Uniswap logs low trading volumes, but just on this network

- Uniswap’s volume on Ethereum declined as another L2 absorbed the volume.

- UNI faced a price correction after consecutive days of an uptrend.

According to a recent report, Uniswap’s [UNI] trading volume has declined. This downward trend prompted a look at whether the dip has affected other crucial metrics and the trajectory of the UNI token. As trading volume often serves as a barometer of market activity and interest, the UNI token’s performance is inextricably tied to the health of the Uniswap ecosystem.

Read Uniswap (UNI) Price Prediction 2023-24

Uniswap volume declines, but…

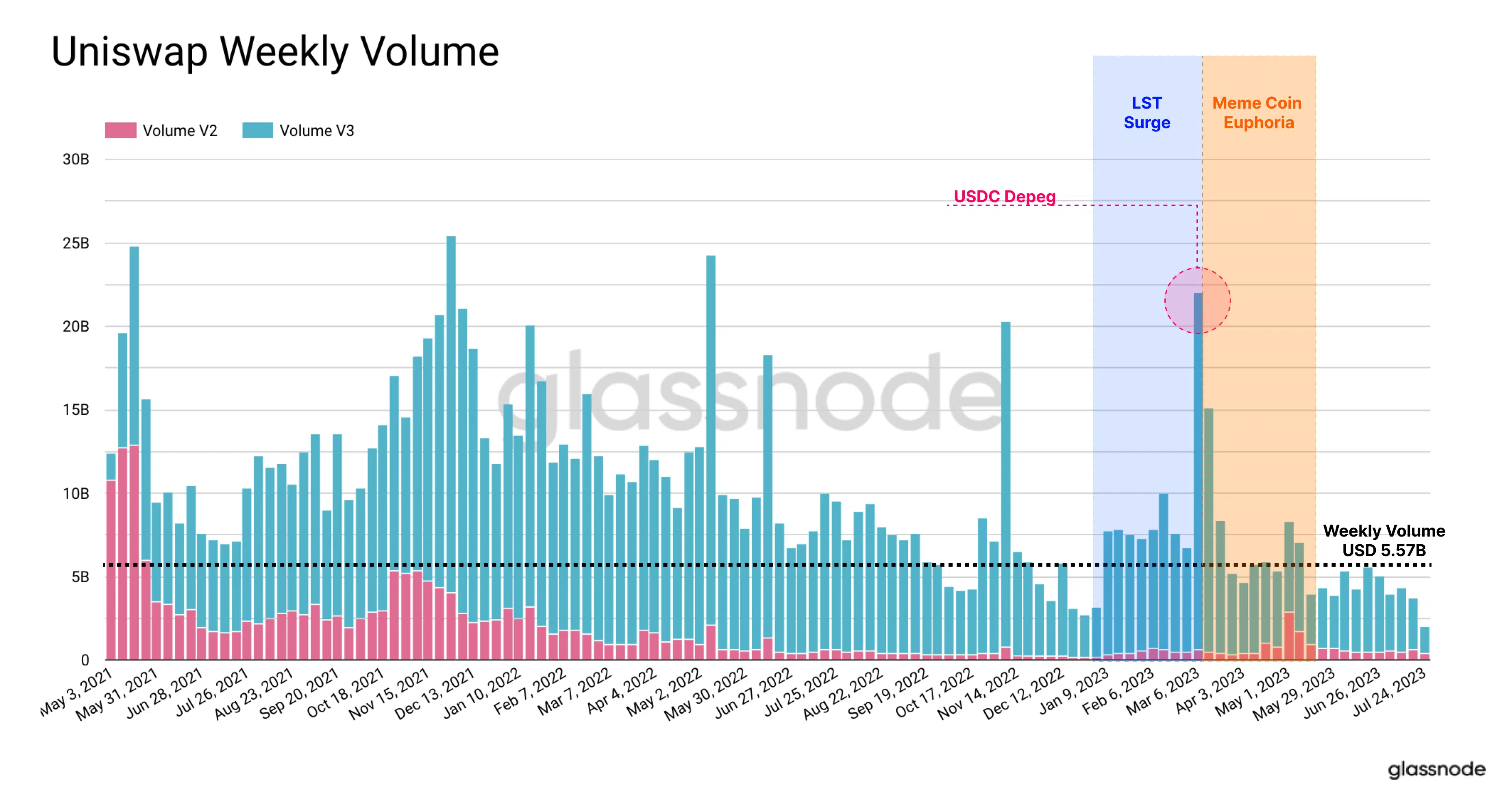

Glassnode’s recent post shed light on Uniswap’s volume decline on Ethereum, particularly compared to previous years. The data showed only two notable exceptions to this trend: a surge in volume during the rise of interest in Liquid Staking Tokens (LSTs) and another spike during the launch of meme tokens on the platform.

Interestingly, the decrease in volume was not due to a lack of transactions on Uniswap. Upon closer examination of the distribution of trade volume across different Layer 2 solutions, per Glassnode, a more comprehensive understanding emerged. A significant portion of trading activity has shifted away from the Ethereum mainnet and towards Arbitrum.

In fact, as of March, Arbitrum attracted up to 32% of Uniswap’s trading volume, indicating a noticeable migration away from Ethereum. This trend has persisted, remaining elevated in both June and July, which provided a compelling explanation for the decline in volume on Ethereum.

Breaking down Uniswap’s volume and TVL trend

The latest iteration of Uniswap, known as Uniswap V3, recently displayed a positive volume trend. As of this writing, according to data from DefiLlama, the weekly trading volume for the V3 has surpassed $2.5 billion.

Concurrently, Uniswap V2, the previous version of the platform, also maintained a respectable volume of approximately $1.2 billion. This cumulative trading volume across Uniswap V3 and V2 was nearly $4 billion.

Also, as of the latest available data, the TVL on Uniswap experienced a slight decline, currently hovering around $3.7 billion. However, this performance demonstrated a much-improved trend compared to a previous dip experienced in March.

UNI embarks on price correction

The daily time frame chart of Uniswap showed a clear and notable uptrend in recent days. Specifically, between 25 July and 1 August, UNI witnessed an impressive price surge of over 15%, as indicated by the price range tool.

How many are 1,10,100 UNIs worth today

This consecutive uptrend propelled UNI’s price into the overbought zone on the Relative Strength Index (RSI). However, as of this writing, a price correction was underway, leading to a decline of over 4% from the recent peak.

UNI was trading at around $6.3 at press time. Additionally, the RSI line dipped below the overbought zone, indicating a potential shift in market sentiment.