UNI is ripe for buying opportunities after a bullish crossover, but…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- UNI could reach the 50% Fib level in the next few days or weeks if BTC maintains its uptrend

- UNI’s open interest is rising, which is a bullish outlook for derivatives markets

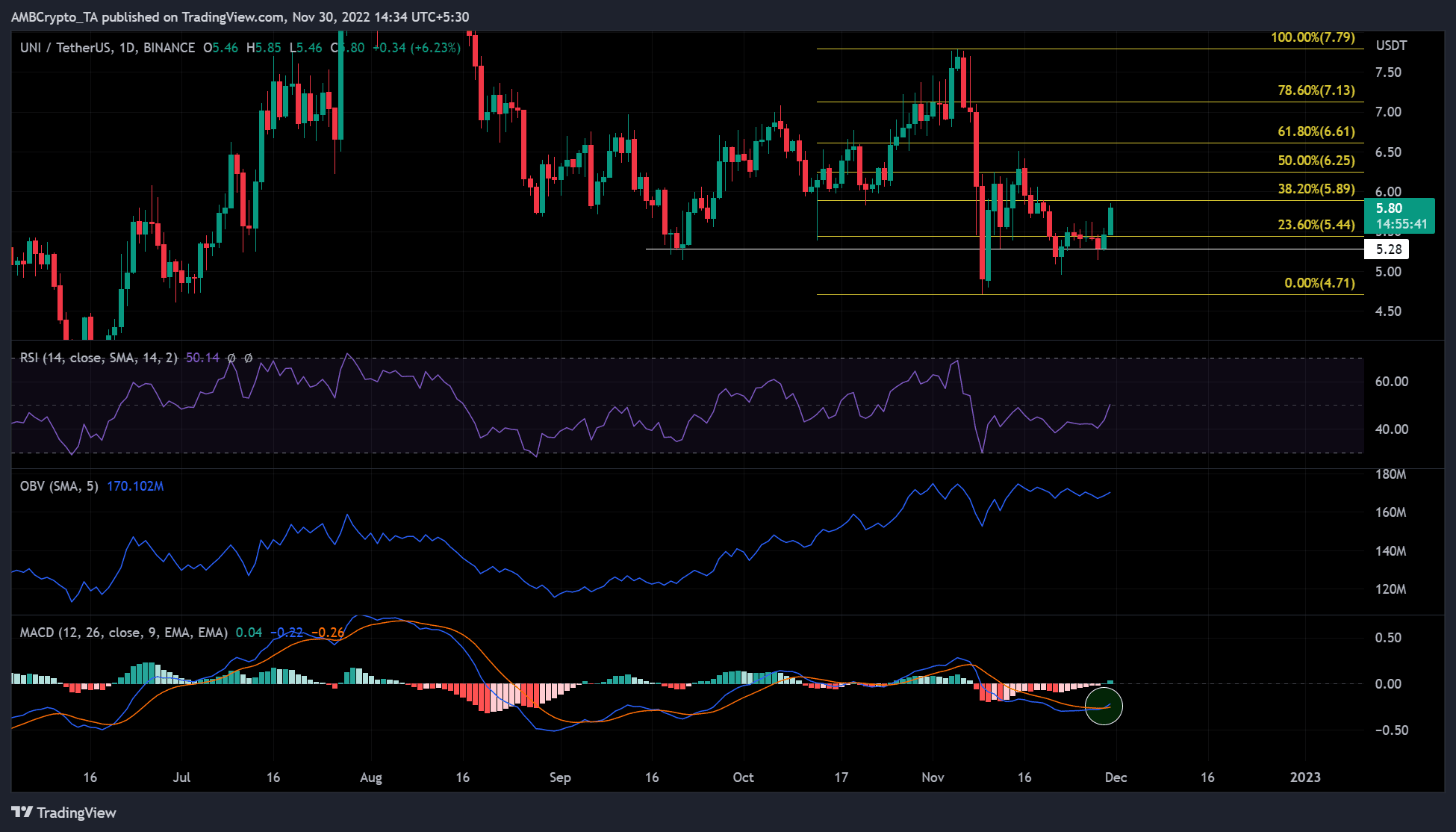

Like the rest of the altcoins, Uniswap [UNI] also rallied after BTC regained the $16,000 level on 22 November. At press time, it was trading at $5.80 and was in an uptrend. The Moving Average Convergence Divergence (MACD) also gave investors a buy signal through its bullish crossover.

However, the price rally faced significant resistance, which cautious traders should watch out for before going long on UNI.

Read Uniswap’s [UNI] price prediction 2023-2024

We have a buy signal, but can the uptrend last?

In October, UNI witnessed a major rally that extended into November before the FTX saga put the brakes on it. Subsequent recovery attempts after the market crash established $5.28 as solid support for the bulls.

At press time, UNI was poised for another rally after BTC attempted to reclaim $17K. A bullish MACD crossover provided buying opportunities for UNI traders. However, the question was: Is the buy signal solid and could the uptrend continue?

A key technical indicator showed that the uptrend could sustain momentum. The Relative Strength Index (RSI) retreated from the lower part of the selling range with a steep rise. This showed that the selling pressure had eased, and the bulls were able to prop up UNI’s price.

The On-Balance Volume (OBV) also showed a rise in the upper range despite an almost flat profile since 21 November. This showed that there was a significant trading volume that could increase buying pressure.

If the bulls maintain the above leverage, they could break the 38.2% level ($5.89) and target the 50% Fib level ($6.25). However, an intraday close below the current support at $5.28 could negate the above inclination.

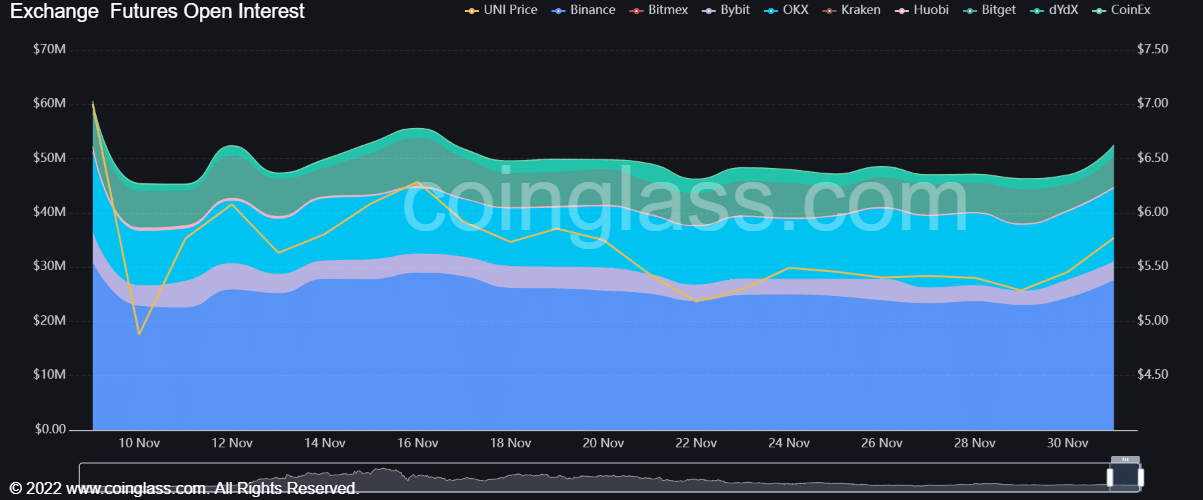

UNI sees an increasing Open Interest

According to Coinglass, UNI saw conflicting open interest trends in November. After the market crashed in early November, UNI’s open interest rose steadily, only to drop again starting in mid-November.

At press time, a rising open interest could be seen towards the end of November. This showed that money was flowing into the derivatives market of UNI.

Furthermore, this also indicated a bullish outlook in the derivatives market, which could soon spill over into the spot market. In this case, the upward momentum of UNI could continue if BTC continues to trend upward.