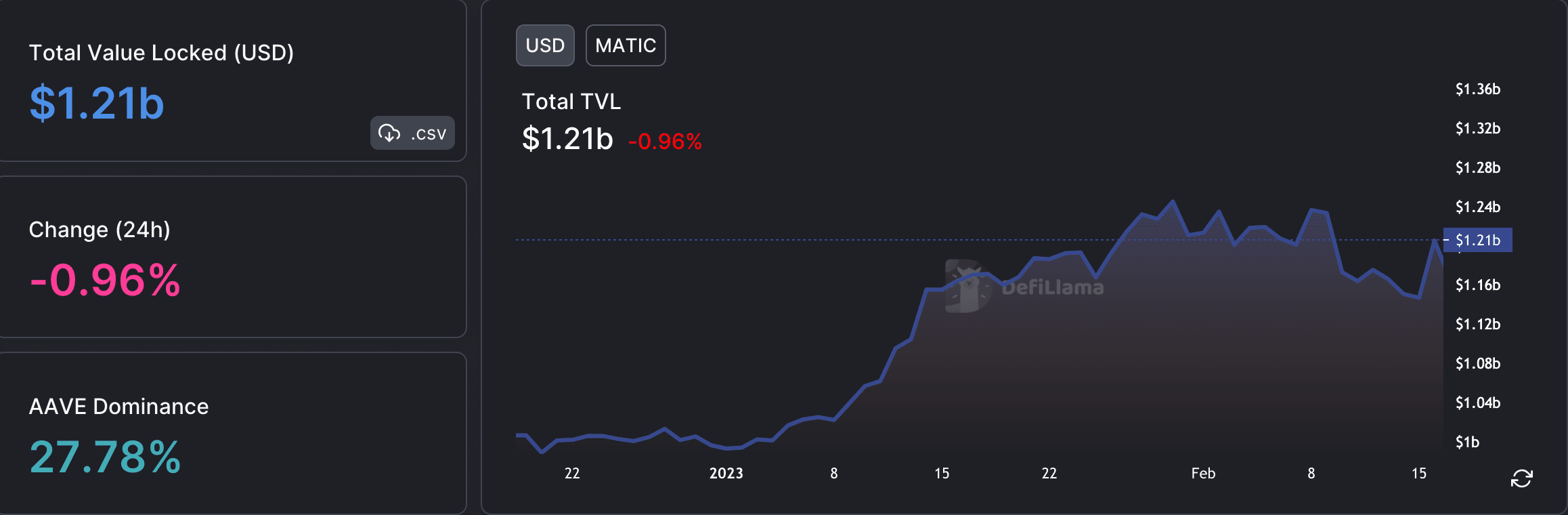

These developments impacted Polygon’s TVL, which increased materially over the last month. According to DeFI Lama, Polygon’s TVL increased from $1.01 billion to $1.21 billion. Despite this spike, Polygon was still far away from the likes of Arbitrum and Optimism, which boasted of TVLs of $3.26 billion and $1.88 billion, respectively.

Not only has Polygon not been able to perform as well as its competitors in the DeFi space, its token activity has also taken a hit.

Bears come for MATIC?

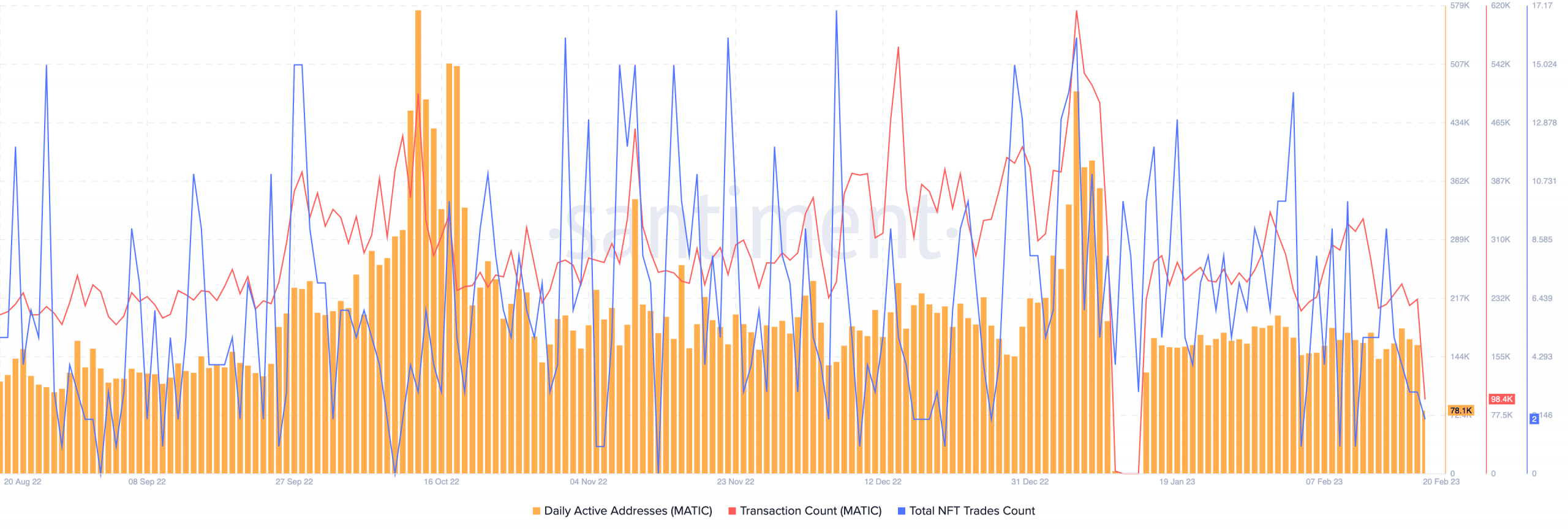

According to Santiment’s data, the daily active addresses transferring MATIC have declined. As a result, the number of MATIC transfers also fell. This was suggested by the declining transfer count of MATIC.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

Polygon wasn’t able to drive the attention of its NFTs in February 2023 as well as its overall NFT trade count declined immensely over the past few weeks, as per Santiment.

Despite Polygon’s improvements in its ecosystem, it still may have a long way to go before it could catch up to its competitors in the L2 space.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)