UNI traders must keep an eye on these key buy entry zones

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

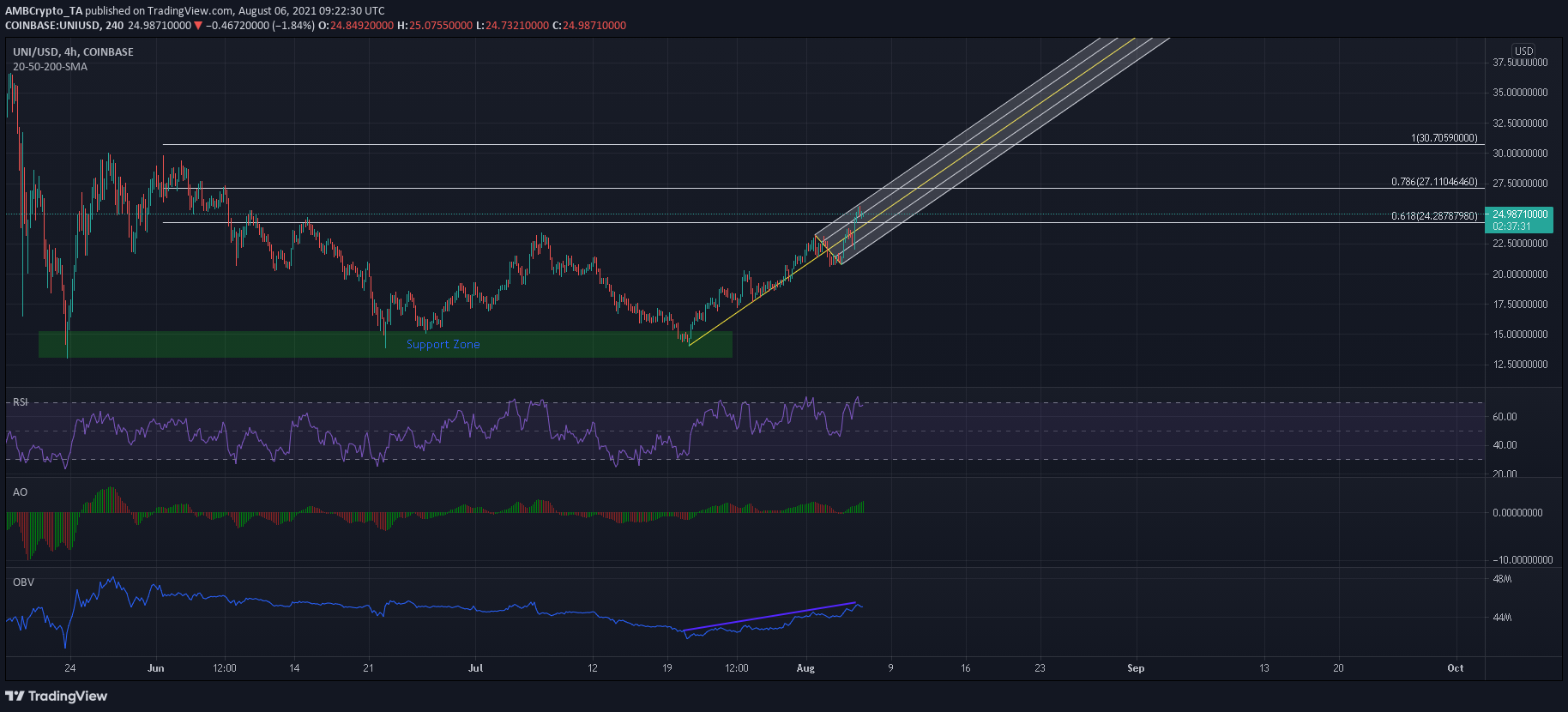

Uniswap’s break above $23.4 was an important development for the market. This created a higher high for the digital asset at $25.6 and marked a bullish beginning. Moreover, at press time, certain signs seemed to suggest that its uptrend is yet to exhaust itself.

At the time of writing, UNI was being traded at $25.1, up by 7.57% over the last 24 hours.

Uniswap 4-hour chart

Source: UNI/USD, TradingView

UNI’s latest rally, which emerged from its 24 June low of $14, pointed to an 88% jump in value in a little over two weeks. A close above $23.4 indicated a newer high and presented chances of an extended rally over the coming sessions. The Pitchfork tool showed that UNI met with some resistance at the upper trendline, one which also coincided with the daily 200-SMA (not shown).

In case of a dip, the altcoin can find support around the median line and the 61.8% Fibonacci Extension of its 22 June swing low. Target levels will lay at the 78.6% ($27.1) and 100% ($30.7) Extension levels when the next leg forward is initiated.

Reasoning

The Relative Strength Index has held a position above 50 since 21 July as bulls were in control of near and mid-term prices. A reading of over 60, at press time, suggested that buyers are still dominating proceedings.

The Awesome Oscillator was at its highest level in two months and continued to note a rise in upwards pressure. The same was backed by the OBV which formed higher peaks.

Conclusion

The 78.6% ($27.1) and 100% ($30.7) Fibonacci Extension levels were in the crosshairs as UNI prepared for its next upswing. Before making such a move, the price can find a resting ground at the 61.8% Fib level ($24.28) – An area that can be longed by traders.