UNI’s price sees +15% uptick after Uniswap’s new proposal beckons vote

- Despite regulatory concerns, Uniswap has continued to make changes to its governance mechanisms

- UNI’s price appreciation over the last 24 hours was pretty significant too

Uniswap [UNI] has established itself as a leader in the Decentralized Exchanges (DEXs) sector based on activity and other metrics. However, recent regulatory scrutiny did cause some problems for the protocol as a Wells Notice was sent to Uniswap’s team.

Uniswap responds

Uniswap responded to the Wells Notice swiftly. Marvin Ammori, Chief Legal Officer at Uniswap Labs, tweeted that the project is in full compliance with U.S law. In fact, he also accused the SEC of targeting assets and people beyond its authority.

Ammori highlighted that approximately 75% of Uniswap’s usage and nearly 90% of the trading volume on the DEX occurs outside the U.S. Hence, it falls outside the SEC’s jurisdiction, he argued. The exec also stated that Uniswap has already presented its views on the SEC’s allegations and is prepared to litigate, if necessary.

Despite these problems being faced by the protocol, however, Uniswap governance continues to see new and major developments.

Governance remains unfazed

According to a recent governance proposal, on 31 May, UNI token holders will cast their votes on a proposal that would establish a system for autonomous fee collection and distribution. This system would automatically collect fees generated by trades on Uniswap V3 pools and distribute them proportionally among UNI holders who stake and delegate their tokens.

While this initial vote won’t activate fees immediately, it lays the critical groundwork for future votes that will determine the specifics of fee implementation in Uniswap V3. To participate in this crucial vote, UNI holders must delegate their tokens before the 31 May deadline. This delegation process allows them to either vote directly or entrust their voting rights to a third-party delegate. Platforms like Agora and Tally facilitate this delegation process.

Looking beyond the initial vote, the proposal also outlines a plan to streamline future fee-related votes. This plan aims to make the process of adjusting fees faster and more efficient, ultimately reducing the burden on Uniswap’s governance participants. Additionally, this future-oriented approach seeks to maintain the protocol’s neutrality, a core principle for decentralized exchanges.

More details on this proposed mechanism for streamlined fee adjustments will be available soon in a dedicated forum post, providing further clarity for UNI token holders and the wider Uniswap community.

If passed, this proposal could significantly boost Uniswap’s tokenomics by incentivizing UNI holding, while also streamlining governance for smoother future fee adjustments.

Is your portfolio green? Check out the UNI Profit Calculator

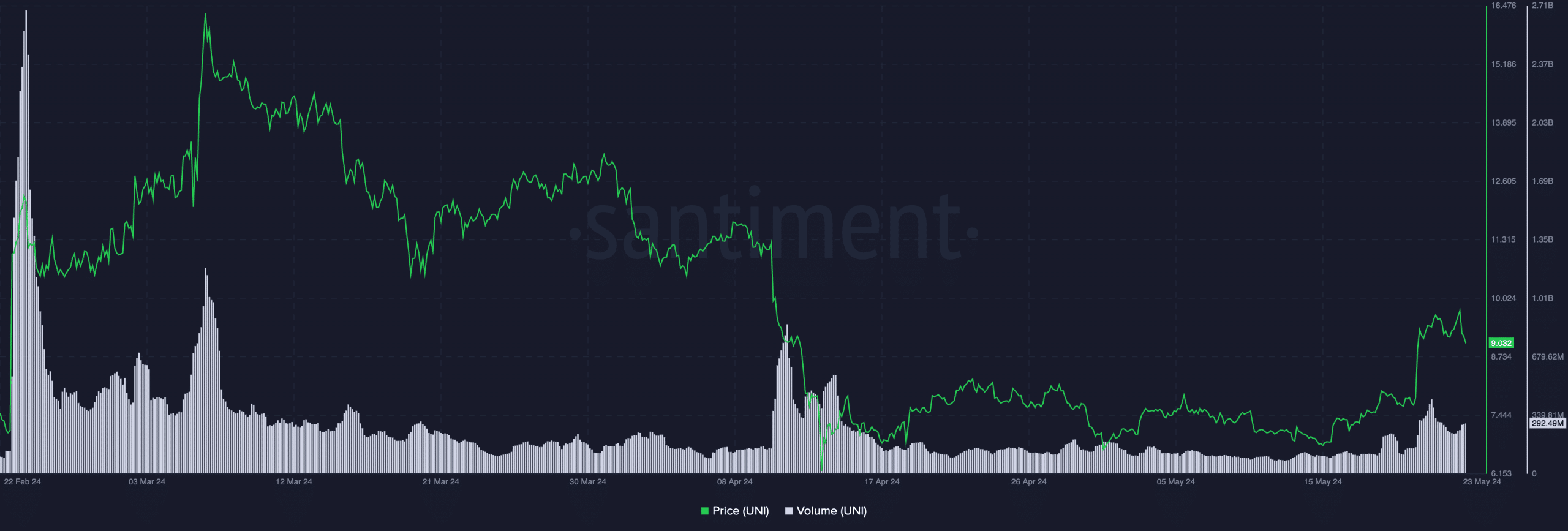

Here, it’s worth noting that UNI’s price responded extremely positively to these developments. At press time, UNI was trading at $10.86 following a massive 19.78% uptick in value