UNI traders willing to make major market moves may want to read this first

- Uniswap’s social dominance registered an increase over the past week

- However, market indicators and metrics revealed that UNI’s price might do down further

The entire crypto market’s price action over the last few days didn’t exactly align with investors’ interest. Most cryptocurrencies didn’t manage to register an uptick, and Uniswap [UNI] wasn’t any different.

Despite its underperformance, LunarCrush revealed that UNI remained a hot topic in the crypto space as its social dominance went up this week. Thus, reflecting its high popularity.

Uniswap social dominance is up +443.6% to 4.28% this week! ?

See all $UNI insights + more with a level 5 account.

? https://t.co/6ouSuI49Zc pic.twitter.com/PV5exUu8JT— LunarCrush (@LunarCrush) December 24, 2022

Are your UNI holdings flashing green? Check the Profit Calculator

A long winter behind and ahead

At the time of writing, UNI’s price decreased by more than 3% over the last week and was trading at $5.18 with a market capitalization of over $3.95 billion. Though UNI remained popular, market indicators revealed that investors should be cautious as things might get worse in the coming days.

UNI’s Relative Strength Index (RSI) registered a decline and was resting way below the neutral mark, which was a bearish signal. Furthermore, UNI’s On Balance Volume (OBV) also followed the same path, further increasing the chances of a continued price decline.

The Exponential Moving Average (EMA) Ribbon also looked bearish. This was was further augmented by the Bollinger Band’s data as it revealed that UNI’s price was entering a high volatility zone.

Read Uniswap’s [UNI] Price Prediction 2023-24

Are the metrics supportive?

Despite the poor performance, UNI managed to be popular among the whales, as it became one of the most used smart contracts among the top 500 Ethereum whales on 23 December.

JUST IN: $UNI @Uniswap one of the MOST USED smart contracts among top 500 #ETH whales in the last 24hrs?

We've also got $BONE, $SHIB, $BAL, $LINK & $AURA on the list ?

Whale leaderboard: https://t.co/tgYTpOm5ws#UNI #whalestats #babywhale #BBW pic.twitter.com/OclWOAhjVu

— WhaleStats (tracking crypto whales) (@WhaleStats) December 23, 2022

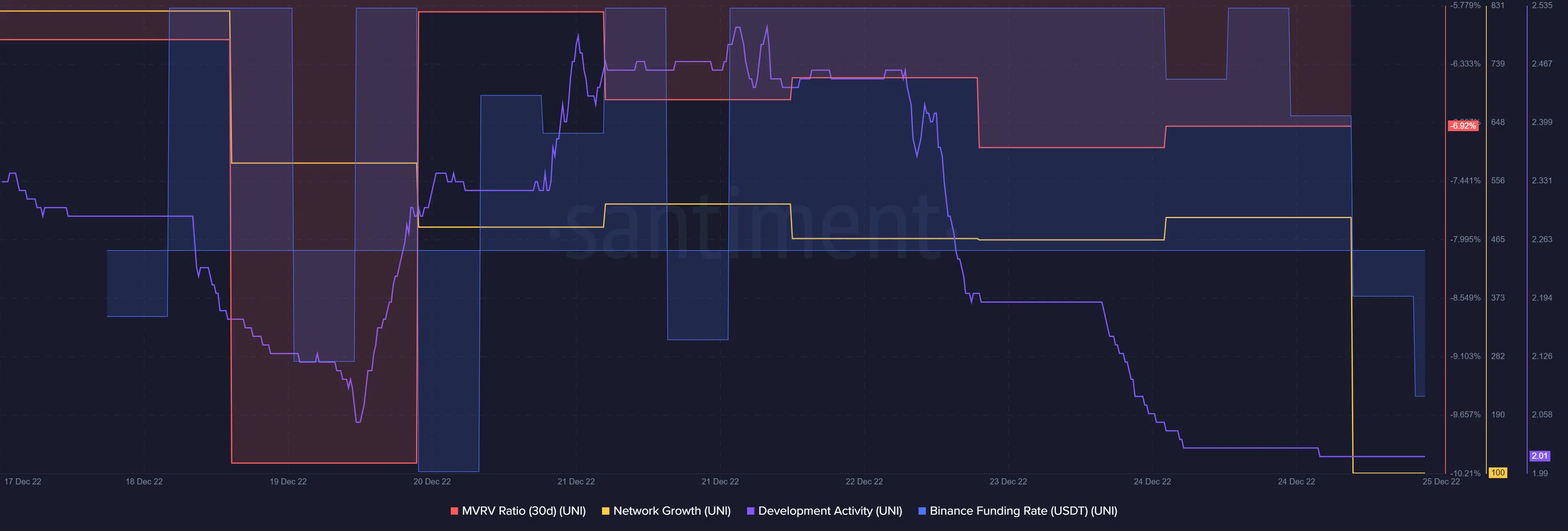

Incidentally, a few of the on-chain metrics were also unsupportive of a price surge. This could be a matter of concern for investors. For instance, UNI’s development activity went down, which by and large is a negative signal.

UNI’s network growth also decreased over the last week, along with a slight decrease in Binance funding rate. This suggested that UNI’s price might go down further. Nonetheless, the Market Value to Realized Value (MVRV) Ratio went up, giving hope to the investors.