Uniswap hits 4-month high but profit-taking stalls rally – What now?

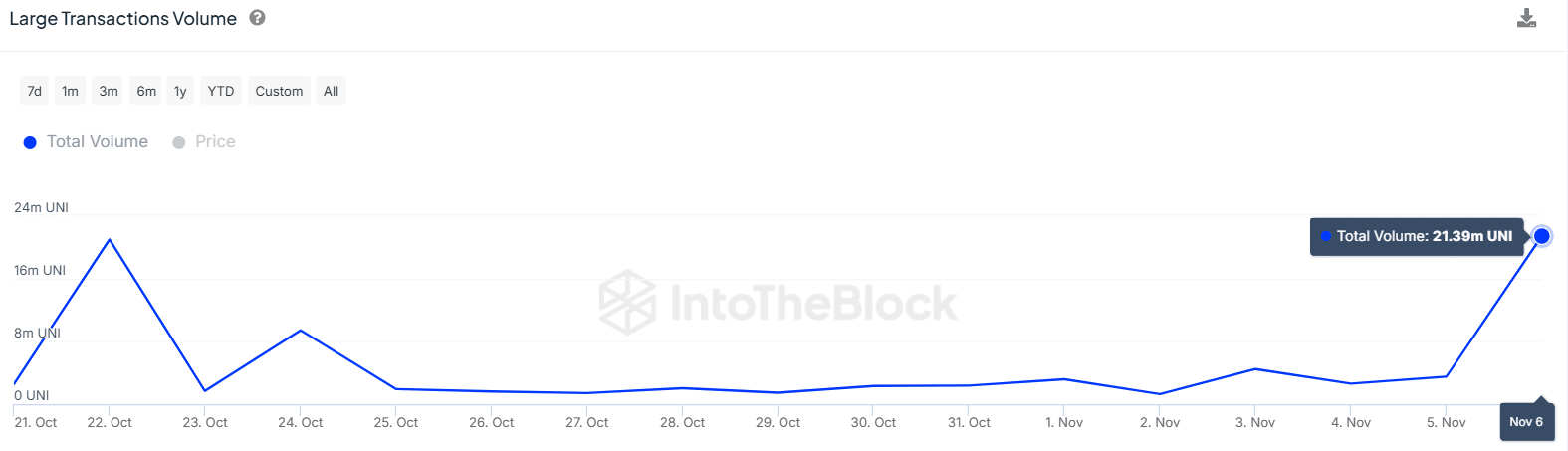

- Uniswap whale activity surged as large transaction volumes increased from 3.05M to 21.39M.

- UNI’s rally to a 4-month high stalled after more than 9M UNI were deposited to exchanges, increasing the selling pressure.

Uniswap [UNI] has seen a massive spike in volatility in the last 24 hours as the price oscillated between $8.83 to $9.63. The volatility came amid a rise in whale activity.

Data from IntoTheBlock showed that in 24 hours, large transaction volumes surpassing $100,000 increased from 3.05 million to 21.39 million. This represented an over 500% increase.

If these large traders were buying, it most likely drove the recent surge. For the uninitiated, whales account for 51% of UNI’s circulating supply, while retail accounts for only 16%.

Therefore, when whale transactions increase, it is bound to have an impact on volatility.

Is Uniswap primed for a 30% rally?

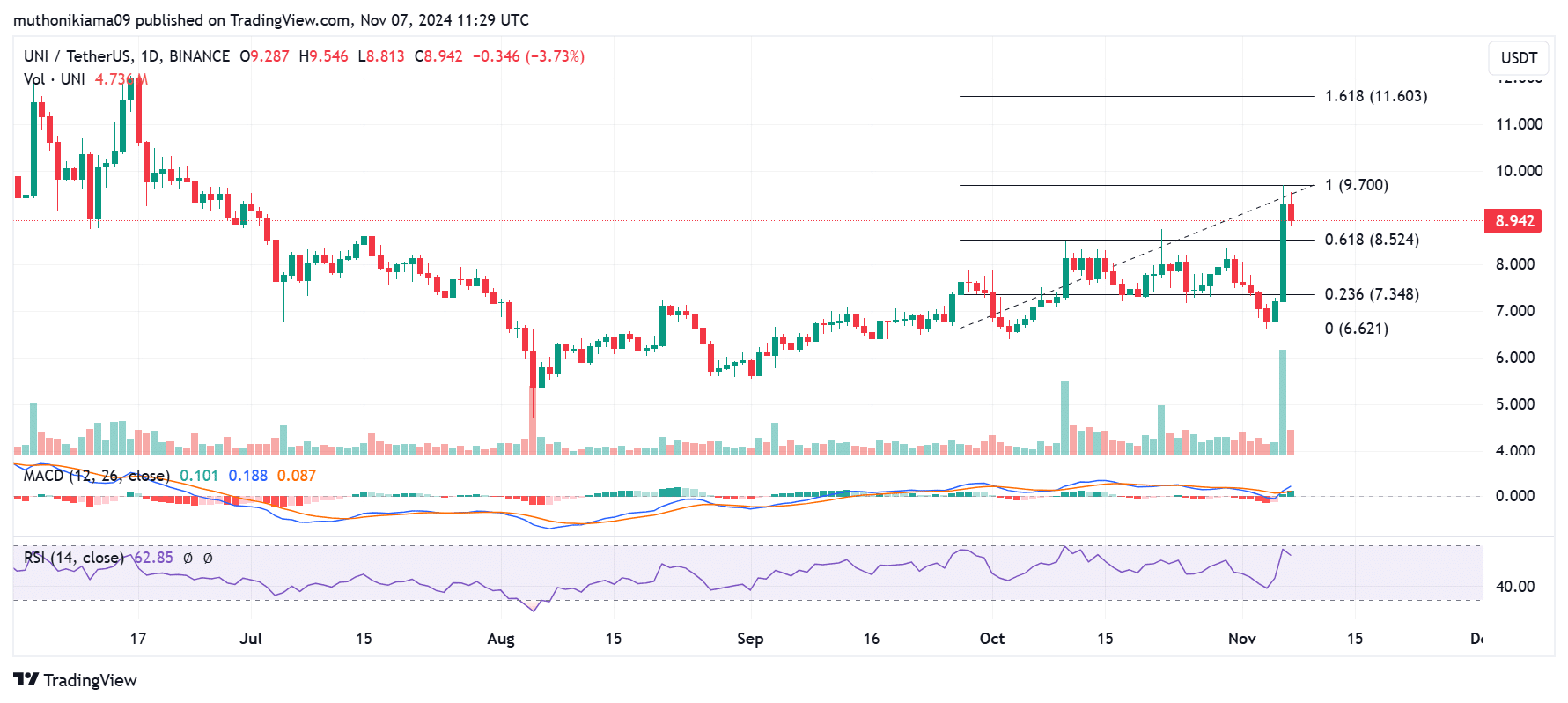

UNI traded at $8.93 at press time. The recent rally stalled due to buyer exhaustion after the price hit a 4-month high of $9.63.

The volume histogram bars on the one-day chart showed that buying pressure was significantly high. The Relative Strength Index (RSI) has also increased to 62, suggesting that buyers were behind the bullish momentum.

Despite the price retracing, the Moving Average Convergence Divergence (MACD) showed that bulls remained in control. The MACD line has flipped positive alongside the histogram bars.

For Uniswap’s uptrend to continue, it needs more buyer support. This could ignite a 30% rally towards the next resistance at the 1.618 Fibonacci level ($11.60).

However, if there is no fresh uptick in buying activity, the uptrend will weaken. Traders should watch out for support at $7.34 as a drop below it could fuel the downtrend.

Profit-taking presents headwinds

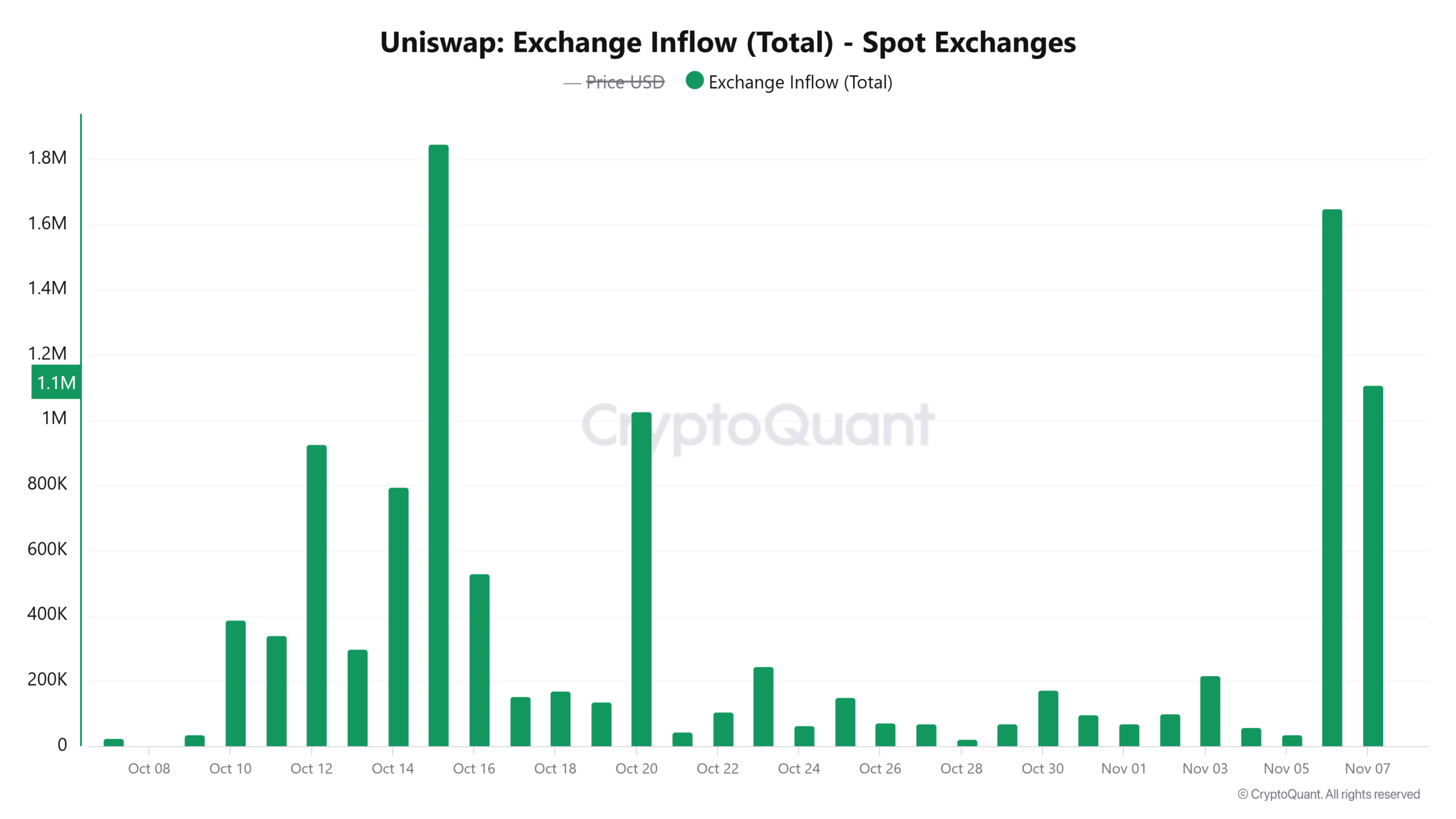

Sellers were currently in a position to trigger a resumption of bearish trends. Exchange inflow data from CryptoQuant showed that in the last two days, traders have sent more than 9 million UNI tokens to exchanges.

When traders deposit their tokens to spot exchanges, it shows that they are preparing to sell, which could prevent more gains.

However, there was also a spike in deposits to derivative exchanges. This could cause a spike in volatility if traders increase their open positions on UNI.

Read Uniswap’s [UNI] Price Prediction 2024–2025

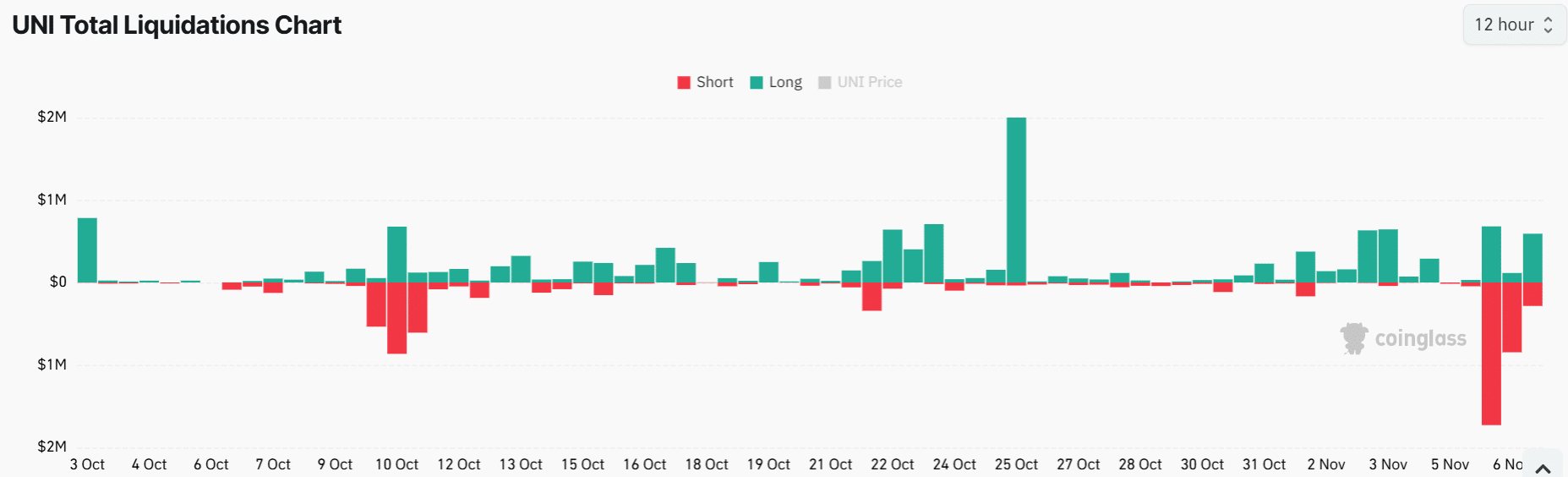

On the derivative market, there was a surge in forced liquidations on short open positions. Data from Coinglass shows that in less than 48 hours, more than $2.8 million UNI short positions were liquidated.

Short liquidations tend to drive buying activity as short sellers become forced by buyers to close their positions. If the renewed bullish sentiment around UNI causes more forced liquidations, the altcoin could trend higher.