Uniswap shows accumulation, but here’s what holders can expect next

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Uniswap shifted its market structure to bearish on the recent plunge

- A bearish order block could further oppose attempts at recovery

Uniswap saw sharp bearish price movements in August and early November. After the fall in August, there was some evidence to suggest that buyers have been accumulating the coin. Yet, UNI did not see a strong rally. The $7.5 mark halted the bulls in their tracks.

Read Uniswap’s Price Prediction in 2023-24

If Bitcoin managed to acquire bullish momentum, Uniswap could be a coin that is quick to rally. However, until the market sentiment shifts, new lows were likely for UNI. From a technical perspective, the $5.8 level could offer a shorting opportunity.

Bearish market structure and an order block to beat at $5.83

On 8 and 9 November Uniswap began to pull back from the $7.51 level that bulls had worked so hard to attain since September. This pullback quickly became a bearish structure break as the selling pressure intensified.

A set of Fibonacci retracement levels (yellow) was drawn based on this UNI drop. It showed the 38.2% level to lie at $5.89, which was close to the horizontal level of significance at $5.83. For a good chunk of November, the bulls tried to push past $5.8 and $6.2. And they succeeded briefly, but selling pressure mounted once again to force a drop from the $6.25 mark.

In the past week, a bearish order block formed at $5.89. Highlighted by the red box, it had confluence with horizontal levels and the market structure also favored short positions. The RSI was also below the neutral 50 mark to show bearish dominance.

Yet, the OBV has made a series of higher lows since September. Despite the sharp drop in November, the OBV did not register an enormous selling volume. The buyers have been steady despite the price trend, and this showed that when the market sentiment shifted to a bullish favor, Uniswap could be one of the quickest coins to rally.

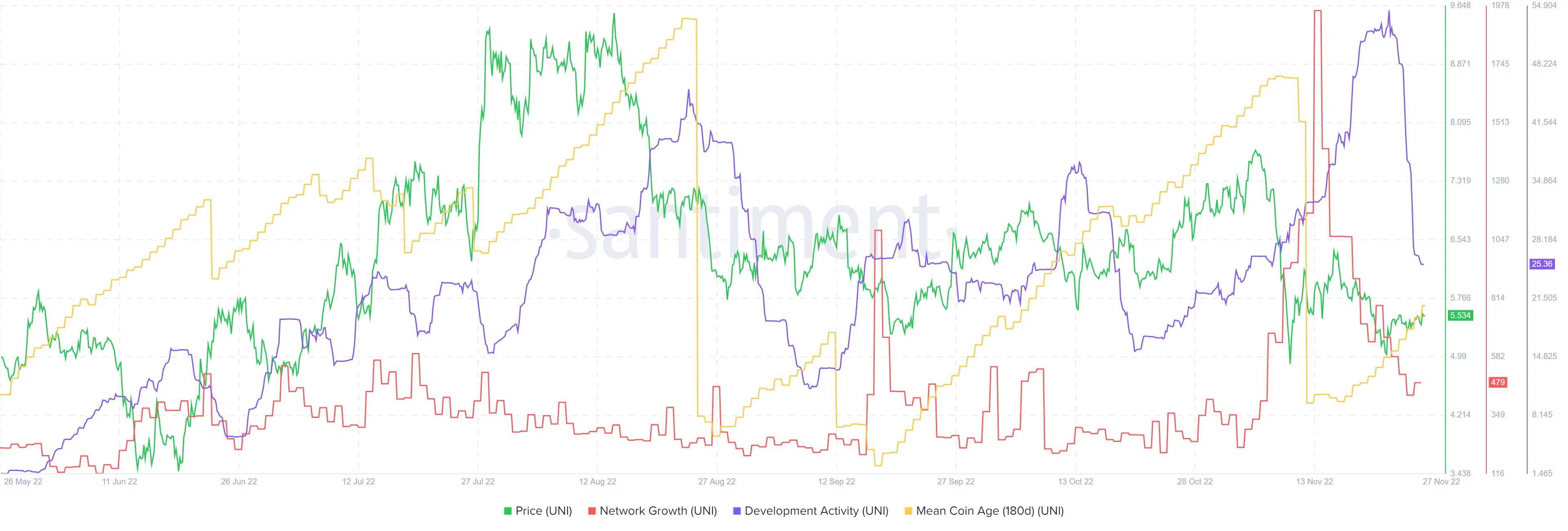

Mean coin age is on the rise once more while development activity also soared

Source: Santiment

Long-term investors can take heart in the fact that development activity was significant in recent months. It has been on the rise steadily since June. The network growth metric also saw a surge two weeks ago, which suggested that newer users were in the market. This could see an increase in the demand for UNI tokens. However, this metric has declined since then.

The mean coin age metric (180-day) also saw a sharp drop earlier this month but was rising once again. This suggested that the coin age was on the rise after the recent sell-off, and could signal accumulation.