Analysis

Uniswap faces price rejection: Here’s where to look for buying opportunities

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

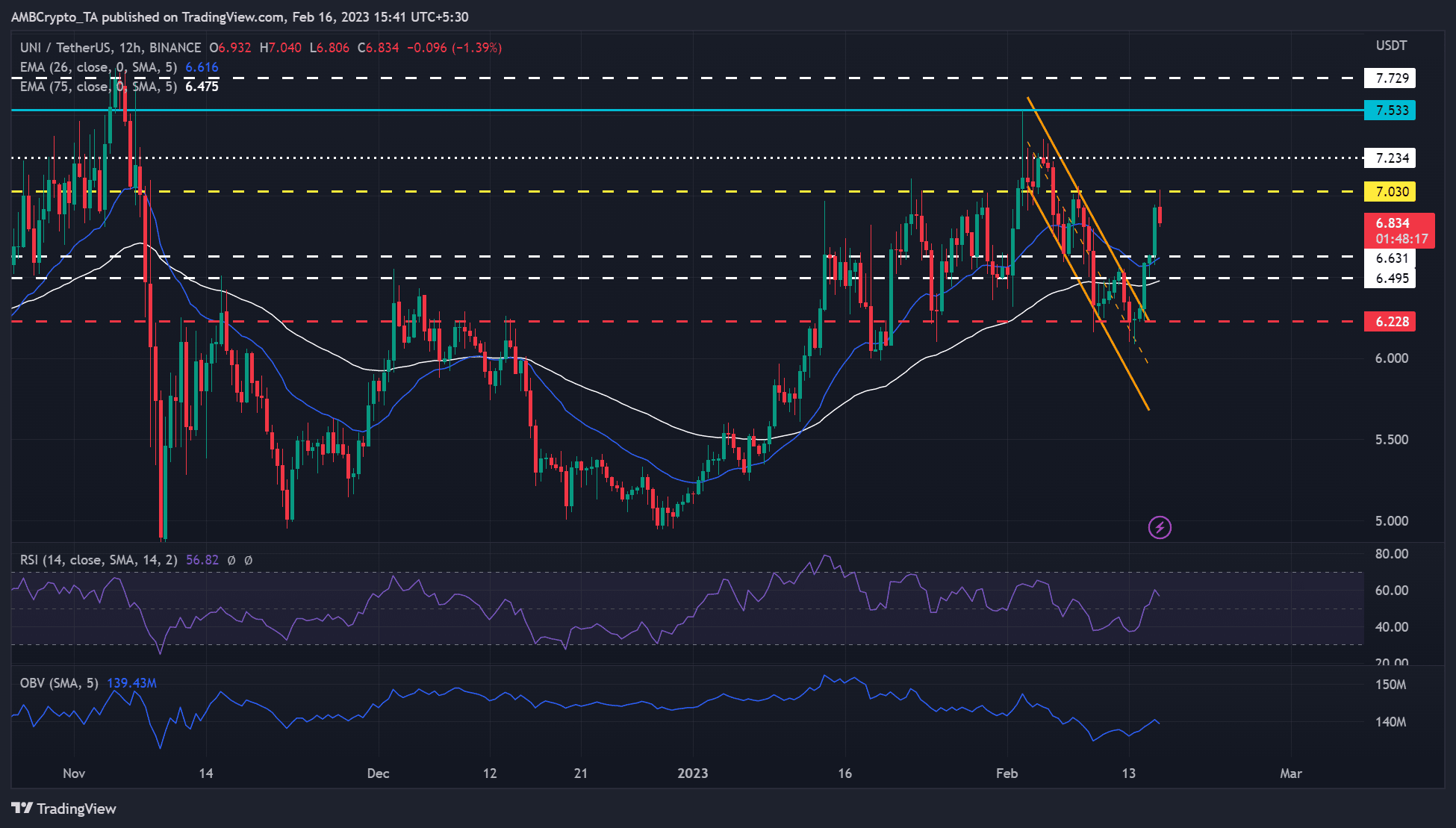

- UNI broke above its descending channel but faced rejection by press time.

- Sentiment has remained eerily negative for the past two months.

Uniswap’s [UNI] recovery could be at stake after facing a price rejection at press time. UNI recently plunged by 19%, dropping from $7.533 to $6.103. But bulls found steady ground at $6.228 only to face rejection at $7.030 at the time of writing.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Will the rejection offer bears more leverage?

UNI’s recent price correction formed a descending channel pattern to denote the selling pressure UNI weathered in the last few days. The steady ground at $6.228 allowed the bulls to post a 12% rally, but the gains could be cleared if BTC doesn’t surge past $24.95K.

The bears could push UNI to the $6.495 – $6.631 zone. This zone could offer new buying opportunities. A further drop to $6.228 could offer an even better-discounted bargain for the token. But the extended fall could be checked by the 75-period EMA of $6.475.

How much are 1,10,100 UNIs worth today?

However, a break above the price rejection level of 7.030 would tip bulls to aim at the November level of $7.73. But bulls must clear the obstacles at $7.234 and $7.533 to target UNI’s November high.

The RSI recorded a sharp rise, while OBV exhibited a gentle increment, indicating significant buying pressure and demand to boost the recent uptrend.

Bulls could gain more leverage if the trend continues. But a slowed momentum, as witnessed at the time of wiring, will tip the scale in favor of the bears.

UNI’s sentiment remained negative despite the recent rally

UNI showed a bearish sentiment from investors despite the rally in January. Notably, the weighted sentiment has remained relatively negative since November. It also saw fluctuating demand, as seen by the Funding Rate at the end of last year but stabilized in January.

Similarly, the development activity declined in the same period but made a new low at the time of press. The decline in development activity could have affected investors’ outlook on the token. However, the Funding Rate and demand for UNI remained positive at press time.

It means the recovery could continue hence the need to gauge BTC price action. If BTC swings above $24.95K, UNI bulls could overcome the price rejection level. However, a drop below $24.45K could tip bears to push down UNI’s value.