UNI: Here’s what could really save Uniswap

Cryptocurrencies, Decentralised Finance (DeFi), and other similar opportunities that web3 presents are helping the likes of Uniswap to strengthen its dominance in the community. While some investors have been lamenting their losses, others are content to look at UNI’s metrics.

Uniswap did not fail to not disappoint

Uniswap, like the rest of the market, noted a 9.21% dip on 11 April. Thus, losing 24.83% in a week. The coin is now only 9% away from invalidating all of March’s 44.83% gains. This will leave UNI back at $8.42.

Uniswap price action | Source: TradingView – AMBCrypto

While price indicators have been giving a bearish signal, Uniswap’s ecosystem developments are somewhat on the bullish side. UNI noted a 5% hike in prices after Uniswap announced the launch of the Uniswap Labs Ventures.

The venture fund will be investing in projects at different stages of development with a focus on infrastructure to developer tools and consumer-facing applications. As stated in the launch, Uniswap Labs Ventures has already invested in 11 companies and in the future it intends to participate in the governance systems of MakerDAO, Aave, Compound, and Ethereum Name Service protocols.

4/ And in keeping with our ethos of decentralization and community engagement, ULV will be participating in the governance of portfolio protocols.

To start, these protocols include @AaveAave, @compoundfinance, @MakerDao, and @Ensdomains ?

— Uniswap Labs ? (@Uniswap) April 11, 2022

The growth of web3 this year has been exceptional. Consider this- FTX launched its venture fund, Bain Capital. It also established a $650 million crypto fund. On the other hand, fintech platform Cake DeFi launched a $100 million investment fund. All this goes to state that Web3 is rapidly developing.

Notably, in the case of Uniswap, the fund will play a major role in increasing investors’ profits.

At the moment, of the 287.86k addresses holding UNI on-chain, only 22.79% of them are observing profits in the market. The rest 77% have been struggling to see profits for more than three months now and it isn’t clear if that will change soon.

Uniswap investors in loss | Source: Intotheblock – AMBCrypto

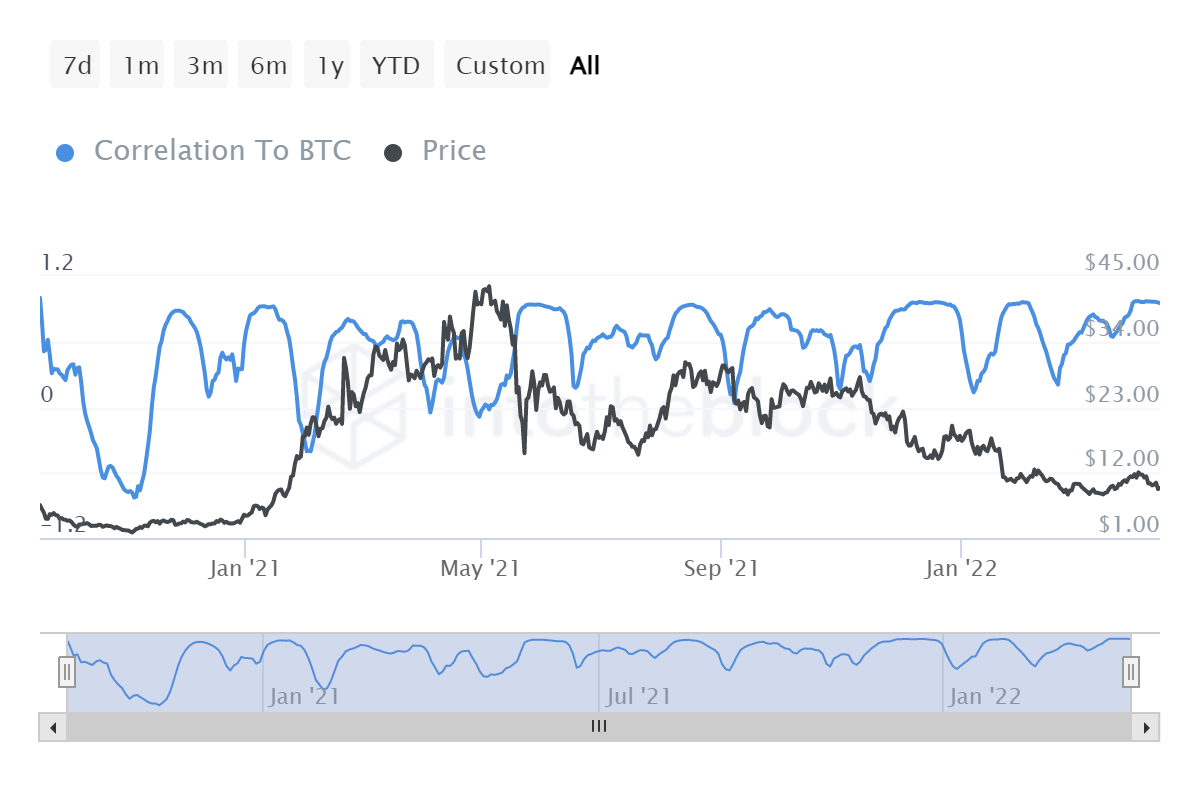

The altcoin does have the support of the king coin thanks to its high (0.95) correlation with Bitcoin. Although BTC itself is struggling at around $40k at the moment, the resurgence of demand will see BTC aim towards its critical resistance at $44k. This will in turn save UNI from falling through its $8.4 support.

Uniswap’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto