Uniswap V3 faces setback: Are heavy USDT outflows cause for concern?

- Uniswap v3 struggles with low stablecoin liquidity amid slow market conditions.

- UNI maintains a bullish outlook despite a short-term cool-off.

Just how much has the recent market slowdown affected the decentralized exchanges? Well, let’s take a look at how Uniswap [UNI], one of the most popular dapps has been fairing in recent times.

Is your portfolio green? Check out the Uniswap Profit Calculator

A recent analysis suggested that Uniswap V3 was walking a tight rope as liquidity runs low. Recent findings revealed that the DEX has roughly $6 million worth of liquidity in the USDT-USDC pair.

This is because the network has been experiencing USDT dumping in the last three weeks. In other words, the slow market conditions offer little incentives for liquidity providers.

Uniswap V3 is looking a bit thin – with about $6mn left on its main USDT-USDC pair – after some pretty heavy USDT dumping since mid-July pic.twitter.com/ZWz5ZcqBwY

— Riyad Carey (@riyad_carey) August 4, 2023

Uniswap’s network activity has also been on the decline for the last four weeks. Transaction count peaked above 1630 and as low as 442 during the same period. Daily active addresses also registered an overall slowdown in the last four weeks.

At first glance, one might conclude that the USDT outflows may have something to do with Uniswap’s perfomance. However, an alternative view is that the stablecoin outflows are related to the low demand for the network, as well as recent concerns regarding DeFi exploits.

UNI bulls struggle to sustain June-July rally

Uniswap’s native token UNI has been on an overall bearish trajectory so far this month. It exchanged hands at $6.02 at press time, which means it was down by almost 10% from its current weekly high.

However, it is worth noting that its sell pressure does not necessarily reflect Uniswap’s slowdown. This is because UNI maintained an overall upward trajectory in July.

Could this be the start of a major UNI price correction? Well, UNI maintained relative strength during the last six weeks. It has notably avoided dipping into the Relative Strength Index (RSI)’s overbought zone for the most part but the latest pullback has occurred after it was briefly overbought.

UNI is already showing signs of a slowdown in sell pressure near the RSI midpoint (50% level. However, this does not necessarily guarantee some upside. In fact, the price could still be headed for more downside. If that happens, traders should be on the lookout for the next support level near the $5.8 price level. Additionally, interaction with the 200-day moving average is possible.

How many are 1,10,100 UNIs worth today

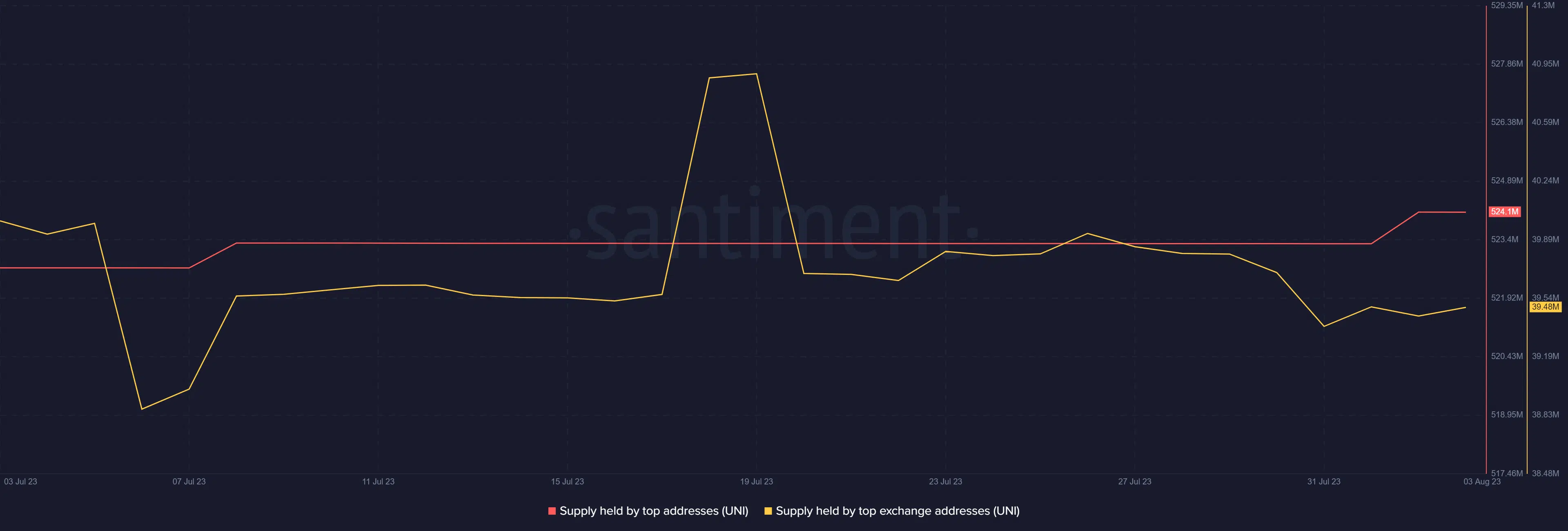

For now, there are signs that the short-term outlook is still bullish. For example, the supply held by top addresses gained slightly since the start of August. This confirms that whales are still accumulating.

Similarly, the supply held by top exchange addresses also improved slightly but considerably. This suggests that the bulls might not be done yet.