Uniswap Price Analysis: 21 March

Uniswap’s price has been on the rise right from January 2021. However, the past few weeks, have seen a slight dip in bullish momentum. Since the latter half of February, the coin has had to endure a period of consolidation and the past week’s price action has been purely sideways.

At the time of writing, Uniswap was being traded at $32.3 and noted a market capitalization of $16.7 billion. In the past day’s time, the coin’s price saw a minor correction of over 3 percent and the coin may see increased bearish pressure in the coming week.

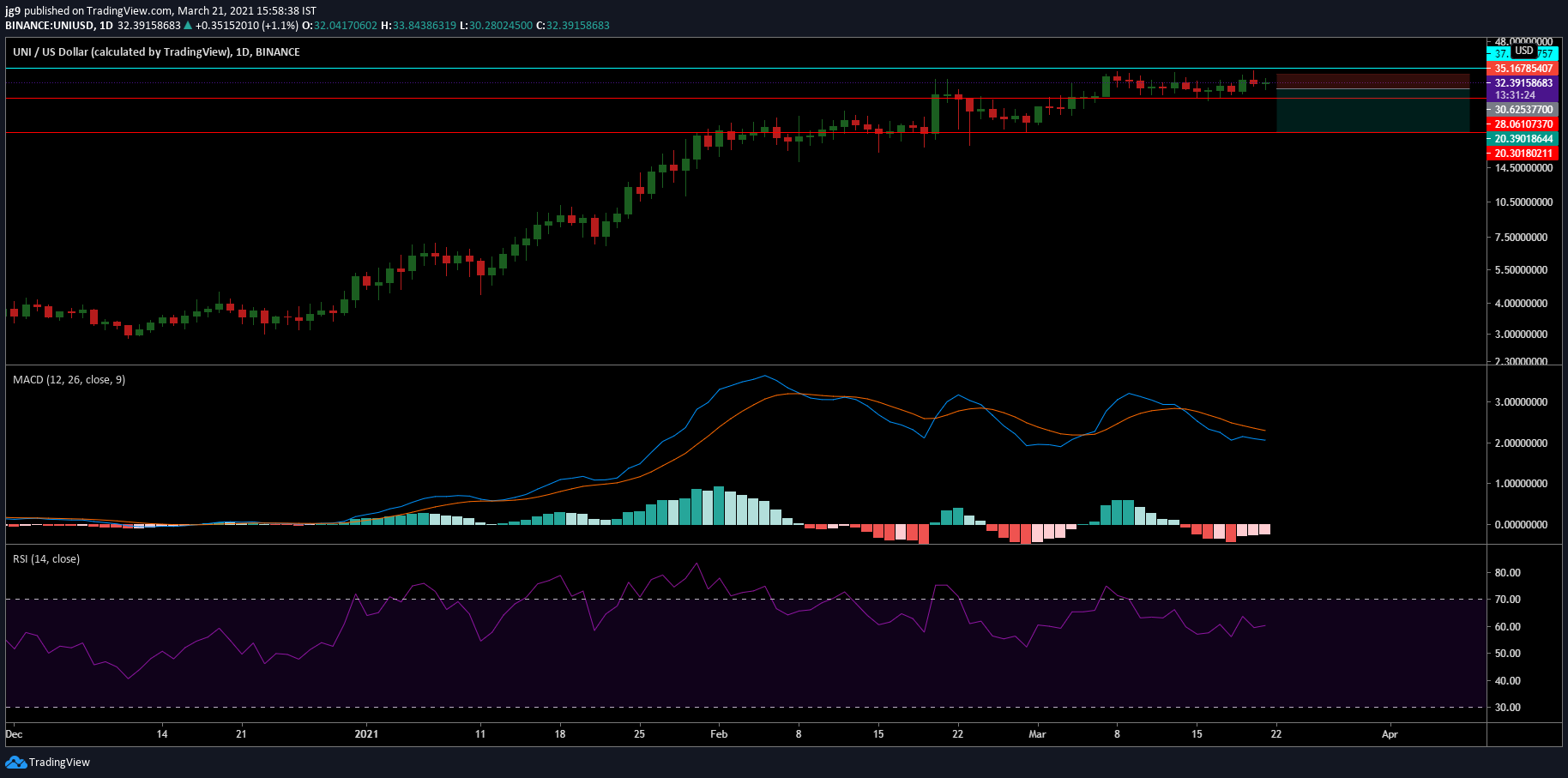

Uniswap 1-day chart

Source: UNI/USD, TradingView

Uniswap’s trading price has come in contact with a strong level of resistance around the $36-$37 price range and during the past week, the coin has had multiple failed attempts at trying to breach this resistance. This to a large extent has created a trend reversal for UNI and the bears seem to be in control of the market at the time of writing. The coming 24-hour window is crucial for the coin and if the resistance is unbreached the coin may test its immediate support at $28 with a lot of bearish pressure and see a drop to the second support at $20 in the coming week.

The way the market plays out in the coming 48-hours will determine UNI’s trend in the coming week. If the first support is breached, traders with short positions stand to benefit in the next few days.

Rationale

The technical indicators for the coin paint a rather bearish picture. The MACD indicator has undergone a bearish crossover with the signal line going past the MACD line. The RSI echoes a similar sentiment but shows a bit of divergence. While the indicator did move away from the overbought zone, it continues to remain quite close to it.

Important levels to watch out for

Resistance: $37.1

Support: $28, $20

Entry: $30.6

Take Profit: $20.3

Stop Loss: $35.1

Risk/Reward: 2.25

Conclusion

Two scenarios are likely to play out for UNI in the coming week. If the support at $28 is breached, the price of UNI is likely to fall significantly and in such a scenario short traders stand to benefit. However, there is also the chance that UNI will continue to trade sideways and continue to be restricted to the tight channel it currently finds itself in even in the coming week.